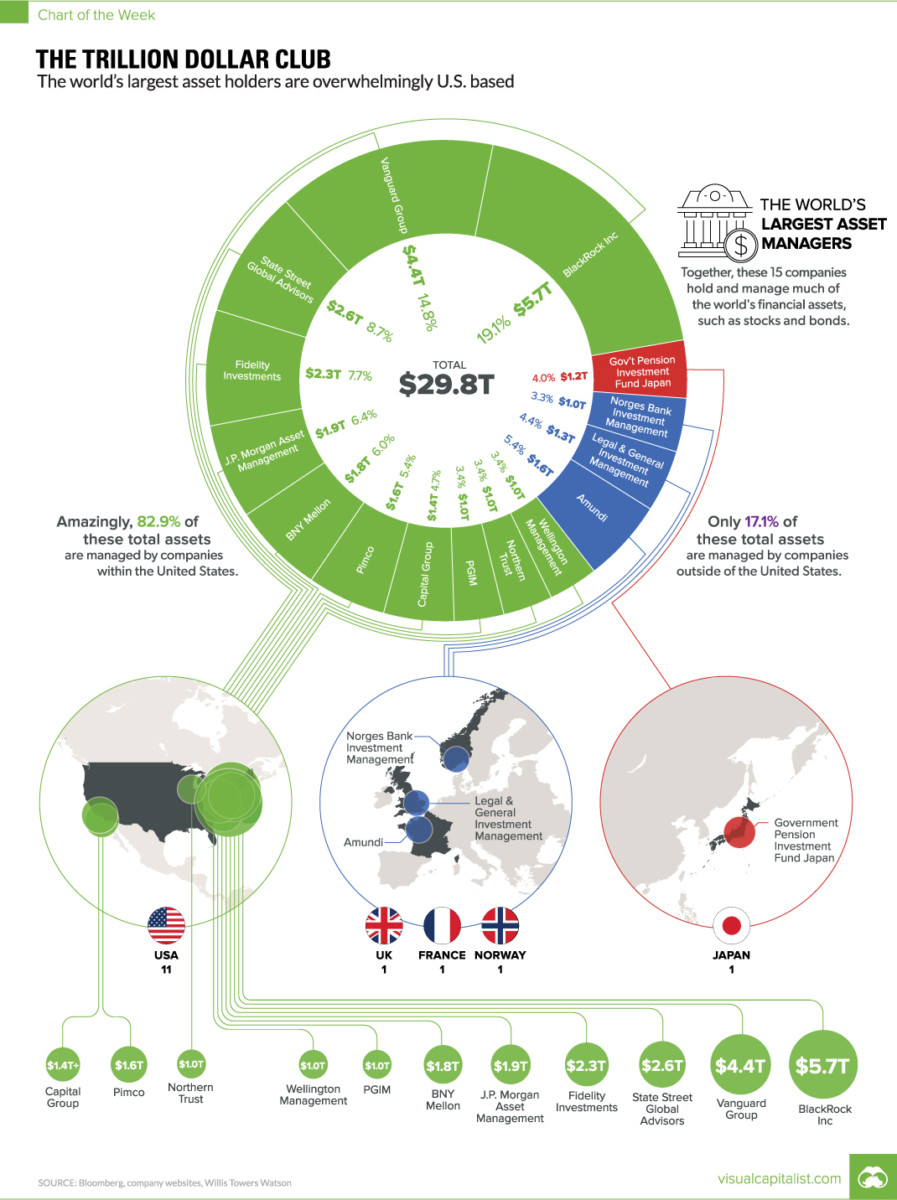

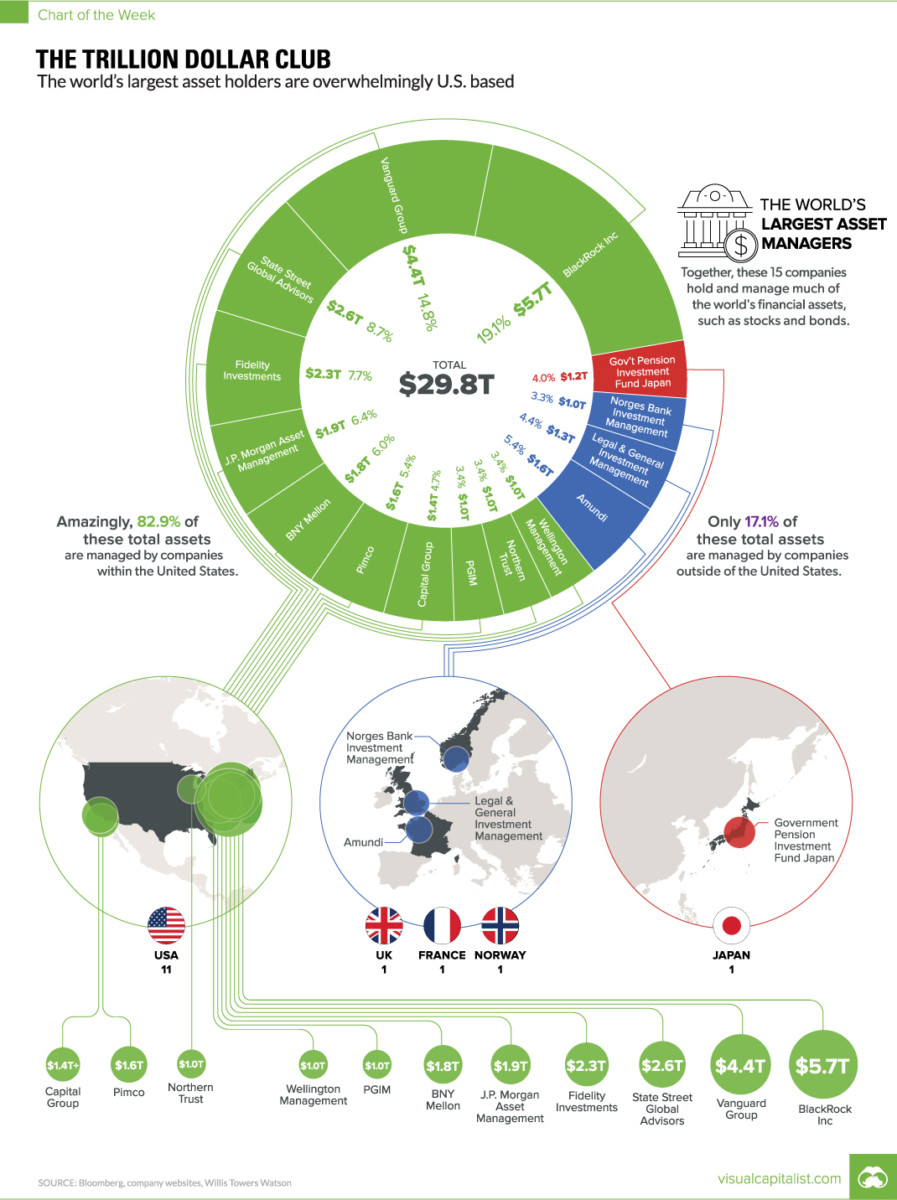

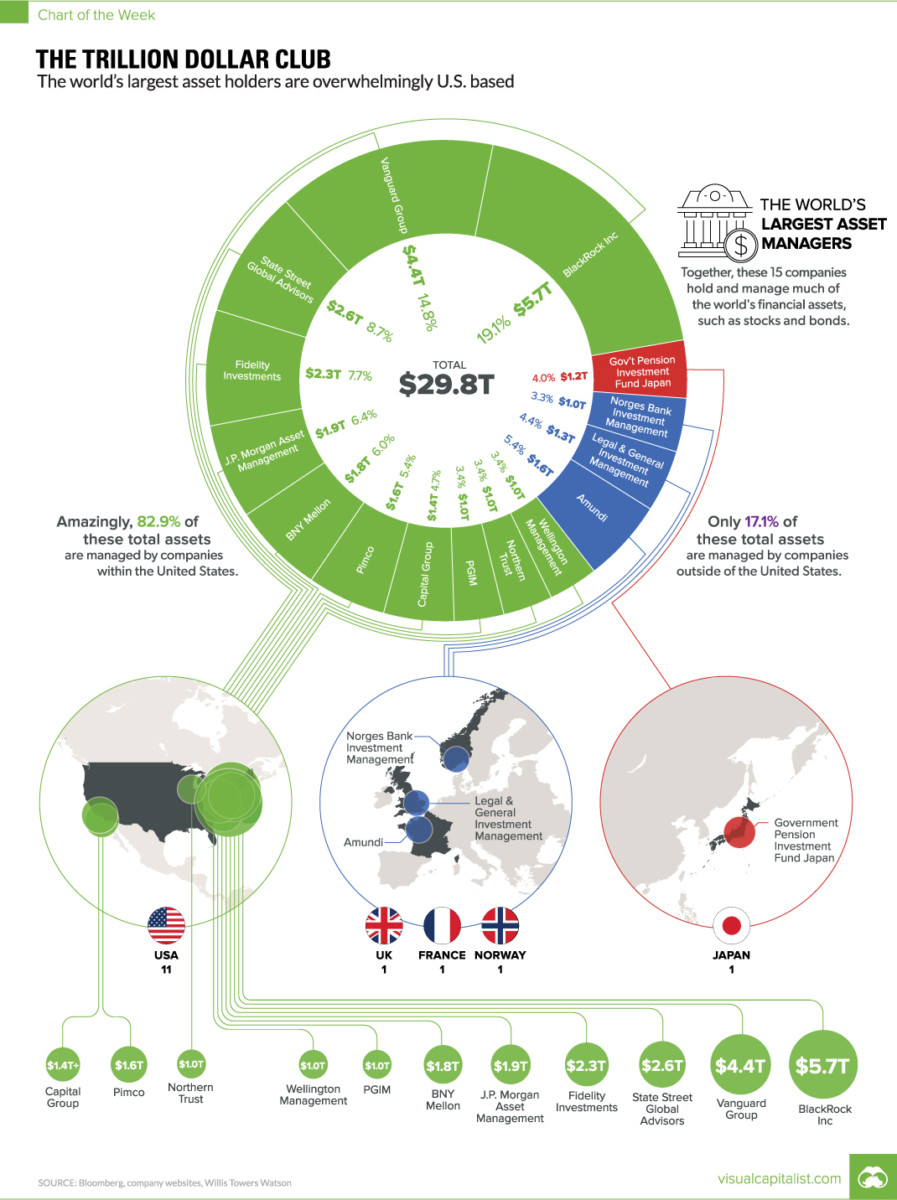

Asset Managers: Trillion Dollar Club

Optimism means expecting the best, but confidence means knowing how you will handle the worst. Never make a move if you are merely optimistic.

Optimism means expecting the best, but confidence means knowing how you will handle the worst. Never make a move if you are merely optimistic.

Take a trading break. A break will give you a detached view of the market and a fresh look at yourself and the way you want to trade for the next several weeks.

It is a safe bet that the money lost by (short term) speculation is small compared with the gigantic sums lost by those who let their investments “ride”. Long term investors are the biggest gamblers as after they make a trade they often times stay with it and end up losing it all. The intelligent trader will . By acting promptly—hold losses to a minimum.

People who buy headlines eventually end up selling newspapers. (more…)

