DON’T ASSUME THERE IS A RATIONAL REASON BEHIND THE MARKET DIRECTION

Market direction is simply the way the market is moving at any given time during the day, and can change at any moment. Market direction is based on the number of trades that take place at certain prices, no more no less. That is why when you think you have the direction called, the markets change and move in a new direction.

When a trader remains focused on what is happening, they remain focused on their own trades without wasting energy trying to understand why. The market will move where the market will move, one thing is for sure, the market does not need to have a rational reason why it is moving in a direction. Overcoming the need to rationalize a reason behind a market direction will serve to support a stronger trading plan.

SHOW UP EVERY DAY AND MAKE YOUR TRADING ASSUMPTION BASED ON WHAT YOU ARE SEEING (more…)

Archives of “Business_Finance” tag

rssWhat to Monitor During a Correction

- Bull market correctionReversed for bear market correction.

- Support below

- Fibonacci retracement levels of prior uptrend

- Bottoming price action

- Positive divergence — index vs. indicators

- Positive divergence — index vs. internals

- Bullish candlestick pattern or western reversal bar

- Notable change in scan hits

- Break of resistance (downward sloping) trendline

Classifying Bull Market Declines

- 1 to 3% – Market pullback

- 3 to 5% – Minor correction

- 5 to 8% – Standard correction

- 8 to 12% – Deep correction

- 12 to 16% – Very deep correction

- 16 to 20% – Minor bear market

- More than 20% – Bear market

MRI’s of Succesful Traders

I’ve seen this study making the rounds on several websites now as a type of neuroeconomic confirmation of Buffetological principles…

Perhaps procedure might be slightly useful as a means of seeing physical brain improvement by training– such as that found through meditative practices.

“Traders who buy more aggressively based on NAcc signals earn less. High-earning traders have early warning signals in the anterior insular cortex before prices reach a peak, and sell coincidently with that signal, precipitating the crash. These experiments could help understand other cases in which human groups badly miscompute the value of actions or events.”

“Neuroeconomists Confirm Warren Buffet’s Wisdom”:

“Seeing what’s going on in people’s brains when they are trading suggests that Buffett was right on target,” says Colin Camerer, the Robert Kirby Professor of Behavioral Economics at Caltech.

That is because in their experimental markets, Camerer and his colleagues found two distinct types of activity in the brains of participants—one that made a small fraction of participants nervous and prompted them to sell their experimental shares even as prices were on the rise, and another that was much more common and made traders behave in a greedy way, buying aggressively during the bubble and even after the peak. The lucky few who received the early warning signal got out of the market early, ultimately causing the bubble to burst, and earned the most money. The others displayed what former Federal Reserve chairman Alan Greenspan called “irrational exuberance” and lost their proverbial shirts.

8 Words For Traders

1. CONFIDENCE: absolutely essential in an environment that feeds on emotional instability.

2. TRUST: if you cannot trust yourself who can you trust? Trust your rules, trust your edge, trust that you will do the right thing-no matter what!

3. FOCUS: you will never learn all there is to learn about the market. Push your ego aside and focus on one market and one edge.

4. ACCEPTANCE: you have to accept what the market is willing to give or you will give the market what it wants to take.

5. RESPONSIBILITY: you and you alone are responsible for the money you lose and the money you make. Take the credit for both. Either way you deserve it.

6. PATIENCE: The market is not the place to learn patience, it is the place to practice it.

7. RULES: the market has no rules and no one else will do it for you. Develop rules for entering AND exiting trades before trades are made.

8. RESPECT: you have to respect the market for what it is not for what you want it to be. The market has a logic all its own. You may not like it but you have to accept it.

Trade Like A Casino, Not A Gambler

Trade Like a Casino: Find Your Edge, Manage Risk, and Win Like the House

Any quick drive through Las Vegas makes it pretty clear who is rolling in the money – the Casinos! Why do gamblers keep going back despite losing most of the time? Misplaced hope, fantasies about the big win, promising themselves they will walk away when they are up and still winning, and probably the inability to calculate probabilities. These symptoms may sound familiar to new traders who have lost money in the stock market, especially when we were new to trading and had delusions of grandeur about trading theirway to prosperity quickly and easily.

