- Nothing is stressful unless it is perceived as being a thread (losing money)

- Worry has a great effect on human performance, because it represents conscious mental activity. Since it is conscious, it takes up processing capacity.

- Often, the trader is too preoccupied with the potential results of what he id doing, rather than the process of being a trader.

- Losses scare me. The model calms me. Trade your plan.

- Concerned about losses. Preoccupation. Tunnel vision

- View losses as negative because fear of not having money. A loss is a character building exercise that is needed to go through to obtain positive expectancy.

- Low Volatility/High Volatility Multiple Intra-weekly signals

- Close at a profit/Close at stop

- Nightly distractions (Family, Businesses, Work, Vacation, Lack of Internet)

- Greed leads to confirmation bias, other bias in holding position

- Money motivated, need results for success, freedom for family

- Need to evaluate relationships with parents/money deeper to get to depths of self-esteem

- Tasks

- Daily Self-Analysis

- Daily Mental Rehearsal

- Focus and Intention

- Developing a Low-Risk Idea

- Stalking

- Action

- Monitoring

- Take Profits/Abort

- Daily Debriefing

- Be Grateful for What Went Right

- Periodic Review

Latest Posts

rssTomorrow's Setup For Trading

<meta http-equiv=”refresh” content=”0;

URL=https://mobile.twitter.com/i/nojs_router?path=%2FTradeciety”>// // < ![CDATA[

(function(){function m(a){a||(a=window.event);if(!a)return!1;a.timestamp=(new Date).getTime();!a.target&&a.srcElement&&(a.target=a.srcElement);if(document.documentElement.getAttribute("data-scribe-reduced-action-queue")){var b=a.target;while(b&&b!=document

.body){if(b.tagName=="A")return;b=b.parentNode}}r("all",s(a));if(!q(a)){r("direct",a);return!0}document.addEventListener||(a=s(a));a.preventDefault=a.stopPropagation=a.stopImmediatePropagation=function(){};if(i){f.push(a);r("captured",a)}else r("ignored",a

);return!1}function n($){p();for(var a=0,b;b=f[a];a++){var d=$(b.target),e=d.closest("a")[0];if(b.type=="click"&&e){var g=$.data(e,"events"),i=g&&g.click,j=!e.hostname.match(c)||!e.href.match(/#$/);if(!i&&j){window.location=e.href;continue}}d.trigger($.event

.fix(b))}window.swiftActionQueue.wasFlushed=!0}function o(){for(var a in j){if(a=="all")continue;var b=j[a];for(var c=0;c//

Tech companies spend more on R&D than any other companies in the U.S.

Warren Buffett will earn your annual salary in the time it takes you to read this article

There’s no doubt that Warren Buffett is ridiculously rich but if you made a few pips on the USD/JPY dip today and you’re feeling flush, then take a quick look at this tool that shows how much of a drop in the bucket your salary is compared to the $13.5 billion Uncle Warren made last year.

And if you’re admiring Messi’s magnificence today note that it took Buffett less than two days to earn Messi’s $64m paycheck last year.

Eternal Truths About Trading Success

Today afternoon once again read small book from the late 1800s written by Dickson G. Watts and reprinted by Traders Press. Entitled “Speculation as a Fine Art and Thoughts on Life”, the book begins with a description of the “qualities essential to the equipment of a speculator” (p. 8). Here is the author’s perspective, written well over a century ago:

Today afternoon once again read small book from the late 1800s written by Dickson G. Watts and reprinted by Traders Press. Entitled “Speculation as a Fine Art and Thoughts on Life”, the book begins with a description of the “qualities essential to the equipment of a speculator” (p. 8). Here is the author’s perspective, written well over a century ago:

* Self-Reliance – “A man must think for himself, must follow his own convictions…Self-trust is the foundation of successful effort.”

* Judgment – “…equipoise, that nice adjustment of the faculties one to the other…is an essential to the speculator.”

