1. CONFIDENCE: absolutely essential in an environment that feeds on emotional instability.

2. TRUST: if you cannot trust yourself who can you trust? Trust your rules, trust your edge, trust that you will do the right thing-no matter what!

3. FOCUS: you will never learn all there is to learn about the market. Push your ego aside and focus on one market and one edge.

4. ACCEPTANCE: you have to accept what the market is willing to give or you will give the market what it wants to take.

5. RESPONSIBILITY: you and you alone are responsible for the money you lose and the money you make. Take the credit for both. Either way you deserve it.

6. PATIENCE: The market is not the place to learn patience, it is the place to practice it.

7. RULES: the market has no rules and no one else will do it for you. Develop rules for entering AND exiting trades before trades are made.

8. RESPECT: you have to respect the market for what it is not for what you want it to be. The market has a logic all its own. You may not like it but you have to accept it.

Latest Posts

rssSomewhere in UK -Somebody has written This…..

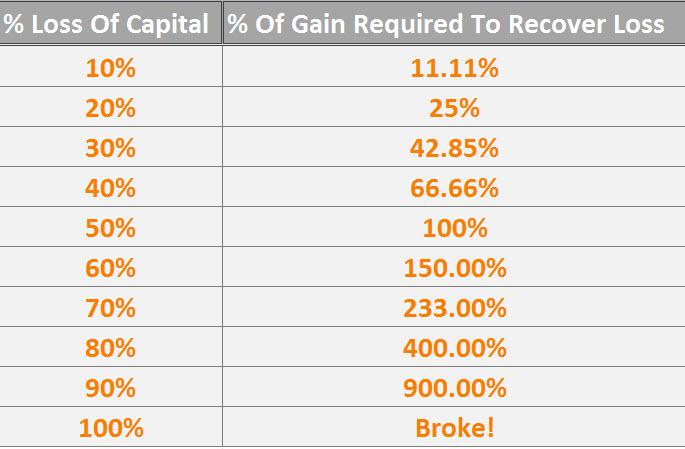

Never forget risk of ruin is, NOT LINEAR

Evolution

Who Owns Greek Debt And When Is It Due?

Funding needs and repayment schedules for Greek sovereign debt

Summary:

- Greece owes EUR 315bn.

- There are three large blocks of officially held debt still outstanding: (1) the Greek loan facility (EUR 53bn, at EURIBOR+50bp, which matures from 2027 onwards); (2) EFSF / ESM loans (EUR 142bn disbursed, EUR 2bn committed; at EFSF funding plus small administrative fee, maturing in 30 years or after); and (3) IMF loans (EUR 20bn, maturing currently).

- There is also EUR 66bn of marketable debt outstanding, of which EUR 27bn is held by the ECB as a result of purchases under the Securities Markets Programme (SMP). There are EUR 15bn of outstanding Treasury bills. The remaining obligations are government and government-backed loans.

- Between 2016 and 2022, total debt servicing costs (both redemptions and interest payments) are small – between EUR 6 and EUR 10 bn.

- In 2015 financing requirements are more substantial. Core funding needs are about EUR 19bn. We have little information on available cash reserves.

- Key upcoming maturities are: (a) bonds held by the ECB in July and August (Table 2); (b) IMF loans in February and March of around EUR 3.5bn (Table 3); and (c) Treasury bills (most of which will be rolled by domestic banks, but a small portion of which are held by foreigners with a likely failure to roll resulting in a drain on government cash reserves).

Things Money Can't Money

"Pay yourself first. A part of all you earn is yours to keep."

This is Great

"You can't produce a baby in 1 month by getting 9 women pregnant." Nothing replaces experience. Learn thru battle!