In gambling there are really only two sides to choose to be on, either you are a gambler or you are the house. The gamblers have the long term odds stacked against them. The more they gamble, the more the odds are that they will inevitably lose. The casino has stacked the odds on their side over the long haul. The more the gambler keeps gambling, the more the odds shift in favor of the casino operator. The more they gamble the greater the chance the gambler will leave empty-handed.

The book featured in this blog post explains the winning principles of trading by using the casino paradigm. Profitable traders operate like casinos, with the odds in their favor over the long term. They have learned to trade with historically, back-tested trading systems that put the odds on their side. Much like casino operators, they risk small amounts of equity per trade (around 1% – 2% of their accounts), so no one trade can hurt them financially and mentally for that matter.

Most unseasoned traders behave like gamblers, with no real advantage. They plunge large bets on stocks so haphazardly that they just have a 50-50 shot like a roulette wheel – red or black. Many times these traders hurt themselves even worse by buying into the market in a downtrend and shorting into a rally, believing that they can pick the bottom or top. Some new traders would love to have a 50/50 win ratio, many actually to all the wrong things and are no where near a 50% win rate. (more…)

Just Avoid These 7 Words -If U Are A Trader

Be careful how you use the following words and phrases as they become road blocks or worse take you down the wrong path.

Should– Phrases include: “The market should have” and “I should have”. Those phrases are often used to socialize losses. They are a strong signal something is off. They should be used to aid you in correcting your vision not make you feel better.

Must– Phrases include: “The market must…”, “I must make money”, or “I must trade”. The market does not have to do anything and either do you. When you use the word “must” it is hardly ever from a position of strength. The market knows when you are desperate and will take full advantage of you. Keeping your expenses as low as possible will make it easier to not make those statements.

Will– Phrases include: “The market will..” and “I will make money”. Once again the market does not like to be told what to do. It is the bratty kid screaming at the tops of his lungs. The word “will” relaxes your mind, similar to “should”, people use it to be lazy instead of a black background in an otherwise light picture. You can do everything right and still lose money. That is why trading is so effective at diminishing confidence. In most every activity, if you do everything right you are going to get the desired result. Doing the “right” things is bare minimum. Of course, over time you will get paid for doing the right things but it is never when you think it should be and hardly how much you anticipated. (more…)

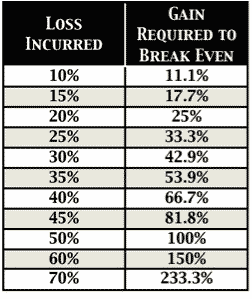

This One Thing that Separates losing traders from the Winners

Making money in the financial markets is not only challenging but just surviving an account blow up is also a win for many new traders. There is one thing that ultimately determines your success in the markets. It is not your stock picking skills, your trend following or even trading a robust method. The dividing line between the winners and the losers in trading and investing is risk management. If you trade all in and risk it all over an over you will eventually blow up your account, and the funny thing is that it will likely be on your ‘can’t miss’ trade that is just way to obvious to everyone and is a crowded trade. Traders that believe have 10 losing trades in a row are impossible will discover it is very possible. Each trade should be large enough to return enough to make it worth your while, but small enough to make it inconsequential to your results in the long term. Trading small not only eliminates the financial risk of account ruin that is ever present in a market environment that is not conducive to your methodology but small risks also keep your logical brain in control of your trading and your emotions on the side lines.Nothing is more painful in my opinion than to build up an account during a great string of wins only to give it back with a string of losses in a different market environment. Small bets and staying out when he market waves get wild is a great formula to avoid big draw downs. You can still win big when you are right by letting a winner run but always lose small when you are wrong. The bet size on each trade will make or break ever trader at some point usually sooner than later. (more…)

You Might be a Bad Trader if:

You Might be a Bad Trader if:

…You are 100% sure about a trade being a winner so you have no need to manage risk.

