You Might be a Bad Trader if:

…You are 100% sure about a trade being a winner so you have no need to manage risk.

…You go all in on one trade and it will make you are break you.

…You like to buy deep out of the money stock options not understanding how bad the odds are on them.

…You love directly giving unsolicited advice to other traders due to not understanding they have different trading plans and time frames.

…You are so new to trading you think it is a place of easy money.

…You think traders that talk about risk management and trader psychology are silly and that you are above that.

…You brag to much about your account size and last trade, it indicates to me you do not understand the long term in the markets.

…You are very loud about your winners but never discuss your losing trades.

…You brag to much.

And You Might really be a bad trader if: If you attack trading principles that you do not even fully understand due to lack of real trading.

Latest Posts

rssPerfect Failure

Subject not many like to talk about, but dealing with failure and transforming it into something better, more meaningful is an art any trader has to learn…or get out of the kitchen.

Below is one of the best presentations on this subject, the place and way of doing it a little eccentric (may be), but it hits the spot and target audience perfectly while contradicting cliché “Once a loser always a loser”.

Without further due:

Paul Tudor Jones – Failure Speech June 2009

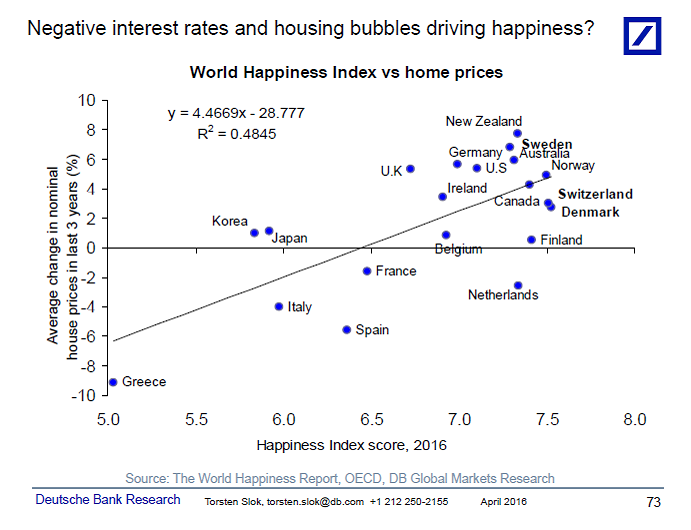

World Happiness Index vs Home Prices

Simple Rule for Traders

Would you like to get someone to hand you all their money?

Would you like to get someone to hand you all their money?

No, you don’t need a gun.

You don’t need to blackmail or kidnap anyone.

I swear that what I’m about to show you is NOT Illegal!

I guarantee that this article will change everything you have heard, seen or tried in stock market trading.

This is the best lesson you will ever learn in stock market trading.

Trading is part rational and part emotional. People often act on an impulse even if they know they have harmed themselves time and time again in the process of so doing. A winning trader becomes too confident about his positions and misses sell signals. A fearful trader beaten up by the market becomes too fearful and sells too early. When he sees the stock immediately rise again, overshooting his original profit target, he can no longer stand the pain of missing the rally and buys way above his original entry point. The stock stalls and slides and he watches in horror as it sinks like a rock. In the end, he can’t take any more pain and sells out for a loss—right near the bottom. The original plan to buy may have been rational, but actually executing on his plan created an emotional storm.

Emotional traders do not pursue their best long-term interests. They are too busy bragging about a winning position and how smart they were for buying a stock or complaining and coming up with conspiracy theories about a losing position.

Your goal is to take money from emotional amateur traders. (more…)

3 Types of Confidence

I see three types of confidence among traders:

First, is what I call ‘false confidence’ That’s the person who talks big and poses like a big shot. This type of person often takes big risks in an effort to either impress others or to assuage their own discomfort, and the results can be terrible.

Next, there is temporary confidence, which is conditional on recent performance. This is the person whose self-esteem is tied to their account equity or P&L. When on a good run, they feel confident and take larger risks (often the prelude to giving it all back). And when performance is lousy they start grasping at anything, maybe exiting winners prematurely or taking on excessive risk to get their money back.

Finally, we have true confidence. This is confidence that does not depend on recent results. It is based on a deep sense of inner trust. This is the person who has a history of doing the right thing, regardless of the outcome. Doing the right thing in the sense that they act in their own best interest and trust and understand that doing such over time has a positive impact on results. The trust runs deep enough to provide resilience in the face of disappointment. This is true self-confidence, the kind you want in trading and in life.

Almost everyone says that discipline is a requirement to succeed in trading. But most people never talk about what really underlies that type of discipline. The answer……true self-confidence.

