We all know that sentiment is a critically important ingredient in the pricing of tradable assets. But it is extremely difficult to move from this general and somewhat amorphous principle to a trading/investing edge. Richard L. Peterson takes up this challenge inTrading on Sentiment: The Power of Minds Over Markets (Wiley, 2016).

We all know that sentiment is a critically important ingredient in the pricing of tradable assets. But it is extremely difficult to move from this general and somewhat amorphous principle to a trading/investing edge. Richard L. Peterson takes up this challenge inTrading on Sentiment: The Power of Minds Over Markets (Wiley, 2016).

Peterson is the CEO of MarketPsych, a firm that in 2011 joined forces with Thomson Reuters to produce the Thomson Reuters MarketPsych Indices (TRMI), sentiment data feed covering five asset classes and 7,500 individual companies that Thomson Reuters distributes to its clients. As the Thomson Reuters website explains, these indices use “real-time linguistic and psychological analysis of news and social media to quantify how the public regards various asset classes according to dozens of sentiments including optimism, fear, trust and uncertainty.”

Odds are that, unless you’re a bank or hedge fund employee, you won’t have access to TRMI. Peterson’s book is the next best thing, although you have to realize that if you want to incorporate sentiment (not some proxy for sentiment) into your trading decisions and can’t do big data analysis yourself, you’re working with one hand tied behind your back.

Trading on Sentiment is divided into five parts: foundations, short-term patterns, long-term patterns, complex patterns and unique assets, and managing the mind.

Latest Posts

rssPlato on DEMOCRACY

Barron’s: Whose Better for Investors, Trump or Clinton?

HOW TO LOSE MONEY IN THE STOCK MARKET

According to Mark Douglas…

In any particular trade you never really know how far prices will travel from any given point. If you never really know where the market may stop, it is very easy to believe there are no limits to how much you can make on any given trade. From a psychological perspective this characteristic will allow you to indulge yourself in the illusion that each trade has the potential of fulfilling your wildest dream of financial independence. Based on the consistency of market participants and their potential to act as a force great enough to move prices in your direction, the possibility of having your dreams fulfilled may not even remotely exist. However, if you believe it does, then you will have the tendency to gather only the kind of market information that will confirm and reinforce your belief, all the while denying vital information that may be telling you the best opportunity may be in the opposite direction.

There are several psychological factors that go into being able to assess accurately the market’s potential for movement in any given direction. One of them is releasing yourself from the notion that each trade has the potential to fulfill all your dreams. At the very least this illusion will be a major obstacle keeping you from learning how to perceive market action from an objective perspective. Otherwise, if you continually filter market information in such a way as to confirm this belief, learning to be objective won’t be a concern because you probably won’t have any money left to trade with (italics mine).

In trading less is more

Traders must find rest & balance.

Tomorrow is Too Late

Trading has many ups and downs and can easily cause us to feel defeated.

Trading has many ups and downs and can easily cause us to feel defeated.

However, defeat can only be disastrous if we classify it as disastrous.

Losses, defeats, failures, etc. have been a part of history for every person who has reached high levels of success. The difference with the successful people is that they analyze the situation immediately. Those that tend to fade away are those that wait until tomorrow or maybe never to review and discover why the results were not what they expected.

To be successful we must accept every result as a part of our growth and to apply those findings today. Don’t wait until tomorrow, because tomorrow may be too late.

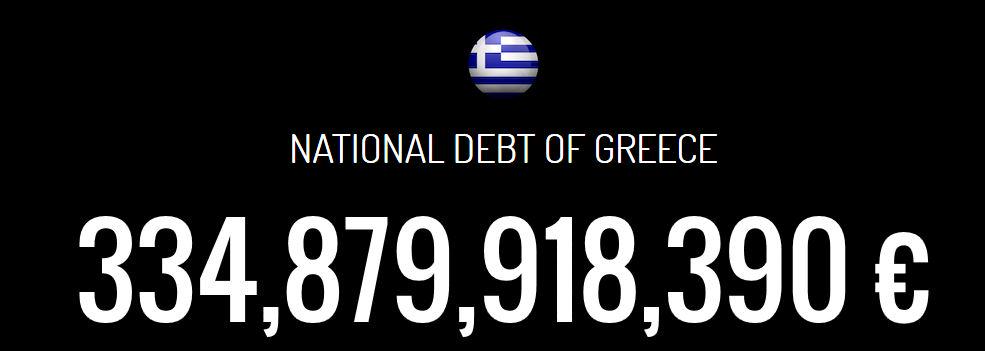

Greece -You could wrap $1 bills around the Earth 1,465 times with the debt amount! Unrecoverable.

5-minute MBA ( 6 Lessons )

Lesson 1:

A man is getting into the shower just as his wife is finishing up her shower, when the doorbell rings.

The wife quickly wraps herself in a towel and runs downstairs.

When she opens the door, there stands Bob, the next-door neighbor.

Before she says a word, Bob says, ‘I’ll give you $800 to drop that towel.’

After thinking for a moment, the woman drops her towel and stands naked in front of Bob, after a few seconds, Bob hands her $800 and leaves.

The woman wraps back up in the towel and goes back upstairs.

When she gets to the bathroom , her husband asks, ‘Who was that?’

‘It was Bob the next door neighbor,’ she replies.

‘Great,’ the husband says, ‘did he say anything about the $800 he owes me?’

Moral of the story:

If you share critical information pertaining to credit and risk with your shareholders in time, you may be in a position to prevent avoidable exposure. (more…)

Volatile vs. Smooth

“Conventional economic reasoning says that if two stocks have similar expected future cash flows and similar dependence on the market, we prefer the one that is less volatile. But might we not see some advantage to stock in volatile company A, which has survived many crises, over stock in safe, untested company B? Perhaps A’s stresses have allowed evolution of the characteristics that will succeed in the future, whereas B is narrowly positioned for the conditions of the past. In the future, perhaps A’s volatility will allow it to move faster into opportunities and away from dead ends, and to evolve as conditions change.”

– Aaron Brown, Red-Blooded Risk

Why does academia assume lower volatility is better?

How many real world instances have you seen confirming that more volatile = more robust, while smooth = over managed, artificial, and possibly brittle?

What are some of the advantages of embracing volatility — managing it versus shunning it?