Latest Posts

rssDow Jones -Hurdles :10209-10315-10350

Double Bottom at 9774-9757 ?

Yesterday spurted by 273 points and closed at 10172 level.

Now ,What to expect ?

Just Watch :10209 level

Crossover above this level will take to recent high of 10315-10350 level.

The level of 10412 is Major Hurdle for Bull’s

Three Consecutive close above 10412 wil take to 10630-10703 level.

I will Update about Nasdaq Composite ,S&P500 in afternoon

Updated at 5:37/11th June/Baroda

Focus

Two lessons from the road

– It only takes a small slip-up to create big negative effects. Conversely, the road to success in many of life’s ventures seems to be more incremental. Think of the engineering behind cars, space shuttles etc. One small error can lead to total disaster, but for everything to work, so many things have to be ‘right’. A related pattern is the carry trade in the currency market, where returns are incremental as the high yielding currencies slowly appreciate, but when we witness episodes of carry trade unwinding, things are not nearly as orderly.

– Missing my junction would be less of a problem if I was less tired and fatigued, because I would feel less downhearted at having to do the additional driving. However, it is when we have energy and are wide awake that we are least likely to miss our junctions, and we are more likely to miss them when we least want to. This reminds me of insurance not working when it comes to claiming, of correlations heading to one in times of crisis, and of markets being flush with liquidity, only for it to dry up right when it counts.

Makers of AK-47 filing for bankruptcy

So we heard that Kalashnikov – the makers of the AK-47 and, also, a fine vodka in an even finer rifle-shaped decorative glass bottle – is filing for whatever is the Russian equivalent of chapter 11 bankruptcy. Straight out of Pravda:

The Court of Arbitration of the Republic of Udmurtia registered a petition in bankruptcy of JSC Izhmash (Izhevsk Mechanical Works), the largest firearms maker in Russia, Interfax reports. The court hearings to investigate the causes of the petition will be held on October 7, 2009. (more…)

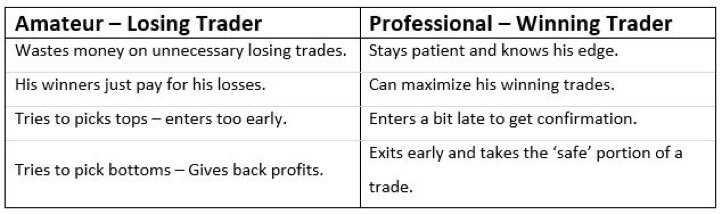

The difference between amateur and professional traders

Survival is on you

In the markets, less = more. Less positions, risk, decisions, hours at the screen and opinions of others = more money

Don’t compare the worst of who you are the to the best of everyone else.

Joseph Belmonte, Buffett and Beyond, 2d ed.-Book Review

In Buffett and Beyond: Uncovering the Secret Ratio for Superior Stock Selection (Wiley, 2015) Joseph Belmonte offers investors a metric he believes is pretty close to the Holy Grail: return on equity (ROE) as configured by Clean Surplus Accounting.

The companies that investors choose for their portfolios should have a ROE that is high and consistent over time. The problem is that practically all investors calculate ROE in a way that is both inefficient and unreliable. Traditional ROE is not a useful ratio for comparing the operating efficiency of one company to that of another because, for most companies, it is inconsistent from year to year. Worse, there is almost no correlation between book value (equity) and stock returns.

Traditional ROE uses earnings to calculate the return portion of ROE. But earnings include both non-recurring items, which are not predictable, and future liabilities. As Belmonte argues, “[i]n no way do these events show how efficiently you’ve been running your operation. And we’re concerned with operating efficiency in our ROE ratio and not branches falling out of the sky because of a hurricane passing by.” (p. 59) So, for the return portion of the ROE ratio one should use net income, not earnings.

What about the equity portion of ROE? Owners’ equity (or book value) equals the common stock issuance plus all retained earnings, where these retained earnings can come only from net income minus dividends.

Based on his research, indicating that stocks with a history of high Clean Surplus ROEs outperformed the S&P 500, Belmonte came up with six simple rules for structuring a portfolio.

(more…)