Archives of “March 2021” month

rss#Bitcoin is now worth more than a one kilogram gold bar.

CFTC Commitments of Traders: JPY long switched to short (dollar long). Dollar buying against all other currencies.

Weekly forex futures positioning data for the CFTC for the week ending Tuesday, March 16, 2021

- EUR long 90K vs 102K long last week. Longs trimmed by 12K

- GBP long 29K vs 34K long last week. Longs trimmed by 5K

- JPY short 39K vs 7K long last week. Traders swing position from long to short with 46K change in position.

- CHF long 5K vs 14K long last week. Longs trimmed by 9K

- AUD long 8K vs 8K long last week. Unchanged

- NZD long 6K vs 17K long last week. Longs trimmed by 11 K

- CAD long 10K vs 11K long last week. Longs trimmed by 1K

- Last week’s report

highlights:

- JPY position swings from long to short with a net change of 46K. The short is the largest position since March 3, 2020 (and the first short since that week too). The short position in the JPY is the only net dollar long.

- All dollar short positioned were trimmed as traders start to exit shorts in the greenback .

- The EUR long was trimmed by 12K and the NZD long was trimmed by 11K. Although the EUR long is still large at 90K, it is the lowest long position since June 2020.

US stocks end mixed as rotation trade reverses today

Nasdaq higher. S&P and Dow lower.

The rotation out of the Nasdaq and into the S&P and Dow was reversed today. The Nasdaq is the big winner. The Dow is the big loser and the S&P is in between those two indices.

- Russell 2000 has its worst week since January

- NASDAQ has its 4th weekly loss in 5 weeks

- Dow post 2 day losing streak Dow, S&P, NASDAQ all down on the week

The final numbers area showing:

- Dow industrial average -234.33 points or -0.71% at 32627.97

- S&P index -2.36 points or -0.06% at 3913.10

- NASDAQ index up 99.066 points or 0.76% at 13215.23

- Russell 2000 rose 19.95 points or 0.88% at 2287.53

For the week:

- Dow industrial average fell -0.46%

- S&P index fell -0.79%

- NASDAQ index fell -0.77%

Thought For A Day

Lots of Fed Talk next week

Powell and Co. all scheduled to speak next week

The Fed decision was on Wednesday and with it ends the quiet period for Fed members to speak.

Next week, we will get a lot of talk from Fed officials that will allow the bond, stock and forex markets the opportunity to either agree or disagree. The market was initially comforted by Powell’s press conference after the Fed decision. That comfort lasted less than 24 hours as long market sent yields higher the very next morning.

So who is speaking and when? Below are some of the scheduled talks:

Monday. March 22

- Fed’s Barkin discusses Covid scarring

- Feds Powell takes part in BIS panel on central bank innovation (9 AM ET)

- Fed’s Bowman gives speech on economic outlook (5:30 PM ET)

Tuesday, March 23

- Feds Bullard discusses economy at LSE event (9 AM ET)

- Fed’s Barkin takes part in virtual discussion (11 AM ET)

- Powell, Yellen appear before House panel on CARES act (12 PM ET)

- Feds Williams takes part in virtual discussion ( 2:45 PM ET)

Wednesday, March 24

- Fed’s parking takes part in virtual discussion (8:50 AM ET

- Feds Powell and Treasury Secretary Yellen appear before Senate banking panel (10 AM ET)

- Feds Williams takes part in moderated discussion (1:35 PM ET)

- Fed’s Evans discusses the economic outlook: (6 PM ET)

Thursday, March 25

- Feds Bostic gives speech at economic club of New York (12 PM ET)

- Fed’s Evans discusses the economic outlook (1 PM ET)

- Fed’s LaRita speaks on the outlook for the economy and monetary policy (3:45 PM)

- Fed’s Daly discusses monetary policy (7 PM ET)

European indices end the session lower

Mixed results for the week

The major European indices are ending the session lower. For the week, the results are mixed:

- German Dax, -0.9%

- France’s CAC, -0.8%

- UK’s FTSE 100, -0.9%

- Spain’s Ibex, -1.2%

- Italy’s 50 MIB, -0.65%

For the week, the provisional closes are showing:

- German Dax, +0.8%

- France’s CAC, -0.55%

- UK’s FTSE 100, -0.6%

- Spain’s Ibex, -1.48%

- Italy’s footsie MIB, +0.37%

IMF economist Gopinath: US stimulus package may cause transitory inflation…

IMF Gopinath speaks to US inflation

IMF Gopinath speak to US inflation saying:

- US stimulus package may cause a transitory bump in inflation

- But inflation is not going to last in the future

That is the $24,000 question that will have to play out over time. The Fed is bullish on the economy and rebound, but the grand experiment is to let the transitory impact from year ago inflation effects, the recent move higher in commodities, the fiscal stimulus and the reopening to play out and then see where inflation lands.

