I recommend this video [see video below] about LTCM. Very interesting. (related to risk management and black swan events).

Latest Posts

rssHOW DISCIPLINE HELPS IN TRADING

“Discipline in executing each and every trade according to your trading methodology is the secret to your success. If you want to improve your trading, what you need to do is very simple. Before you enter any trade, imagine that you will have to explain this trade to a panel of your peers, by explaining to them the reason for your entry, your money, trade, and risk management guidelines, and why you exited the trade. Imagine having to explain why you chose this particular market and this particular time frame, along with how you set objectives for the trade, and how you determined where your initial protection would be. If you can truly do this, I strongly believe that you can be successful.

“Discipline in executing each and every trade according to your trading methodology is the secret to your success. If you want to improve your trading, what you need to do is very simple. Before you enter any trade, imagine that you will have to explain this trade to a panel of your peers, by explaining to them the reason for your entry, your money, trade, and risk management guidelines, and why you exited the trade. Imagine having to explain why you chose this particular market and this particular time frame, along with how you set objectives for the trade, and how you determined where your initial protection would be. If you can truly do this, I strongly believe that you can be successful.

Just prior to entering every trade, try to imagine yourself executing the trade perfectly. Imagine how it will feel when you enjoy having made money with your trading.

Yes I know, you don’t have time to do that. Why? Because you never plan your trades ahead of time. You probably don’t have a strategy, and instead of waiting patiently for trade that meets your well-defined parameters and your thought-out plan, you just jump in the minute you think you see something that looks good.

You need to take a lesson from a spider. The spider waits patiently in his web until some unsuspecting insect flies into the spider’s trap.

Nothing's as good as tuition at the school of trading

42 Ways To Trade Like A Market Wizard

What if you could read the principles for success for some of the world’s greatest traders? Well you can, here is how author Jack Schwager summed up the the similarities of the ‘Market Wizards’ he spent years interviewing in his second book.

The following is a summarized excerpt from Jack D Schwager’s book, The New Market Wizards. I highly recommend this book for all active traders.

- First Things First

You sure you really want to trade ? It is common for people who think they want to trade to discover that they really don’t. - Examine Your Motives

Why do you really want to trade ? Did you say excitement ? Then don’t waste your money in market, you might be better off riding a roller coaster or taking up hand gliding.

The market is a stern master. You need to do almost everything right to win. If parts of you are pulling in opposite directions, the game is lost before you start. - Match The Trading Method To Your Personality

It is critical to choose a method that is consistent with your your own personality and conflict level. - It Is Absolutely Necessary To Have An Edge

You cant win without an edge, even with the world’s greatest discipline and money management skills. If you don’t have an edge, all that money management and discipline will do for you is to guarantee that you will gradually bleed to death. Incidentally, if you don’t know what your edge is, you don’t have one. - Derive A Method

To have an edge, you must have a method. The type of method is not important, but having one is critical-and, of course, the method must have an edge. - Developing A Method Is Hard Work (more…)

In Life & Trading :Don't Become Judge

Be careful who you help. (Politicians & Citizens )

Diary of a Professional Commodity Trader -Book Review

Brandt uses high/low/close bar charts as his primary trading (not, he stresses, forecasting) tools. He is for the most part a longer-term discretionary pattern trader who enters on breakouts that meet his stringent requirements. Since he knows that only 30 to 35% of his trades will be profitable over an extended period of time and up to 80% will be unprofitable over a shorter time frame, he is exceedingly cautious about leverage. For instance, his trading assets committed to margin requirements rarely exceed 15%.

In the first two parts of the book Brandt offers the reader a thorough course in identifying and categorizing trading signals, placing initial protective stops and subsequent trailing stops, pyramiding, and taking profits. The course addresses traders at all skill levels. For instance, he describes his own trading plan as simple, but some of its elements require a degree of judgment and sophistication that can only come with extensive practice. One example: “time phasing is a hurdle all traders must clear in order to be consistently successful.” (p. 88)

The third part of the book is Brandt’s five-month trading diary, and it’s a fascinating read. Not only does it describe individual trades but it shows how good traders evolve. Take month four, where the author is in a drawdown period. He writes that he has always known that there were flaws in his trading plan but that “good times provide cover for the deficiencies of a trading plan.” During tough times “markets have a way of exploiting flaws in a trading plan. … The challenge is to find the fundamental flaws, not just to make changes that would have optimized trading during the drawdown phase. … Almost always the changes [the author has made to his own plan] have dealt with trade and risk management, not with trade identification.” (p. 189) (more…)

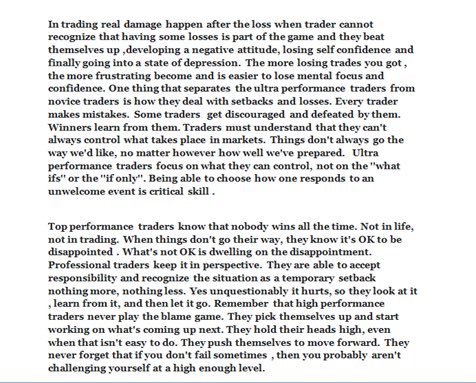

How Top Performance Traders Deals with Losses

8 Rules For Traders

- Don’t Fight the Tape – the trend is your friend, go with Mo (Momentum that is)

- Beware of the Crowd at Extremes – psychology and liquidity are linked, relative relationships revert, valuation = long-term extremes in psychology, general crowd psychology impacts the markets

- Rely on Objective Indicators – indicators are not perfect but objectively give you consistency, use observable evidence not theoretical

- Be Disciplined – anchor exposure to facts not gut reaction

- Practice Risk Management – being right is very difficult…thus, making money needs risk management

- Remain Flexible – adapt to changes in data, the environment, and the markets

- Money Management Rules – be humble and flexible – be able to turn emotions upside down, let profits run and cut losses short, think in terms of risk including opportunity risk of missing a bull market, buy the rumor and sell the news

- Those Who Do Not Study History Are Condemned to Repeat Its Mistakes

You’ll notice that nothing is profound among the 8. You likely have heard some version of each of them before. But when the voices get loud and volatility picks up, it’s nice to have a reminder in what’s important and why we do what we do.

The Artist and the Trader

Art is for the Artist. Words must be written, Songs must be sung. Visions must be seen. Not because they are valued; but because they are Ideas. The Artist understands that wealth, true wealth as opposed to simply being rich, stems from Ideas. Great Art is valued, if valued properly, because they express an Idea well. Not always because they express a grand idea.

Art is for the Artist. Words must be written, Songs must be sung. Visions must be seen. Not because they are valued; but because they are Ideas. The Artist understands that wealth, true wealth as opposed to simply being rich, stems from Ideas. Great Art is valued, if valued properly, because they express an Idea well. Not always because they express a grand idea.

There is the modern myth that the Artist must not be materialist or wealthy. Whereas the Trader, as an Artist, knows that all Artists are wealthy, but all are not rich. It would seem that a great Trader and the Artist share a similar soul.

For they both :

Take a loss. The modern myth largely stems from the Artist producing their best Ideas to bounce back from a loss. They both believe they can replace their losses with better Ideas.

Respect everyone. An Idea can come from anyone. Every trader has been on the wrong side of a trade against someone of much more limited means, brains and circumstances.

Generous souls. For if wealth comes from Ideas, Ideas can always flow. An Artist never will admit he is out of Ideas. Many only have one grand idea, but die thinking the next grand idea is around the corner.

There is never enough. If Ideas are wealth, Life is to be lived to its fullest. The trader that gives up simply to be rich and preserve their riches has given up on their Ideas. Like the Artist that has sold out, simply producing copies of his once great work. Their admitting that it was either great timing or luck; not skill and belief that their Ideas still matter.

Free souls. Comes from the empowerment of wealth coming from your thoughts.

Drawn to excess. Because Ideas are regenerative, its tempting to believe everything is. Like the young that are blind to time. Or the athlete that believes there is always another game, tomorrow.