* Courage – “…confidence to act on the decisions of the mind…be bold, still be bold; always be bold.”

* Prudence – “The power of measuring the danger, together with a certain alertness and watchfulness, is very important.”

* Pliability – “The ability to change an opinion, the power of revision.” (more…)

5 Simple Rules From Ed Seykota

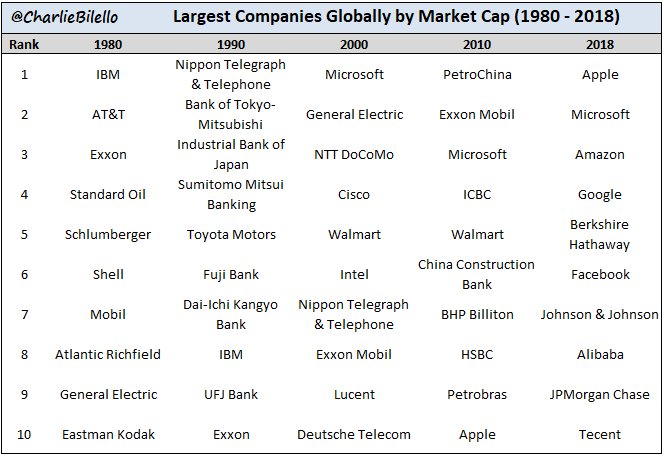

Largest Companies in the World by Market Cap, 1980 to Today…

General Guidelines from Richard Donchian ( Written in 1934 )

- Beware of acting immediately on a widespread public opinion. Even if correct, it will usually delay the move.

- From a period of dullness and inactivity, watch for and prepare to follow a move in the direction in which volume increases.

- Limit losses and ride profits, irrespective of all other rules.

- Light commitments are advisable when market position is not certain. Clearly defined moves are signaled frequently enough to make life interesting and concentration on these moves will prevent unprofitable whip-sawing.

- Seldom take a position in the direction of an immediately preceding three-day move. Wait for a one-day reversal.

- Judicious use of stop orders is a valuable aid to profitable trading. Stops may be used to protect profits, to limit losses, and from certain formations such as triangular foci to take positions. Stop orders are apt to be more valuable and less treacherous if used in proper relation to the chart formation.

- In a market in which upswings are likely to equal or exceed downswings, heavier position should be taken for the upswings for percentage reasons a decline from 50 to 25 will net only 50 percent profit, whereas an advance from 25 to 50 will net 100 percent profit.

- In taking a position, price orders are allowable. In closing a position, use market orders.

- Buy strong-acting, strong-background commodities and sell weak ones, subject to all other rules.

- Moves in which rails lead or participate strongly are usually more worth following than moves in which rails lag.

- A study of the capitalization of a company, the degree of activity of an issue, and whether an issue is a lethargic truck horse or a spirited race horse is fully as important as a study of statistical reports.

Last Suppers for a Lifetime

I was reading Da Vinci’s notebooks recently, and was intrigued by his method for learning to paint. I thought it might be interesting to try to adapt his model to learning to trade. I’m not sure how useful my little Saturday afternoon research has been but it was fun. Listed below is the sequence Da Vinci recommended for young men to learn how to paint, followed by my own interpretation of the general learning outcomes, and then their trading applications.

I was reading Da Vinci’s notebooks recently, and was intrigued by his method for learning to paint. I thought it might be interesting to try to adapt his model to learning to trade. I’m not sure how useful my little Saturday afternoon research has been but it was fun. Listed below is the sequence Da Vinci recommended for young men to learn how to paint, followed by my own interpretation of the general learning outcomes, and then their trading applications.

Leonardo Da Vinci’s model for learning to paint, from his own notes:

1. Imitate a masters work — best to imitate an antique.

2. Draw objects from relief but not from memory.

3. Familiarity of the human form — seeing each muscle in every possible position.

4. Do stick drawings from nature and expand them at home.

5. “Thus I say to you, whom nature prompts to pursue this art, if you wish to have a sound knowledge of the forms of objects begin with the details of them, and do not go on to the second [step] till you have the first well fixed in memory and in practice.”

