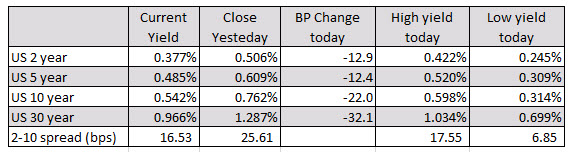

The headline of the day is that the 30 year yield traded to a new all time low of 1.8843%. That took out the August 2019 low yield of 1.9039% and although the yield is closing above that old low, the closing level will be the lowest on record.

Helping the yields move lower is the:

- Expectation of a cut in US rates by July and potential for another cut later in the year

- Flight to safety flows

- Lower global growth from the coronavirus

- Dollar buying as the US remains a safe haven

- The Markit Service and Composite PMI data was below the 50.0 level while the manufacturing index was lower than expectations as well.

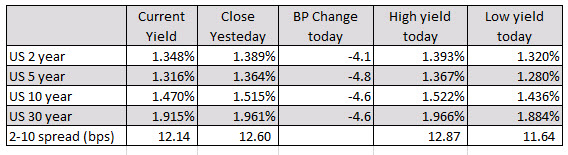

The 10 year yield also moved lower and approached the swing low from 2019 at 1.4272%. The low yield today reached 1.4359% before rebounding into the close to 1.4700%. The all time low yield was in 2016 at 1.3180% (see chart below).

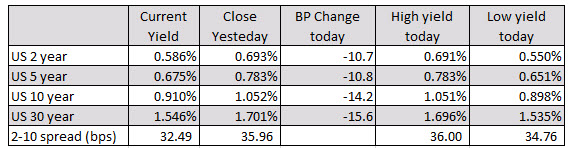

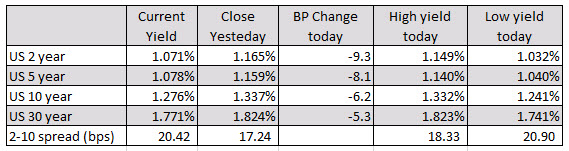

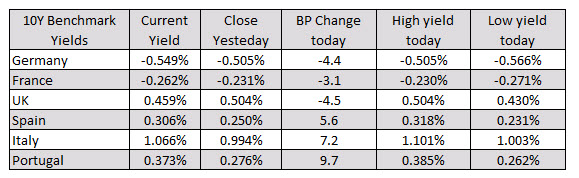

Below is a table of the current, high and low yields for the US debt along the yield curve. The 2-10 year spread also flattened to 12.14 basis points from 12.60 basis points yesterday.

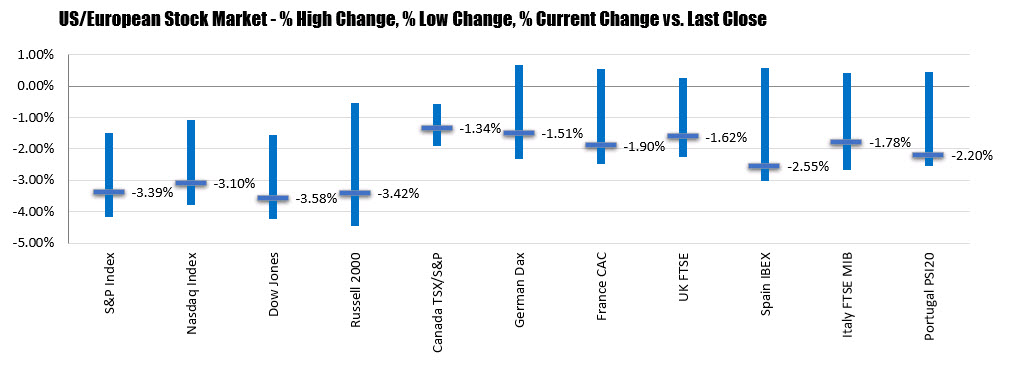

US stocks today fell with the Nasdaq leading the way down. For the day, the Nasdaq fell -1.79% after being down as much as 2.14% at the low. The S&P index closed down a more modest -1.05% after falling as much as -1.33%. For the week, the major indices fell with the Dow down -1.46%, the S&P down -1.07% and the Nasdaq index down -1.39%.

Gold was another big mover today and this week. The price of gold is trading up $24.00 or 1.48% at $1643.43. The high for the day reached $1649.26. That was the highest level since February 2013. For the week, the price of gold settled last Friday at $1584. The current price at $1643.43 is a $59.43 gain for the week or 3.75% gain. Big breakout move for gold this week.

The fall in stocks, rise in gold, fall in yields led to a fall in the USD today. The USD was the weakest of the major currencies today. The strongest currency was the GBP (but it came off the highs in the NY session). The dollar fell by 0.61% vs the GBP. It also fell versus the EUR by -.59% vs the EUR and -0.58% vs the CHF.

US stocks today fell with the Nasdaq leading the way down. For the day, the Nasdaq fell -1.79% after being down as much as 2.14% at the low. The S&P index closed down a more modest -1.05% after falling as much as -1.33%. For the week, the major indices fell with the Dow down -1.46%, the S&P down -1.07% and the Nasdaq index down -1.39%.

US stocks today fell with the Nasdaq leading the way down. For the day, the Nasdaq fell -1.79% after being down as much as 2.14% at the low. The S&P index closed down a more modest -1.05% after falling as much as -1.33%. For the week, the major indices fell with the Dow down -1.46%, the S&P down -1.07% and the Nasdaq index down -1.39%.