Forex futures positioning data for the week ending September 24, 2019 from the CFTC should

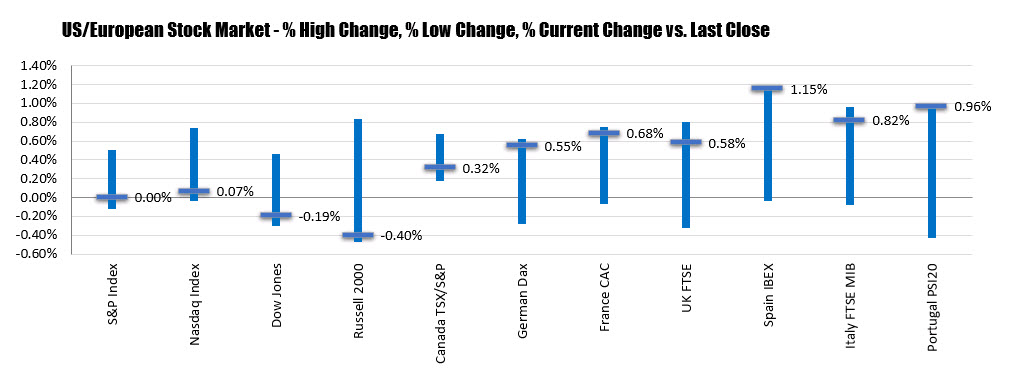

- EUR short 66K vs 61K short last week. Shorts increased by 5K

- GBP short 77K vs 81K short last week. Shorts trimmed by 4K

- JPY long 14K vs 13K long last week. Longs trimmed by 1kK

- CHF short 12k vs 11k short last week. Shorts increased by 1K

- AUD short 52k vs 47k short last week. Shorts increased by 5K

- NZD short 42K vs 45K short last week. Shorts trimmed by 3K

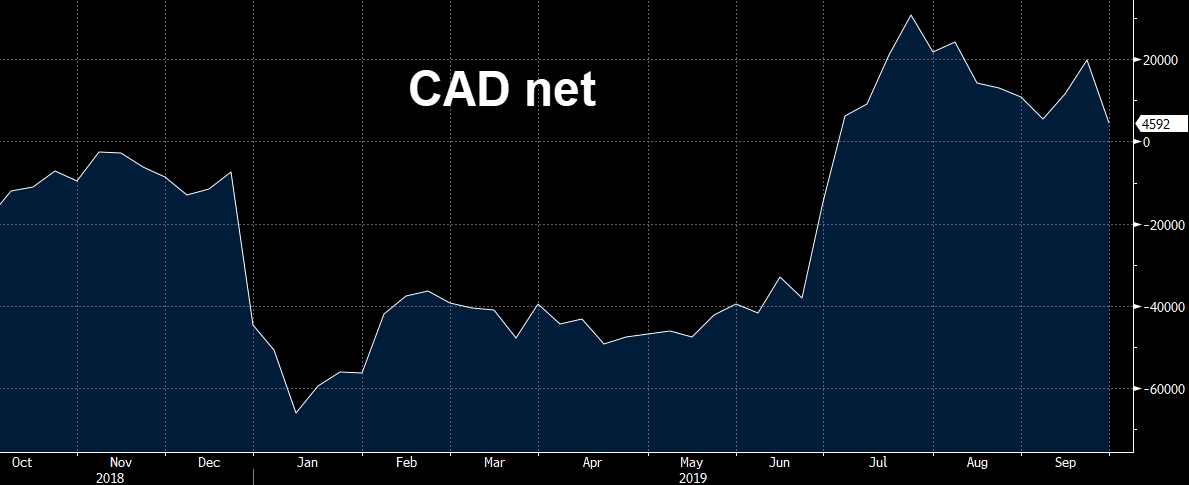

- CAD long 6K vs 5K long last week. Longs increased by 1K

- prior week

Modest changes in the major currencies for the current week. Although speculators trimmed short positions in the pound, it remains the largest specular position. The EUR shorts increased by 5K. It is the 2nd largest short position.