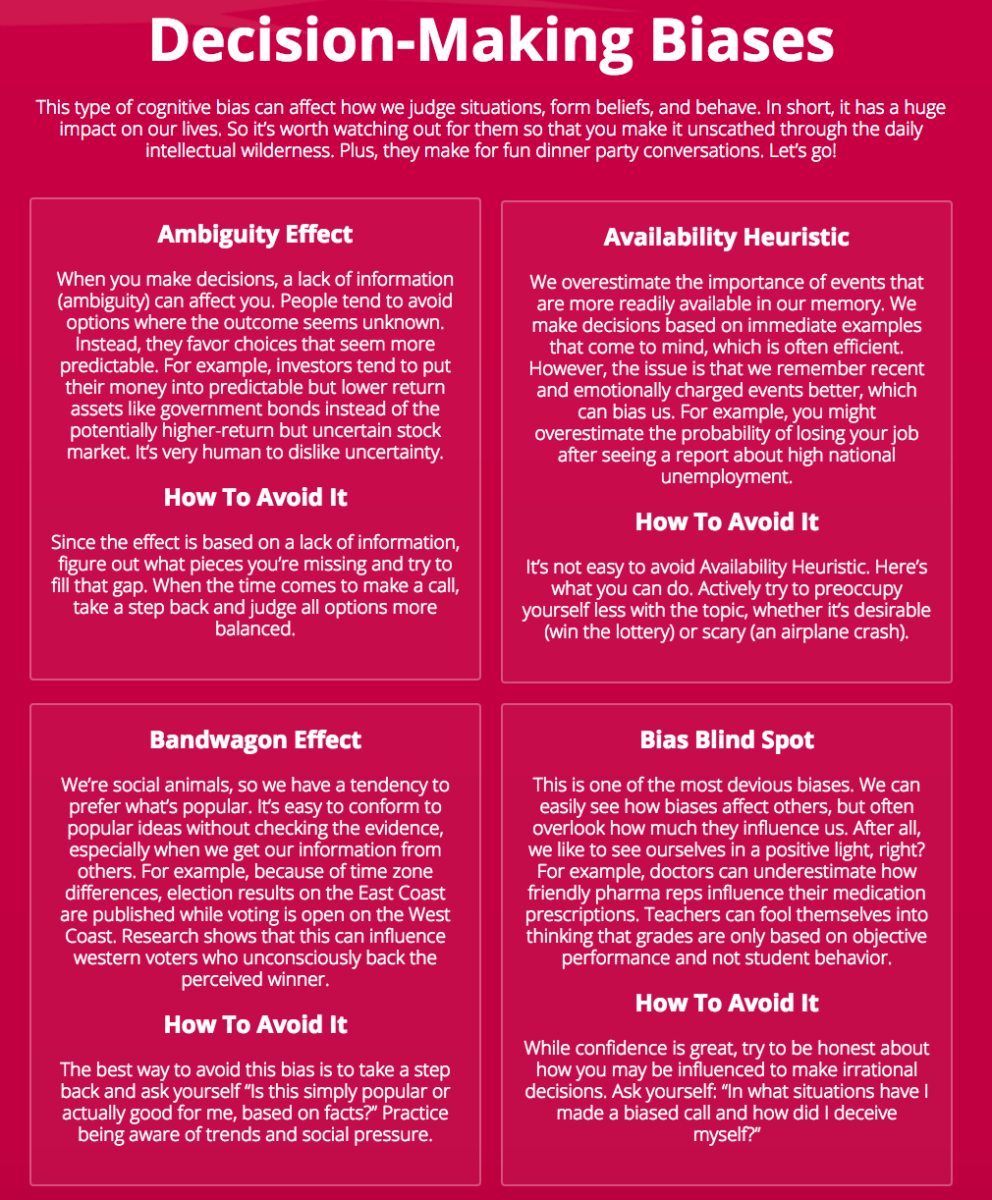

Ultimate Cognitive Bias Survival Guide

One Out Of Every Ten Wall Street Employees Is A Psychopath, Say Researchers

Maybe Patrick Bateman wasn’t such an outlier.

One out of every 10 Wall Street employees is likely a clinical psychopath, writes journalist Sherree DeCovny in an upcoming issue of the trade publication CFA Magazine (subscription required). In the general population the rate is closer to one percent.

“A financial psychopath can present as a perfect well-rounded job candidate, CEO, manager, co-worker, and team member because their destructive characteristics are practically invisible,” writes DeCovny, who pulls together research from several psychologists for her story, which helpfully suggests that financial firms carefully screen out extreme psychopaths in hiring.

To be sure, typical psychopathic behavior runs the gamut. At the extreme end is Bateman, portrayed by Christian Bale, in the 2000 movie “American Psycho,” as an investment banker who actually kills people and exhibits no remorse. When health professionals talk about “psychopaths,” they have a broader range of behavior in mind.

A clinical psychopath is bright, gregarious and charming, writes DeCovny. He lies easily and often, and may have trouble feeling empathy for other people. He’s probably also more willing to take dangerous risks — either because he doesn’t understand the consequences, or because he simply doesn’t care. (more…)

Winners-Losers

The algos are bearish

WSJ story says trend-following algos have sold

Trend-following investment strategies-a computer-based way of trading that has become a major force in some markets-have gone from bullish to bearish to a degree not seen in a decade, according to AlphaSimplex Group.

The WSJ writes about how algos are an increasingly big part of investment decisions and that they’re still uniformly bearish.

I’m skeptical of this kind of thing, because how is AlphaSimplex Group supposed to know what the algos at Renaissance or Bridgewater are doing? At best, they’re guessing.

This is how Trump tweets about the stock market