|

Latest Posts

rssHow to Trade Through the Pain

10 painful aspects of trading and what to do about them.

The pain of losing money. (Trade smaller so it is not as painful, it is just an outcome not an emotion).

- The pain of being wrong about a trade you were sure about. (You lost simply because the market didn’t match your trade, trend followers lose money in choppy markets, swing traders lose money in trending markets, it’s the market not you. As long as you followed your own plan.)

- The pain of a draw down in capital.

- Consecutive trading losses hurt. They make you doubt yourself, your method, and your system. (You need to remember your winning trades, your winning years, or your back-testing, or paper trading of the method. You have to keep the faith or get with a method you have faith in).

- The embarrassment of public losses. You told everyone who would listen about a great trade you were taking and you were wrong. Social media has given us all the ability to embarrass ourselves anytime we want. (Never be overconfident in any trade, but always be sure of your stop loss.)

- The pain of of admitting you were wrong. (Cut your loss and move on to the next trade, trade reality not your ego.)

- Losing paper profits, you are up 20% on a trade then a massive whip saw takes back those profits in one move. (Take your trailing stop and move on to the next trade, there is truly no reason to cry over spilled milk.)

- You are following a guru and come to realize he truly is a salesman not a trader. (You stop following gurus and look to learn how to trade for yourself using a method and a trading plan).

- You buy a super hot stock that you have researched for many weeks then it goes down due to a bear market. (Only trade stocks long in up-trending markets)

You start trading a system that did amazing in back-testing and promptly lose 10% of your account. (You have to stick with it so it can win in the long term, you may need to make slight adjustments in position sizing or stops to account for volatility that you may have missed.)

Manage your risk of ruin as a trader or your account will be buried.

What are these elements of planning? 6 Questions

1) What you’re trading – Why are you selecting one instrument to trade (one stock, one index) versus others? Which instruments maximize reward relative to risk?

2) How much you’re trading – How much of your capital are you going to allocate to the trade idea versus other ideas?

3) Why you’re trading – What is the rationale for the trade? Why does the trade idea provide you with an “edge”?

4) What will take you out of the trade – What would lead you to determine that your trade idea is wrong? What would tell you that the trade has reached its profit potential?

5) Where you will enter the trade – Given the criteria that would take you out of the trade, where will you execute your idea to maximize the reward you’ll obtain relative to the risk you’ll be taking?

6) How you will manage the trade – What would have to happen to convince you to add to the trade, scale out of it, and/or tighten your stop loss?

Day Trading Starting Out

1• Don’t Mixing up Apples and Oranges

2• Don’t’ Winning 7 trades and LOSING ALL Gains on the Next 3 trades

3• When PREMISES FAIL, EXIT TRADE

4• 70% Consistency = 7 out of 10 trades

5• Be BORED = APATHY = EMOTIONAL DETACHMENT

6• DON’T WORRY ABOUT MAKING MONEY

7• Pauses in your Trading. Putting oneself into a position where defeat is impossible.

8• Determine Your STYLE

9• Stops based on type of Trade and Premises

10• Expect to make mistakes

12• Volume is KEY

13• Those who can recognize PATTERNS and Keep an OPEN Mind Will Succeed Faster – The ability to ADAPT – The Ability to REACT – The Ability to Admit Defeat Cut Losses Fast

Here's a chart of how the mkt performed for the past decade. We're in 39th week

Think Less & Keep It Simple

“One of the most difficult things to get investors and traders to understand is that no matter how much they investigate an investment, they will probably do better if they did less. This is certainly counter-intuitive, but the way that our brains function almost guarantees that this will happen. This kind of failure also happens to those investors frequently regarded as the smartest. In essence, the more information that investors have, the more opportunity that they have to choose the misinformation that suits their emotional purposes.

Speculation is observation, pure and experiential. Thinking isn’t necessary and often just gets in the way. Yet everywhere we turn, we read and hear opinion after opinion and explanation on top of explanation which claim to connect the dots between economic cause and market effect. Most of the marketplace is long on rationale and explanation and short on methods.

A series of experiments to examine the mental processes of doctors who were diagnosing illnesses found little relationship between the thoroughness of data collection and accuracy of the resulting diagnosis. Another study was done with psychologists and patient information and diagnosis. Again, increasing knowledge yielded no better results but did significantly increase confidence, something which the smartest among us are most prone to have in abundance. Unfortunately, in the markets, only the humble survive.

