It’s impossible to hedge

It has been more than a year since the S&P 500 went down 10%. In the nearly 17 years since March 2003, there have been 19 declines of 10% or more. There have been 82 declines of 5% or more.

Drawdown Qty Trading days Days since last

5% 82 4234 64

10% 19 4234 298

20% 5 4234 259

25% 2 4234 2731

33% 1 4234 2831

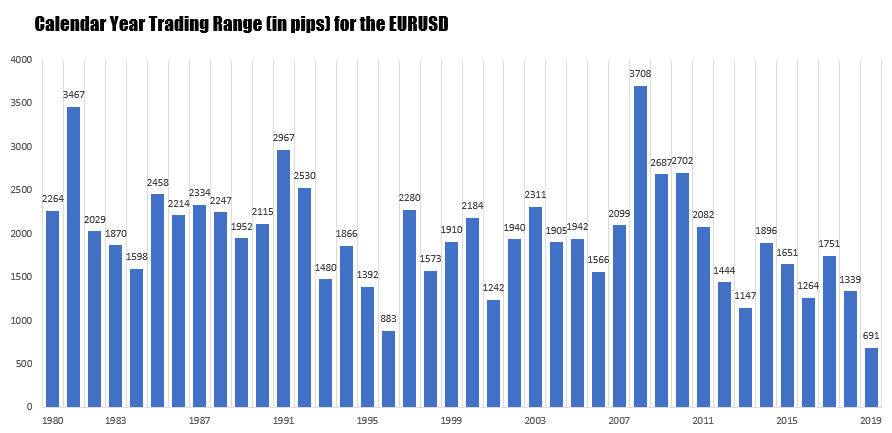

Below are the graphical historical ranges for the major currency pairs versus the dollar along with comments about each. .

The low to high trading range for the EURUSD in 2019 could only extend to 691 pips. That was the lowest range going back to 1980. The prior low was 883 pips back in 1996. In 1997, the range rose to 2280 pips.

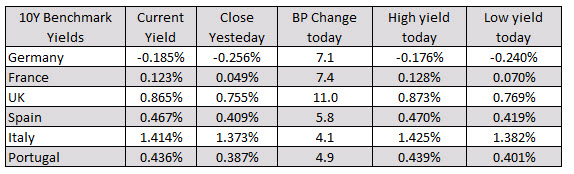

In other markets as European traders exit:

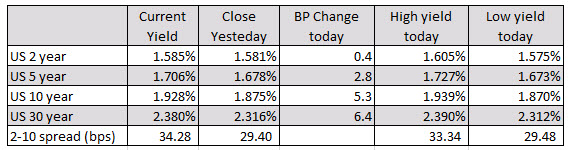

In other markets as European traders exit:US yields are also higher with the yield curve steepening. The 2 – 10 year spread has widened out to 34.28 basis points from 29.4 basis points on Friday.

2330 GMT Tokyo inflation data for December – Tokyo area CPI (national level CPI for the month follows in three weeks). The y/y rate has received a wee boost from the October 1 sales tax hike. But not much.

Also at 2330 GMT Japan Jobless (Unemployment) rate for November

and Job to applicant ratio for November

2350 GMT Bank of Japan monetary policy meeting ‘Summary of Opinions’ of the December meeting

2350 GMT Japan Retail sales for November

expected 5.0% m/m, prior -14.2% (the huge drop was helped along by that sales tax hike I mentioned above)

2350 GMT Japan Industrial Production for November (preliminary)

0130 GMT China Industrial Profits for November % y/y

Headlines via Reuters