Jefferies LLC is a US multinational independent investment bank and financial services company.

- The firm is headquartered in New York City.

A company statement says its chief financial officer Peregrine “Peg” Broadbent has died from “coronavirus complications”

The virus is cutting a swathe through New York, deaths in the city are nearing (if not above as I post) 1000.

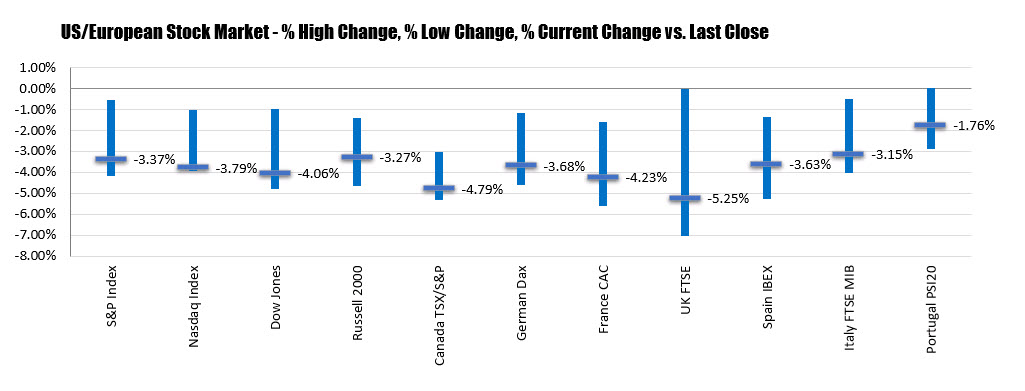

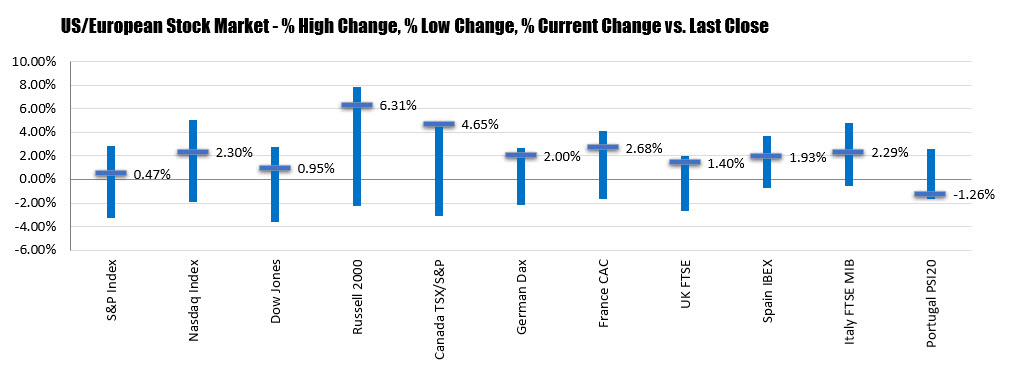

Although lower for the day for all major indices closed with gains.

Although lower for the day for all major indices closed with gains.

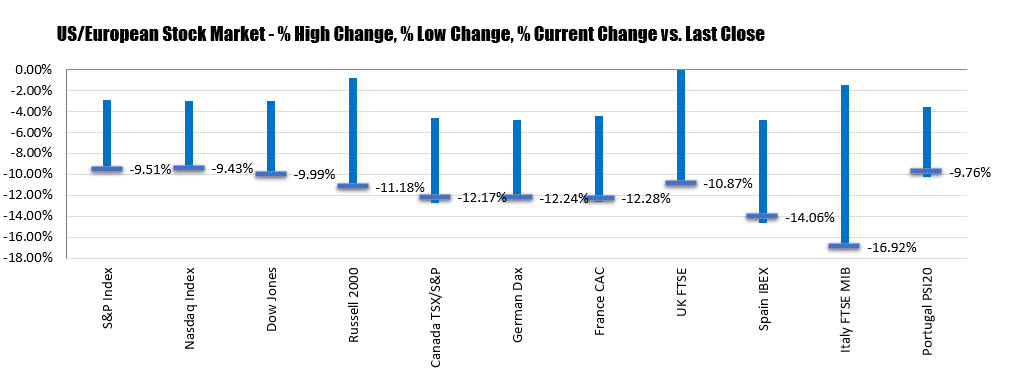

Year to date numbers are showing:

Year to date numbers are showing: