Archives of “Education” category

rss"Whether the object of ur faith be true or false, u will get the same results." Take control of your thoughts!

The Ten Most Foolish Things a Trader Can Do

In the spirit of April Fools Day here are the ‘Ten Most Foolish Things a Trader Can Do’. In no particular order of foolishness.

- Try to predict the future movement of a stock, and stay in it no matter what.

- Risk your entire account on one trade with no stop loss plan.

- Have a winning trade but no exit strategy to get out, no trailing stop or exhaustion top signal.

- Ask for and follow the advice of others instead of trading with your own trading plan, method, rules, and system.

- Trade your emotions instead of signals: buy when you are greedy and sell when you are afraid.

- Trade your opinions, not a quantified method.

- Do not bother to do your homework on trading, just jump in and trade, you are smart, you will figure it out.

- Short the best and most expensive stocks in the stock market and buy the cheapest junk stocks.

- Put on trades you are 100% sure are winners so you do not even need a stop loss or risk management.

- Buy more of a trade that you are losing money in and sell your winners quickly to lock in small profits.

Do not trade foolishly my friend.

10 Lessons for Traders

10) Those who are willing can be taught almost anything.

10) Those who are willing can be taught almost anything.

9) Great people want to help others achieve great success.

8) Success in business requires tremendous concentration. Outside distractions must be avoided.

7) Sometimes it is best to leave politics to politicians.

6) Everyone fails at some point in his life. The true winners rebuild after their failures.

5) To put on a trade when everything is going against you requires character and commitment.

4) Rules are rules. Stick to them.

3) Adapt with the times. Be willing to be malleable.

2) Always leave yourself outs. Never commit everything to one position or to one person.

1) The market is bigger, stronger and badder than you. Always respect it for the beast it is.

10 Mistakes -Done By 95% Traders

- Not honoring your original stops. Big losses make winning systems losing ones.

- Quit trading it during drawdowns. All systems have losing streaks, the key is to manage risk and stick to it until the system has time to play out with profits as the market becomes conducive to your system’s method.

- Lack of discipline, drifting from taking defined entries and exit signals to your own opinions is hazardous.

- Trading too big, no system can survive huge positions sizing that makes the first string of losses the last.

- Style drift is deadly, slowly changing your trading system during active trades is not good. Research has to happen after hours when the market is closed and backtested before changes are made.

- If you can’t mentally and emotionally deal with the equity curve of your trading style then you can’t trade it long term. You can’t quite during losing streaks or get too excited during winning streaks.

- You have to believe that your method will work over the long term, confidence comes from research, backtesting, and homework.

- Don’t trade someone else’s system, build your own. Custom to fit who you are by using the principles that you believe in and work.

- Trading too big during losing streaks ruins the potential of winning, don’t try to get back the blood the market took from you instead try to stop the bleeding by trading smaller and smaller until a new winning streak emerges.

- Straying from the trading plan and making one big, bold, can’t miss trade and blow up all your previous profits. Don’t let greed make you do something stupid, stick to the plan.

The leaders who work most effectively, it seems to me, never say “I”…

Overtrading

Most new traders overtrade.

Most new traders overtrade.

Overtrading is when you (hoping to receive the maximum possible profit) opens a huge position consisting of multiple lots.

Considering the typical market activity, it’s easy to lose half or even all your trading capital.

This problem is sometimes directly connected to insufficient trading capital.

But it’s more likely due to the trader lacking knowledge of money management principles, which means lack of competence to control their trading capital properly.

Your trading capital is used to earn money. You should treat each rupee is like a newborn baby.

Your first and foremost responsibility is to protect it. If you lose it, you have less to help you earn money.

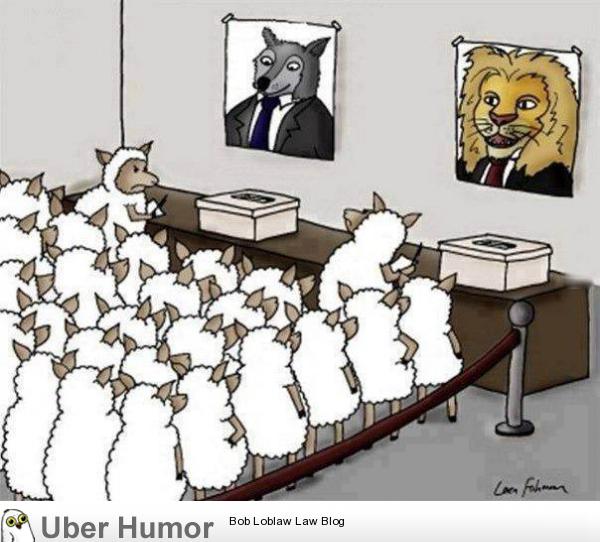

India : It’s still Democracy…

40 Gems for Traders and Investors

- There are only three kinds of investors – those who think they are geniuses, those who think they are idiots, and those who aren’t sure.

- One of the clearest signals that you are wrong about an investment is having the hunch that you are right about it.

- Investors who focus on price levels earn between five and ten times higher profits than those who pay attention to price changes.

- The only way to be more certain it’s true is to search harder for proof that it is false.

- Business value changes over time, not all the time. Stocks are like weather, altering almost continually and without warning; businesses are like the climate, changing much more gradually and predictably.

- When rewards are near, the brain hates to wait.

- The market isn’t always right, but it’s right more often than it is wrong.

- Often, when we are asked to judge how likely things are, we instead judge how alike they are.

- Most of what seem to be patterns in stock prices are just random variations.

- In a rising market, enough of your bad ideas will pay off so that you’ll never learn that you should have fewer ideas. (more…)

COMMANDMENTS For Traders

Have you written down your trading rules? Do you have rules for entry and for exit with a profit and with a loss? Do you have a rule telling you whether a market is trending and what the trend is? Do you have rules stating when the market is in a trading range and what that range is? Do you have rules saying what markets you will trade and what has to happen to trade them?

Or do you simply shoot from the hip and call it artistry or intuition? Does this work for you?

Do you follow your rules rigidly without flexibility or discretion? Does this serve you over time?

Do you abandon your rules in the heat of trading, only to regret it? Do you stubbornly go against your rules thinking this time you know better? What would happen if you didn’t do this? (more…)