…You go all in on one trade and it will make you are break you.

…You like to buy deep out of the money stock options not understanding how bad the odds are on them.

…You love directly giving unsolicited advice to other traders due to not understanding they have different trading plans and time frames.

…You are so new to trading you think it is a place of easy money.

…You think traders that talk about risk management and trader psychology are silly and that you are above that.

…You brag to much about your account size and last trade, it indicates to me you do not understand the long term in the markets.

…You are very loud about your winners but never discuss your losing trades.

…You brag to much.

And You Might really be a bad trader if: If you attack trading principles that you do not even fully understand due to lack of real trading.

List of Common Characteristics of Great Traders -10 Points

1. They all have a tested, positive expectancy system that’s proved to make money for the market type for which it was designed.

2. They all have systems that fit them and their beliefs. They understand that they make money with their systems because their systems fit them.

3. They totally understand the concepts they are trading and how those concepts generate low-risk ideas

. 4. They all understand that when they get into a trade, they must have some idea of when they are wrong and will bail out

. 5. They all evaluate the ratio of reward to risk in each trade they take. For mechanical traders, this is part of their system. For discretionary traders, this is part of their evaluation before they take the trade.

6. They all have a business plan to guide their trading. You must treat your trading like any other business

7. They all use position sizing. They have clear objectives written out, something that most traders/investors do not have. They also understand that position sizing is the key to meeting those objectives and have worked out a position sizing algorithm to meet those objectives.

8. They all understand that performance is a function of personal psychology and spend a lot of time working on themselves. You must become an efficient rather than inefficient decision maker.

9. They take total responsibility for the results they get. They don’t blame someone else or something else. They don’t justify their results. They don’t feel guilty or ashamed about their results. They simply assume that they created them and that they can create better results by eliminating mistakes.

10. They understand that not following their system and business plan rules is a mistake. If you make even one mistake per month, you can turn a profitable system into a disaster. Thus, the key to becoming efficient is to eliminate such mistakes.

What elements from the above list do you need to work on more than any other? Yes, take a moment to think about this today. As you set your top priorities for this new second quarter, I recommend focusing on just one of these elements by outlining specific steps you need to take this quarter to improve. For some, this will require further study. For others, it only requires just some minor behavior modification, refocus and attitude adjustment. Many times the difference between being great and mediocre

Atkeson & Houghton, Win By Not Losing-Book Review

Nicholas Atkeson and Andrew Houghton, founding partners of Delta Investment Management, have written what, in the words of the lengthy subtitle, is a disciplined approach to building and protecting your wealth in the stock market by managing your risk. Win By Not Losing (McGraw-Hill, 2013) is a mix of stories about some not-so-famous investors (in fact, a few are identified simply by their first names) and an introduction to tactical investing.

Nicholas Atkeson and Andrew Houghton, founding partners of Delta Investment Management, have written what, in the words of the lengthy subtitle, is a disciplined approach to building and protecting your wealth in the stock market by managing your risk. Win By Not Losing (McGraw-Hill, 2013) is a mix of stories about some not-so-famous investors (in fact, a few are identified simply by their first names) and an introduction to tactical investing.

The authors contend that “stock prices are influenced by oddities in human behavior that often cause security pricing to be predictable.” (p. 120) They support their contention by sharing some of their observations from the trading floor of an investment bank. Earnings momentum, for instance, can be both predictable and profitable: “the cycle of exceeding analysts’ estimates is often predictable in light of the pressures on analysts to be overly conservative.” (p. 121) And one study found that “over the 60 trading days after an earnings announcement, a long position in stocks with unexpected earnings in the highest decile, combined with a short position in stocks in the lowest decile, yields an annualized ‘abnormal’ return of about 25 percent before transaction costs.” (p. 122) (more…)