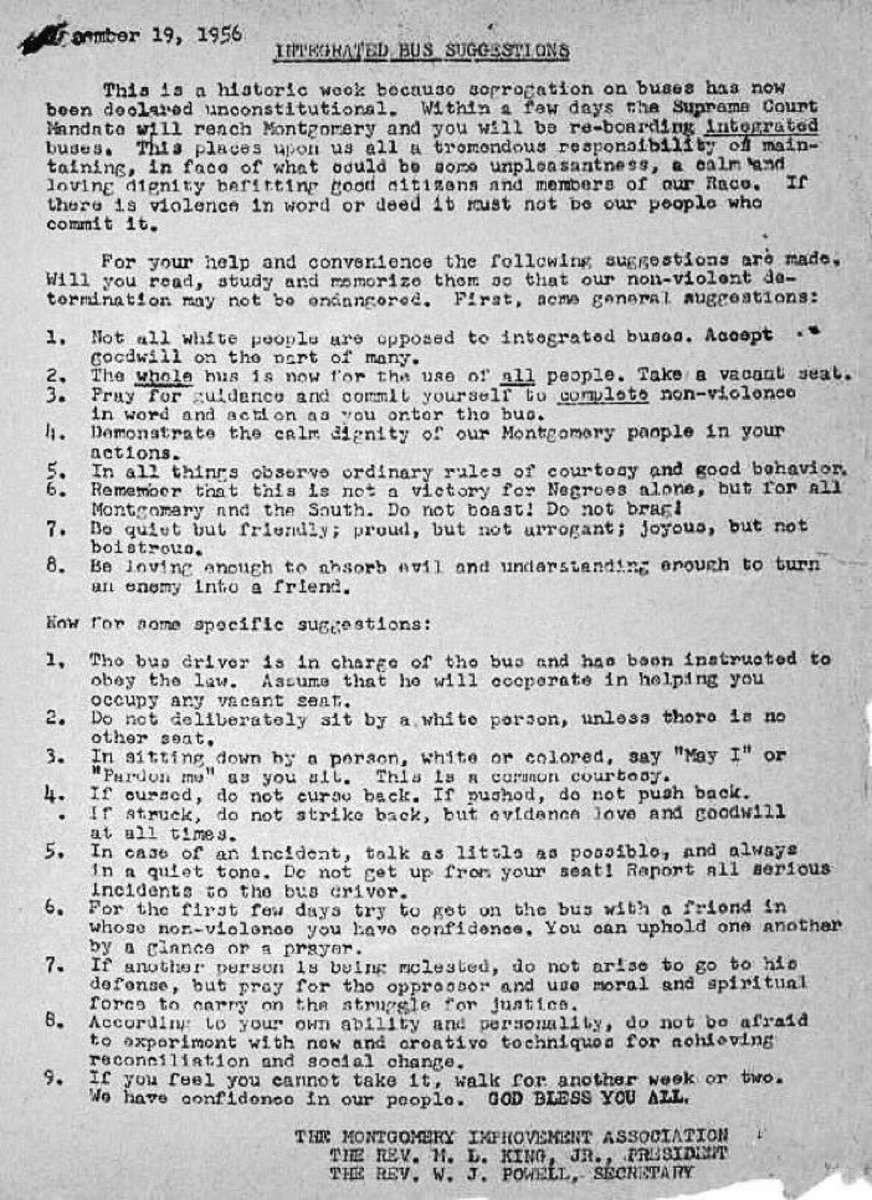

Martin Luther King's instructions to bus riders trying to integrate buses, 1956 — "observe rules of courtesy"

In what may be the funniest bit of economic humor uttered today, funnier even than the deep pontifications at Jackson Hole (where moments ago Stanley Fischer admitted that “research is needed for a better inflation indicator” which means that just months after double seasonally adjusted GDP, here comes double seasonally adjusted inflation), in an interview with Swiss newspaper Le Temps (in which among other things the fake-bronzed IMF head finally folded and said a mere debt maturity extension for Greece should suffice, ending its calls for a major debt haircut), took some time to discuss China.

This is what she said.

Turning to China, Lagarde said she expected the country’s economic growth rate to remain close to previous estimates even if some sort of slowdown was inevitable after its rapid expansion.

China devalued its yuan currency this month after exports tumbled in July, spooking global markets worried that a main driver of growth was running out of steam.

“We expect that China will have a growth rate of 6.8 percent. It may be a little less.” The IMF did not believe growth would fall to 4 or 4.5 percent, as some foresaw.

Actually, some – such as Evercore ISI – currently foresee China’s GDP to be negative, at about -1.1%. (more…)

One spent many pleasant moments this weekend after uncovering a cache of books that no one has seen for some 80 years: Squash and Badminton Annual, the magazine of winter court games of Massachusetts 1932, and 1933 and Set For Three, A Brief History of Squash Rackets I, Massachussets, 1905-1934, Volume 1. One saw pictures and history of the game that started by displacing squash tennis in 1905 and already by 1927 allowed women the privilege of playing the game in the mornings at the Union Boat Club and the Harvard Club. Eleonara Sears was the womens champion and she was closely followed by Mrs. George Wightman, Miss Maurine Boyen and Mrs. Will Howe, and Miss Priscilla Bartol. The game took a big change in 1921 when Harry Cowles became the coach at Harvard until 1932 and taught the college kids the short drop and the volley pioneered by Palmer Dixon. Jack Summers, coach at MIT and John Skillman, coach at Yale, were already prominent in the pro circuit. It is rare that I read something that I don’t learn something about markets and it was the case here.

Here’s a list from the April 1934 magazine of don’ts in badminton.

1. Don’t alter your grip for any stroke

2. Don’t lose short

3. Don’t try to kill everything

4. Don’t omit to feint but not too often

5. Don’t do a half-hearted smash

6. Don’t try impossible strokes

7. Don’t underrate your opponent

8. Don’t give up trying

9. Don’t forget to encourage your partner

10. Don’t get in your partner’s way

11. Don’t forget that to lose your temper generally loses the game

12. Don’t ever stand still but be always on the move. (more…)

Trading is one of the most difficult profession, winning traders have business plans. They have set of rules and guidelines to help keep their ship sailing in the right direction. Business plan in trading would cover time spend to study markets and trading, techniques and strategies to focus on, systems to use, expenses involved, maximum loss per trade, maximum drawdown, objectives and goals, etc. Best traders keep revisiting there business plans and change them when necessary, improving it with each iteration. Last but not least, the most important trait you would see in all successful traders is discipline. Without discipline no trader could be competent, because knowing in not the same as doing. Competence means that one has progressed beyond knowing what to do, to doing what one knows. Discipline makes trader competent.

Over trading is one of the biggest causes why traders never make it in the financial markets. With a click of a button, a trader can place a trade anytime he wants. It takes tremendous discipline to hold yourself back from over trading. There are many reasons why one may choose to over trade.

Over trading is one of the biggest causes why traders never make it in the financial markets. With a click of a button, a trader can place a trade anytime he wants. It takes tremendous discipline to hold yourself back from over trading. There are many reasons why one may choose to over trade.

1. Traders without a plan

Traders without a plan are my favorite type of traders because they will always lose. Without a plan, how would one know when to take a trade and when not to? Having a trading plan is a necessity. I can not trade if I do not have a plan for the day. I feel lost without one.

2. Revenge trading

Many new traders become tilted after a loss or a string of losses. This causes them to revenge trade just to break even. This often leads to reckless trading forcing a trade when opportunity is low.

3. Chasing the markets

Alot of new traders feel more pain when they have missed a move than an actual loss. This is why new traders love to chase the markets. If price has moved away from your projected entry point, let it go. There are plenty of more opportunities. Chasing is one of the worst habits a trader can have. Not only does it offer you low rewards, it also gives you a horrible entry and alters your stop loss placement. Always think about the risk before the profits.

When you have a plan to follow, it is easy to filter out bad trades from good one. This keeps you discipline and selective in your trades. I personally do not like trading more than 5 round trips a day. Patience is a virtue. There are always good high probability trading opportunities everyday. Just sit tight and don’t jump the gun.

One way to control a loss is by reducing your size. The problem with gamblers is that they will often double up their stake so they can get even quicker. This usually leads to a greater loss and devastation. Having the strength to grind your way back from a loss is important in trading. Whenever I am having a losing streak, I will trade small and gradually recover. This also gives me the confidence I need after a string of losses.

Find the people who most consistently come up with the most original and useful observations and ideas, study their thought processes (how they’re generating those ideas), replicate those ways of thinking for yourself, and take the time to begin thinking like them. Imagine doing that across many virtual mentors over time so that you begin to integrate the best thinking of the best people. That is how imitation turns into innovation.

Take a look at who you’re following in social media. If you’re spending much time reading material from those you don’t want to internalize, you’ll wind up with little cumulative development.