Many times day traders are very anxious and want to be involved in a trade all day. The market only gives a few good opportunities a day and that is when traders should react and take what the market is offering.

Trading is very similar to the lion in the jungle. The lion stalks his pray in the brush and he does not pick on the strongest animal in the pack. He looks for the one that is wounded or the animal that is not paying attention. Therefore, as a trader we must do the same thing.

Patience is what pays. Patience is what gives the lion a full belly when he has not eaten all day. Take a page from nature and only take the best chart setups at the most opportune times. As a trader we cannot impose our will on the market we can only take what the market gives us.

The market is not a weighing machine, on which the value of each issue is recorded by an exact impersonal mechanism, in accordance with its specific qualities. Rather, should we say that the market is a voting machine, whereon countless individuals register choices which are the product partly of reason and partly of emotion. (emphasis mine). |

“First of all, never play macho with the market. Second, never overtrade”

“First of all, never play macho with the market. Second, never overtrade”

“I spend my day trying to make myself as happy and relaxed as I can be. If I have positions going against me, I get right out; If they are going for me, I keep them.”

“Risk control is the most important thing in trading”

“Dont ever average losers. Decrease your trading volume when you are trading poorly, increase your volume when you are trading well. Never trade in situations where you don`t have control. For example I don`t risk significant amounts of money in front of key reports, since that`s gambling, not trading”

“If you have a losing position that is making you uncomfortable, the solutuion is very simple: Get out, because you can always get back in. There is nothing better then a fresh start.”

![]()

-For Time Being worst is over ?

-I see rally in EURO !!

-Yes ,Above 124.27 will zoom upto 125.80 ,126.3

-Then will kiss 127.83-128.33.

All levels are valid till it not breaks 121.74 level.

So rally in EURO Means ?????What will happen to GOLD ??Think and act.

Updated at 13:30/20th May/BARODA

MOST PEOPLE WILL GIVE UP AT THIS POINT, AS THEY REALIZE WORK IS INVOLVED. (more…)