Thought For A Day

Consider an illustration that can make you rich:

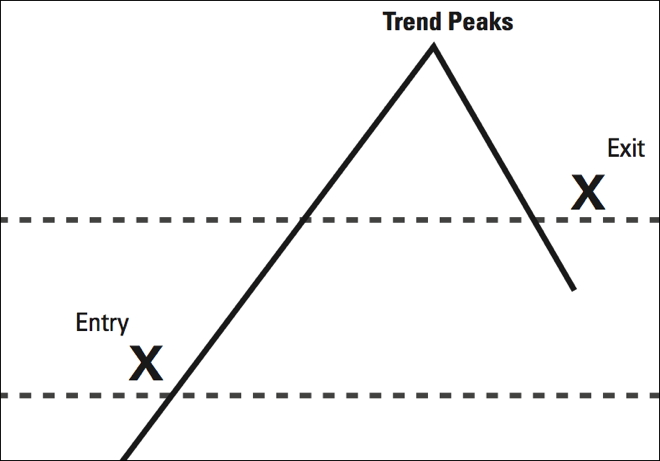

Trend following does not pick bottoms or tops. You always get into a trend late, and get out late. You cannot predict a trend. That chart might not seem like a great strategy at first glance, but it is the foundation of one of the most profitable insights in the history of market speculation: capture the middle meat and you can make a fortune.

On 11th Sept’09 ,I had written about Base Metals ..just click here and see

On 17th Sept’09,Written not to touch GOLD and Don’t hold long in precious Metals….u don’t believe …click here

On 21st Sept ’09 ,written about Natural Gas ..Don’t miss to read …click here

On 21st Sept ’09 written about S&P 500 ,No Magic No Miracle………..yes it had crashed :Click here and see

On 21st Sept ’09,I had written about Shanghai Index and just see in last 4 sessions it had crashed again…look here to BelieveOn 22nd Sept ’09 written boldly that I expect crack in Crude oil….for these type of forecast u dont have to pay money to Jokers ,I will write free…click here

To get all three ,Just join us and become our Subscribers.

To get Details :send me mail at [email protected]

“The key is consistency and discipline,” says Richard Dennis who grew $400 into $200,000,000.

“The key is consistency and discipline,” says Richard Dennis who grew $400 into $200,000,000.

“The key is consistency and discipline. I don’t think anybody winds up making money in this business because they started out lucky.”

For legendary trader Richard Dennis, the importance of being consistent isn’t just theory. In 1984, on a bet, Dennis trained 23 individuals off the street to religiously follow a set of trading rules. His point was to provide that discipline was the key to trading success. All but 3 of those beginner traders made over 100% return their very first year of trading and Dennis won his $1,000,000 bet. Consistent discipline is also what is taught in the “Futures in Motion” advisory service.

“It’s perseverance” declares Tom Baldwin who started with $25,000 and made untold millions trading upwards of $2 billion dollars a day in T-Bond futures.

“It’s perseverance. You don’t need any education at all to do it … because it is like any job. If you stand there long enough, you have to pick it up.” (more…)

| 1) Did I trade well today? – Did I make good use of my preparation? Did I follow rules about position sizing and execution? Did I adapt well to shifts during the trading day? Was I patient in finding trades with good risk/reward characteristics? 2) What did I learn about myself today? – What about today’s trading can I bring to the next day to make myself better? How can I learn from what I did right and wrong today? What goals can I set for tomorrow to make sure that I carry over that learning? 3) What did I learn about markets today? – Did markets do what I expected? Are my views on markets any different based on today’s trade? What levels did I observe in today’s trade that can inform decision making tomorrow? What themes from today will I be tracking tomorrow? |