THE LAWSof Lifetime Growth:

LAW ONE: Always make your future bigger than your past. Find out more

LAW TWO: Always make your learning greater than your experience. Find out more

LAW THREE: Always make your contribution bigger than your reward. Find out more

LAW FOUR: Always make your performance greater than your applause. Find out more

LAW FIVE: Always make your gratitude greater than your success. Find out more

LAW SIX: Always make your enjoyment greater than your effort. Find out more

LAW SEVEN: Always make your cooperation greater than your status. Find out more

LAW EIGHT: Always make your confidence greater than your comfort. Find out more

LAW NINE: Always make your purpose greater than your money. Find out more

LAW TEN: Always make your questions bigger than your answers. Find out more

Latest Posts

rssIf you love Sholay, then this will make so much sense to you! Wisdom from Gabbar Singh!

90 % Traders….Make These Mistakes

5 Basic Tasks Necessary To Become A Winning Trader

- Develop a competent analytical methodology.

- Extract a reasonable trading plan from this methodology.

- Formulate rules for this plan that incorporate money management techniques.

- Back-test the plan over a sufficiently long period.

- Exercise self-management so that you adhere to the plan. The best plan in the world cannot work if you don’t act on it.

The rewards are bigger than ever if you are willing to take risks.

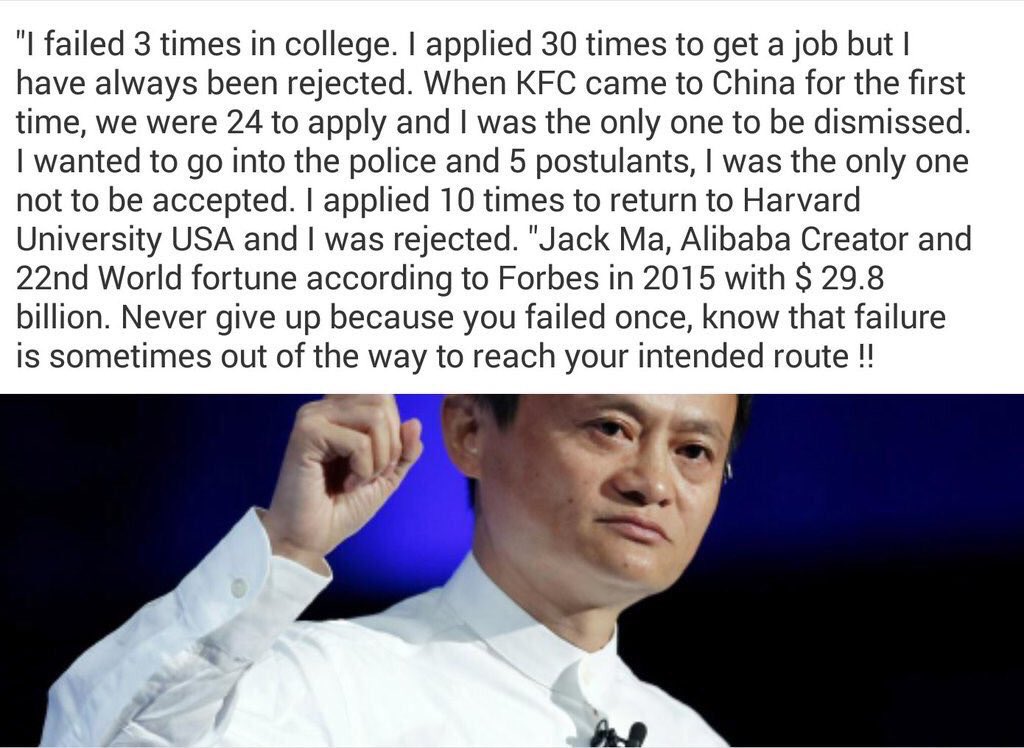

Never Give up Because you Failed Once

My Trading Mantra

10 Essential Trading Words

- Simplicity – have a simple, well defined way to generate trading ideas. Have a simple approach towards the market. You can’t take everything into account when you try to make an educated decision. Filter the noise and focus on several key market components. For me, they are relative strength and earnings’ growth.

- Common sense – create a trading system that is designed on the basis of proven trading anomaly. For example, trend following in different time frames. (more…)

Trading Profits in relations to Time and Accuracy

The size of profits of a trading system, is related to time and accuracy. They are inter-related and it is not possible to get the best out of all 3 factors in any trading system.

Before I elaborate further, I shall define what these 3 factors mean.

Size of profits – I am referring to the average amount of profits the system will earn per trade.

Time – The average length of time you held on to a trade.

Accuracy – The percentage that the system is correct and earns you a profit.

Big Profits = Long Time = Low Accuracy

For systems that aim for big profits, they must allow a greater range of fluctuations for the trade. By having a large trading range will in turn prevent you from getting stopped out so soon. Hence, you will be in a trade for a longer period of time. Besides having a larger profits, it will also serve you losses that are bigger, because your stop loss limit has to be further from your entry point. It is more difficult to grasp for the relationship with accuracy.

Small Profits = Short Time = High Accuracy

On the contrary, a highly accurate trading system allows you to be right most of the time but each time when you are right, you take very small profits. This is possible by making very tight stops in your trades such that you lock in profits as soon as you make them. Hence, you will be in and out of the trades very fast and frequently. This is typical to intraday trading or mean reversion models or even band trading. (more…)

Thought For A Day

THE LAWSof Lifetime Growth:

THE LAWSof Lifetime Growth: