It seems like only yesterday we had the last earnings cycle

Can it be?

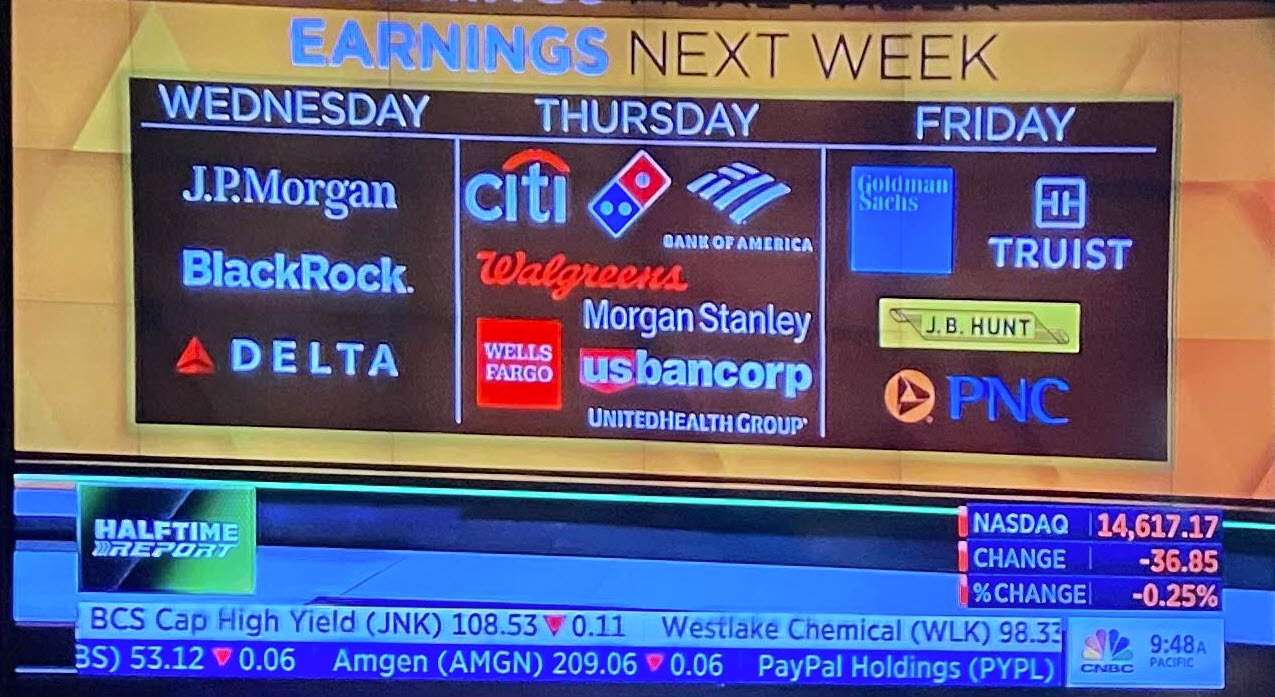

Next week bank earnings will kickoff the quarterly earnings calendar. It seems like only yesterday that the last quarter was complete.

The thanks/financials traditionally are the first to report, but other names are in the mixed.

Some of the major releases include:

Wednesday:

- J.P. Morgan

- BlackRock

- Delta Airlines

Thursday:

- Citi

- Domino’s pizza

- Bank of America

- Walgreens

- Morgan Stanley

- Wells Fargo

- U.S. Bancorp

- UnitedHealth Group

Friday:

- Goldman Sachs

- PNC

- Truist

- JB Hunt

That’s just the start, but it is the start.

Warren Buffett, the US investor,

Warren Buffett, the US investor,