Bloomberg reports on the matter

The report says that Chinese oil demand is all but back to levels last seen before nationwide lockdown measures were imposed to curb the spread of the coronavirus outbreak, according to people with inside knowledge of the country’s energy industry.

Adding that consumption of gasoline and diesel has fully recovered as factories reopen and commuters drive rather than use public transport.

The exact level of oil demand in real time – according to executives and traders who monitor the country’s consumption – is said to be about 13 million bpd, which is just shy of the 13.4 million bpd seen around May 2019 and the 13.7 million bpd seen in December 2019.

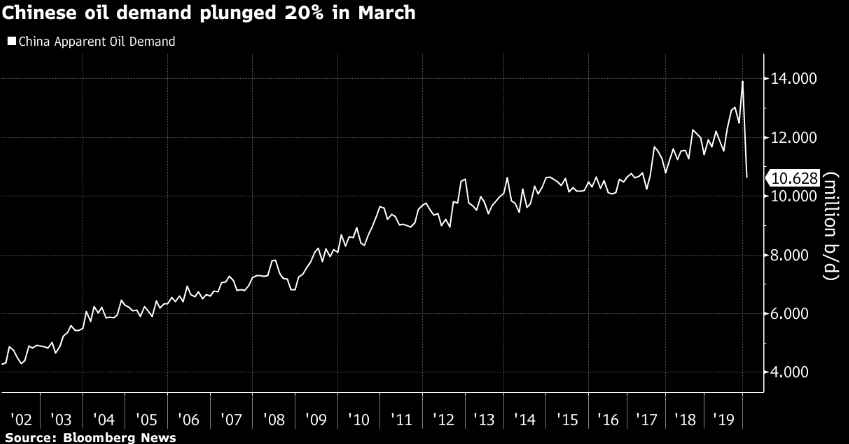

For some context, the apparent drop in Chinese oil demand was seen at around 20%:

However true the figures are from this report, it is certainly giving hope to oil bulls that the market can recover from the severe imbalance – and perhaps more quickly than thought – that we are seeing currently. WTI crude is now up by over 8% on the day to $31.85.