The bond market will have a say in the storyline for the markets. The 10 year is currently down marginally at an .7068%,. The high yield reached 1.7477% earlier

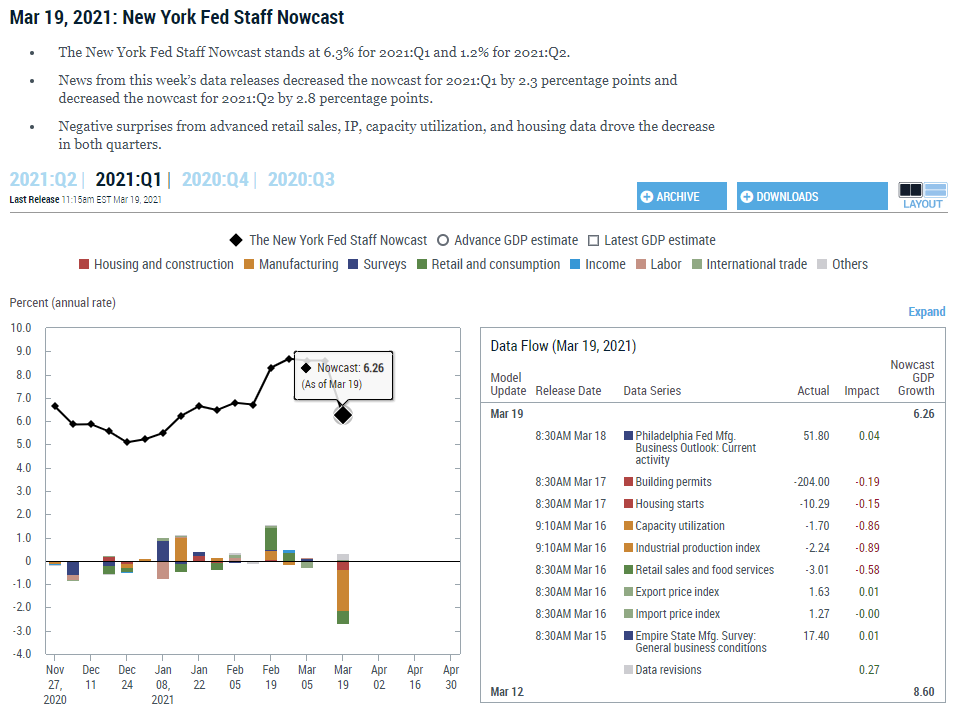

NY Fed’s Nowcast for 1Q GDP fell sharply to 6.3% from 8.6% last week

Industrial production and Capacity Utilization lead to the sharp fall

The NY Fed’s Nowcast model for 1Q GDP growth fell sharply to 6.3% from 8.6% last week.

The biggest negative contributors to the sharp fall this week were from industrial production (-0.89%) and capacity utilization (-0.86%). Retail sales also led to a -0.58% decline in the models GDP growth estimate.

The biggest positive contributor came from data revisions (+0.27%). The Philadelphia Fed manufacturing business Outlook added 0.04%.

The fall in the NY Fed model, brings the estimate more in line with the Atlanta Fed model which pegs 1Q growth at 5.7%. They will announce a new estimate on March 24.

The Feds central tendencies for GDP in 2021 are looking for growth to come in between 5.8% 6.6%.

Standard Economics vs Behavioral Economics

Standard economics assumes that we are rational—that we know all the pertinent information about out decisions, that we can calculate the value of the different options we face, that we are cognitively unhindered in weighing the ramifications of each potential choice. We are presumed to be making logical and sensible decisions. If we make a mistake, the supposition is that we will learn from those mistakes and behave differently in the future.

However, we are far less rational in our decision making than standard economic theory assumes. Our irrational behaviors are neither random nor senseless—they are systematic and predictable. We make the same types of mistakes repeatedly because of how our brains are wired. Behavioral economists believe that people are susceptible to irrelevant influences from their immediate environment, irrelevant emotions, shortsightedness, and other forms of irrationality.

What good news can accompany this realization? The good news is that these mistakes also provide opportunities for improvement. If we all make systematic mistakes in our decisions, then why not develop new strategies, tools, and methods to help us make better decisions and improve our overall well-being? [Behavioral economists believe] that there are tools, methods, and policies that can help all of us make better decisions and as a consequence achieve what we desire.

When it comes to the markets and our quest to understand them, we would all benefit from first learning about ourselves. Then, and only then, may we have a fighting chance to “trade another day”.

Just a thought.