Stocks reverse losses

The dollar is falling after the 50 BP cut by the Fed:

The dollar is falling after the 50 BP cut by the Fed:

3 scenarios for Coronavirus and its FX implications.

“Coronavirus was unknown to asset markets two months ago, may disappear as a factor within a few months, but may also evolve into a major global supply shock if it spreads and intensifies. We lay out the alternative scenarios on how the disease could evolve and what the short-medium term FX responses might be. Our subjective assessment is that current asset market pricing probably lies somewhat closer to the static than good scenarios,” SC notes.

“FX winners (W) and losers (L) under our good scenario where the disease abates:

• W: CAD, CNY, MXN, KRW, IDR, RUB

• L: USD, CHF, JPY

FX winners (W) and losers (L) under our static scenario of neither major intensification nor elimination:

• W: USD, JPY, CHF, MXN

• L: KRW, TWD, THB, SGD, MYR, AUD, NZD, EUR, CNY, CAD

FX winners (W) and losers (L) under our bad scenario where the disease intensifies and spreads:

• W: JPY, USD

• L: KRW, TWD, THB, SGD, MYR, IDR, INR, AUD, NZD, EUR, CNY, CAD,”

Some of the results (more at that link)

The dollar has generally made some gains this week against various currencies. These movements came after fairly good data from the USA as well as the signing of a first stage trade deal between the USA and China.

The dollar has generally made some gains this week against various currencies. These movements came after fairly good data from the USA as well as the signing of a first stage trade deal between the USA and China.Some of the biggest news in forex markets this week came from central banks. Both the South African Reserve Bank (SARB) and the Central Bank of the Republic of Turkey (CBRT) cut rates against expectations. The CBRT was first yesterday morning, cutting its one-week

repo rate from 12% to 11.25% compared with the consensus expectation of 11.5%.

Then the SARB also cut its repurchase rate to 6.25% yesterday afternoon, another decision that defied expectations. In a rare display of agreement among central bankers, the SARB’s

monetary policy committee voted unanimously to cut by 0.25%.

Shares reacted eagerly to news of the preliminary Sino-American trade deal, with US500 continuing its rapid gains since Monday’s open. Many European indices and shares also reached new all-time highs.

Bitcoin-dollar, daily

BTC-USD has surged up even more in the second half of the week. Current levels around $8,900 are the highest for about two months. The red trendline here is based on the weekly chart, starting from last summer’s highs around $13,000.

BTC-USD has surged up even more in the second half of the week. Current levels around $8,900 are the highest for about two months. The red trendline here is based on the weekly chart, starting from last summer’s highs around $13,000.

We can clearly see that price has broken out upward from this trendline, facing little resistance from the 100-period simple moving average.

The first major hurdle for the bulls here is likely to be the 200-day moving average. This is expected to be a strong area that could well resist testing at least temporarily. The 61.8% Fibonacci retracement area which price is currently testing could also function as a resistance.

Technical indicators here give a very strong overbought signal. Price closed the last three days completely outside the upper deviation of Bollinger Bands (50, 0, 2).

The slow stochastic (15, 5, 5) is also clearly within the upper trigger zone. These factors would suggest that a retracement to some degree is likely within the next few periods.

American light oil, four-hour

USOIL’scorrection appears to have paused for now. The large losses from last week’s nine-month highs were driven mainly by the decline of military tension between the USA and Iran in Iraq. Now, though, the signing of the first stage deal between China and the USA has given crude a significant fundamental boost.

As China is the world’s biggest consumer of crude oil, the outlook for the Chinese economy often influences the price of the commodity.

The regular data for crude were somewhat incompatible this week. The API’s stock change announced a gain of 1.1 barrels per million, but the EIA’s stock change read negative 2.55 million on Wednesday night.

USOIL didn’t react very strongly to either release, so we might expect that trade and Chinese data could continue as key drivers next week as well.

From a technical standpoint, the conditions seem to be there for oil to continue its overall uptrend from Q4 2019. Momentum to the downside has dried up this week while buying volume remains fairly high.

