Latest Posts

rssOverconfidence & Greed

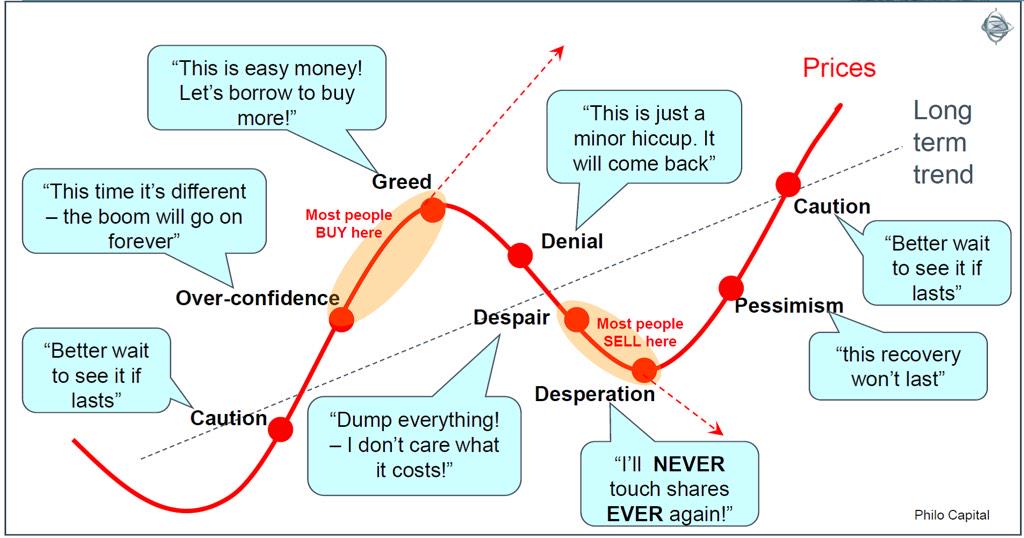

What most traders often don’t realize until it is too late is how quickly one can lose a lot of money in a single trade often with disastrous consequences. More often than not this painful experience comes from poor risk management following a period of successful trading. It is natural of course. We are pattern seeking mammals and when something starts working for us we get confident in our abilities and quickly forget we know very little what the market or a given stock may do at any given moment. In short: We easily become overconfident.

It is after a period of successful trading that traders tend to loosen up on good intentioned rules of discipline. They start thinking in term of dollar signs as opposed to the trade discipline. In short they think they can fly. “Look how much money I would have made if I had traded x % of my portfolio”. Stop yourself right there. While it is tempting to play mind games like this no good will come of it. Why? Because you just stepped overtly into the realm of one of the greatest sins of trading:

Once you get greedy you will start abandoning necessary discipline. Nobody, I repeat nobody, no matter how smart they think they are has a fail proof system or process or secret trading technique that guarantees 100% success. I surely don’t. Neither does Goldman Sachs or anybody else. While there may be some HFT firms out there that are trying to algo their way to a perfect system I have news for you: You are not an HFT or an algo. You are an individual trader and as good as you may be: You will have losing trades, things will go against you and oddly enough this will happen when you are at your most vulnerable: When you are overconfident, greedy and overexposed. Something curious tends to happen though when the losing trade occurs:

11 Trading Rules

Rule #1

Rule #1

Be data centric in your approach. Take the time and make the effort to understand what works and what doesn’t. Trading decisions should be objective and based upon the data.

Rule #2

Be disciplined. The data should guide you in your decisions. This is the only way to navigate a potentially hostile and fearful environment.

Rule #3

Be flexible. At first glance this would seem to contradict Rule #2; however, I recognize that markets change and that trading strategies cannot account for every conceivable factor. Giving yourself some wiggle room or discretion is ok, but I would not stray too far from the data or your strategies.

Rule #4

Always question the prevailing dogma. The markets love dogma. “Prices are above the 50 day moving average”, “prices are breaking out”, and “don’t fight the Fed” are some of the most often heard sayings. But what do they really mean for prices? Make your own observations and define your own rules. See Rule #1.

Rule #5

Understand your market edge. My edge is my ability to use my computer to define the price action. I level the playing field by trading markets and not companies.