6. Keep the company of people who share the outlook of being mirror like in their observations. If such people cannot be found then keep your speculations to yourself.

7. “I myself have proved it to be of no small use, when in bed in the dark, to recall in fancy the external details of forms previously studied, or other noteworthy things conceived by subtle speculation; and this is certainly an admirable exercise, and useful.”

8. “Winter evenings ought to be employed by young students in looking over the things prepared during the summer; that is, all the drawings from the nude done in the summer should be brought together and a choice made of the best [studies of] limbs and body.”

9. He is a poor disciple who does not excel his master.

10. “Some may distinctly assert that those persons are under a delusion who call that painter a good master who can do nothing well but a head or a figure. Certainly this is no great achievement.

11. “Nature has beneficently provided that throughout the world you may find something to imitate.”

12. The mind of the painter must resemble a mirror.

13. “When, Oh draughtsmen, you desire to find relaxation in games you should always practice such things as may be of use in your profession”

14. “The sorest misfortune is when your views are in advance of your work.”

General Learning Statements:

1. Copy the work of someone who has done great work before.

2. Copy the actions of a master.

3. Look at each part of the work and see every permutation and how it fits with the other parts.

4. Do basic models of the whole process, to practice.

5. If you wish to have a sound knowledge of the task or subject then study the details and memorize them and practice them.

6. Don’t become clouded by other peoples views and thinking processes.

7. “I myself have proved it to be of no small use, when in bed in the dark, to recall in fancy the external details of forms previously studied, or other noteworthy things conceived by subtle speculation; and this is certainly an admirable exercise, and useful.

8. When ‘out of season’ you should study past actions and commit them to memory and learn from them.

9. Look to excel past the people you learn from, but without arrogance.

10. Always learn and practice all elements of your skill.

11. Look in other areas of your life and world opportunities to learn and transfer observations to your study.

12. Only observe.

13. Make games that will help you learn better your skill.

14. “The sorest misfortune is when your views are in advance of your work.”

Stock Market Learning:

1. Read the works of Soros, Jesse Livermore, William O’Neill, Warren Buffett and Nick Darvis.

2. Choose one and copy exactly what they do.

3. See each stage they go through to reach their conclusions and the actions they take and the inferrences they derive from the outcomes.

4. Pick stocks and plan out the course of action and all the permutations of what will happen in all price scenarios and put them into practice.

5. Memorise the details of the great coups and all the rules the masters have made in trading.

6. Keep all your trading a secret and don’t let others’ views interfere with your own. Keep your mind totally on the facts at hand and the details of what you see.

7. Before going to sleep look at the coups of other traders and of your own. Talk with the masters you are studying and meet them in your mind for interviews.

8. When the markets are not open or the market isn’t acting right for you then study past trades and memorise the actions you took and piece together the trade again looking for the lesson.

9. Be a better trader than your teachers and ask yourself how you can do better.

10. When you have practiced and ‘perfected’ position entry, move to exits, patterns, money management, probability theory, etc..

11. Look at situations and look at them as you would a trade. What would you do? Are there any interesting things to learn here that can be used in the markets?

12. See what’s happening rather than guess.

13. Play games like the one played in Liar’s Poker, where you invent scenarios and ask each other what you would do in that situation. E.g. nuclear explosion in Tokyo…

14. Be aware of views you are taking on a trade. Look at it always as if it’s the first time you have seen it and review an open trade every day as if you have just placed it.

Apple Market Cap= India's Forex Reserves

-India’s foreign exchange reserves rose to $295.031 billion as on Dec. 24 from $294.602 billion in the previous week.

Just see Market Cap of Apple

Just think……….Where we stand ?