The most important resistances in the short term are likely to be the three moving averages, with the 200-period SMA probably the most important of these.

Dollar-yen, four-hour

USD-JPY has been somewhat less volatile this week while continuing to make some gains overall in the aftermath of decent data from the USA. Annual inflation and core inflation on Tuesday both printed 2.3% in line with expectations, the former beating the previous figure by 0.2%.

American retail sales came in at 0.3% yesterday afternoon in line with the consensus, but November’s release was revised upward slightly.

The charts look positive for dollar-yen but buying saturation could limit any ongoing gains. Price remains above all three of the usual moving averages, with the faster 50 SMA completing a golden cross of the slower two on Wednesday afternoon GMT.

On the other hand, volume remains very low, and the slow stochastic is still slightly inside the overbought zone.

It seems that most traders are waiting for key releases next week to provide some momentum, up or down. The Bank of Japan’s meeting on Tuesday morning and Japanese inflation late on Thursday evening are expected to bring some more direction to USD-JPY.

Annual salary in national currency: 16.7 million krónur

> Time in office: 2 years 9 months

> GDP per capita: $44,029

> Annual salary in national currency: 140,904 euros

> Time in office: 9 months

> GDP per capita: $40,661

CHALLENGE

Getting attention.

REWARD

Barrier to entry nonexistent.

CHALLENGE

Getting publicity.

REWARD

Publicity is nearly irrelevant and the means of spreading the word are at your fingertips.

CHALLENGE

Making money.

REWARD

Successful artists are making more money in adjusted dollars than they ever were, just not as much as bankers or techies. Furthermore, there are many avenues of revenue. Endorsements, merch, privates…and live pays better than ever before.

CHALLENGE

Only Top Forty counts/can make you go nuclear. (more…)

At the dawn of the online gambling industry in the 1990s, the U.S. dollar was the major currency accepted in online casinos, but those days are over. The euro has replaced USD and is now the most popular currency. According to the latest research by KeyToCasino, the euro is currently accepted in 79% of all existing online casinos.

The use of the U.S. dollar changed after the Unlawful Internet Gambling Enforcement Act (UIGEA), legislation regulating online gambling, was passed in the United States. The UIGEA has prohibited all gambling sites from accepting deposits online, forcing U.S.-oriented casinos out of business. At the same time, online gaming business in Europe has flourished, and many online casinos re-oriented their business towards European customers.

It has been 10 years since UIGEA, and many new online casinos have opened throughout this period. They have never considered targeting the U.S. market and never planned to include USD as a currency that is available for deposits. Players from countries with economically unstable currencies were forced to use the euro for their casino transactions.

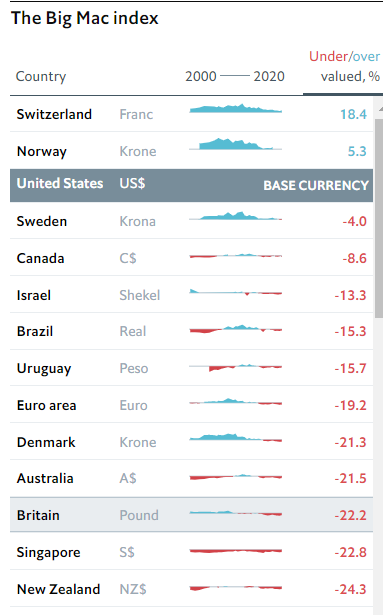

American currency is not completely out of the gaming business however. It remains the second most popular currency in online casinos, followed by the British pound, which is accepted in 58% of online casinos. However, the overall popularity of Scandinavian currencies, which include the Norwegian krone, Swedish krona, and Danish krone, beats the pound because Norway, Sweden, and Denmark have the highest population ratio when it comes to casino popularity.

Among the other currencies that have become prevalent on online gaming market, there are the South African rand, South Korean won, and Russian ruble. The least popular are the Japanese yen and Chinese yuan. The Australian dollar beats the Canadian dollar in popularity because unlike in Australia, the legality of online casinos in Canada is uncertain, which results in the Canadian dollar not being widely accepted at online casinos.