The inference is clear and important. Experienced analysts have an imperfect understanding of what information they actually use in making judgments. They are unaware of the extent to which their judgments are determined by just a few dominant factors, rather than by the systematic integration of all of their available information. Analysts use much less available information than they think they do.

Hope & Fear in Trading

In trading most new traders allow hope and fear to dictate their trading. They have a losing trade and instead of selling it and getting out they instead hope it will come back to even allowing the loss to grow. Another error for new traders is that when they have a winning trade they fear that the profit will disappear so they sell for a small gain and miss the big trend in their favor. When hope and fear controls the trader they end up with big losses and small gains. A formula for ruin.

Instead the rich trader is fearful of losses getting bigger so they sell quickly when losing, risking a maximum of 1% of their capital on any one trade. Rich traders are able to think clearly and trade rationally knowing exactly what they are risking, when their stop is hit, they get out. This enables them to keep all their losses small.

When a trade is immediately a winner for a rich trader they hope it will run 100 points in their favor. Rich traders enable this to be possible with a trailing stop, they do not get out of a winning trade until a key price reversal has happened that tells them that the trend is actually reversing.

Rich traders are fearful of losses growing bigger and hope that their winners will continue on a monster trend. This mindset allows them to be on the right side of trends and avoid any huge losses. This is why the best traders in the world are trend followers and win consistently. Do you want to join their club? Then do not let fear and hope dictate your trading decisions use them correctly.

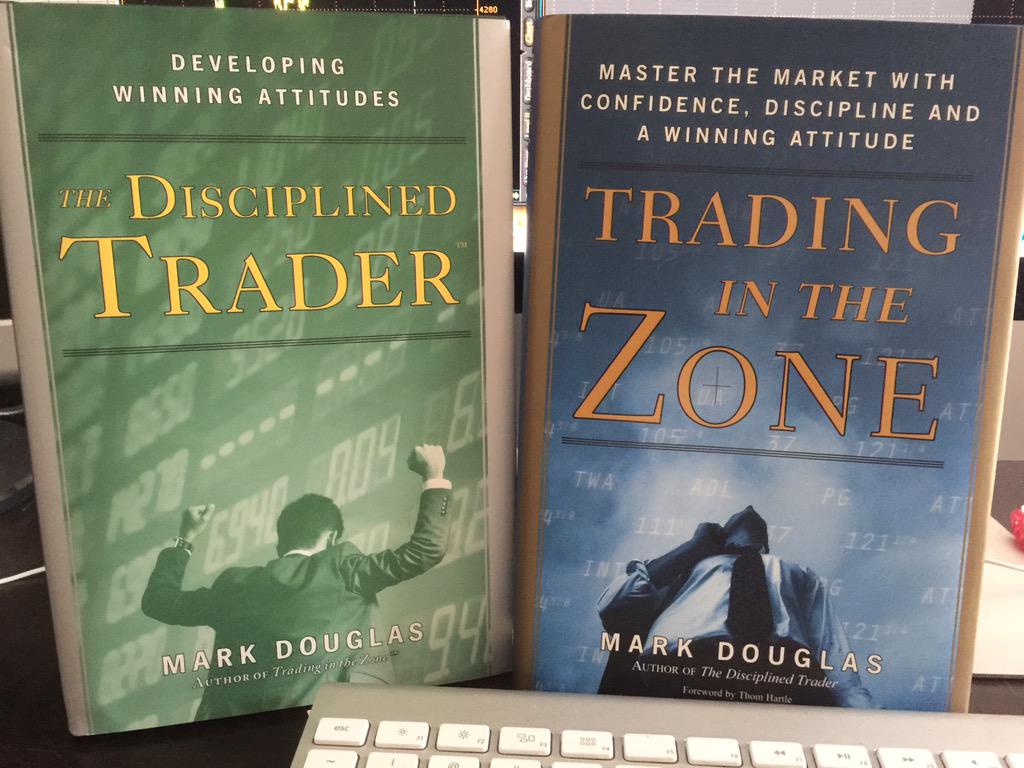

Author of Trading in the zone, The Disciplined Trader : Mark Douglas passed away at the age of 67

2 books all traders should have in their library

Words of Wisdom — Ed Seykota