US directory of national intelligence Ratcliffe announces the discovery

- US has identified Russia, Iran as countries who have attempted to interfere with the US election

- Has sent spoof emails designed to intimidate voters, incite unrest, damage Pres. Trump

- Aware that Russia has obtained some voter information

- intelligence community court threat, reacted swiftly

- This is not a partisan issue

- Prepared for actions by those hostile to democracy

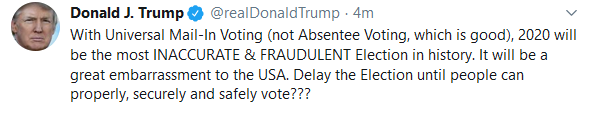

The interference apparently came through emails threatening those who voted against Trump.

Radcliffe says that the email, apparently from The Proud Boys, is intended to hurt Pres. Trump. Of course, if a recipient was intimidated by the email, it might benefit Pres. Trump.

Regardless of the intentions, stopping interference in elections is certainly a prerogative. FBI’s Wray is on the wires saying:

- The FBI will not tolerate 4 interference elections

- Election infrastructure remains resilient