Rule #6

Money management. Money management. Money management. It is so important that it is worth saying three times. There are so few factors you can control in the markets, but this is one of them. Learn to exploit it.

Rule #7

Time frame. Know the time frame you are operating on. Don’t let a trade turn into an investment and don’t trade yourself out of an investment.

Rule #8

Confidence and conviction. Believe in your strategies and bet wisely but with conviction. There is nothing more frustrating than having a good strategy work as you expect, yet at the end of the day, you have very little winnings to show for your efforts.

Rule #9

Persistence. It takes persistence to operate in the markets. Success doesn’t come easy, and if it does, then I would be careful. Even the best strategies come with losses, and they always seem to come when you get the nerve to make the big bet. Stay with your plan. If you have done your home work, the winning trades will follow.

Rule #10

Passion. In the end, trading has to be about your bottom line, but you have to love what you do and no amount of money is worth it if you aren’t passionate about the process. No matter how much success you enjoy, in the markets you can never stop learning.

Rule #11

Take care of yourself. No amount of money is worth it if your health is failing or you have managed to alienate yourself from family and friends in the process.

Traders Daily Lessons

Have the courage to say no.

Have the courage to face the truth.

Have the courage to do the right thing because it is right.

– W. Clement Stone

An inner dialogue typically reinforces the way you think. So the goal is to consciously expose yourself to thoughts that ultimately will positively impact your trading. Through the use of repetition you can considerably strengthen a positive attitude and sound trading behavior. The beauty of it is the simplicity of the method. It’s entirely up to you which trading mantras you want to adhere to. Here are a few that I strongly believe in and that characterize my thinking as a trader:

- Kill your greed

- Isolate yourself from the opinions of others

- Never chase stocks

- Always strive for emotional detachment

- Focus on proper execution

- There is never a shortage of opportunities

- Never make excuses

- Stay in control

- Don’t compare yourself to others

- Always use stop losses

- Standing aside is a position

- Money comes in bunches

- Never add to a losing position

- Stay calm and focused

- Don’t believe the hype

- Cultivate independent thinking

- Be ready for worst case scenarios

- Nosce te ipsum – Know thyself

This cycle plays out on many time frames for traders.

Big, Bold Predictions

The 7 Psychological Mistakes Traders make

Trading too big to “get back to even”.

Going “all in” on one trade that they believe they just can’t lose.

Being on the wrong side of an asymmetric trade. Being short options for possible small gains if right but big losses if wrong. In the long term eventually this blows up.

Fighting a trend over and over again, a trend that a trader or investor can not even believe is very dangerous because shorts look better the higher a stock goes and longs look like they are getting a bargain the lower the stock sinks.

In a losing trade the trader starts thinking “add more to a losing position” instead of “I need to cut my loss short”.

The trader believes they are right and the market is wrong.

Traders are trading markets they do not even fully understand and a trader must fully understand the risk and leverage involved in currencies, futures, options, and commodities to prevent possible blow ups due from ignorance.

If a trader can tightly control risk and position sizes this will get them closer to getting in the club with the 10% of winning traders.

"Free Speech" Summed Up In 1 Cartoon

All Traders Must See

The Win/Loss Ratio

“One common adage on this subject that is completely wrongheaded is: You can’t go broke taking profits. That’s precisely how many traders do go broke. While amateurs go broke by taking large losses, professionals go broke by taking small profits. The problem in a nutshell is that human nature does not operate to maximize gain but rather to maximize the chance of a gain. The desire to maximize the number of winning trades (or minimize the number of losing trades) works against the trader. The success rate of trades is the least important performance statistic and may even be inversely related to performance. … (more…)

“One common adage on this subject that is completely wrongheaded is: You can’t go broke taking profits. That’s precisely how many traders do go broke. While amateurs go broke by taking large losses, professionals go broke by taking small profits. The problem in a nutshell is that human nature does not operate to maximize gain but rather to maximize the chance of a gain. The desire to maximize the number of winning trades (or minimize the number of losing trades) works against the trader. The success rate of trades is the least important performance statistic and may even be inversely related to performance. … (more…)

Have the courage to say no.

Have the courage to say no.