Renesas Electronics is one of the biggest suppliers of automotive chips, the firm had to halt production at a Japanese plant on Friday after a fire. fire broke out in one of its clean rooms This will have another supply reducing impact on semiconductor chips for the automobile industry. Chief Executive Officer Hidetoshi Shibata said on Sunday that the firm is targeting to resume production at the plant within a month.

Archives of “March 2021” month

rssGoldman Sachs expect up to another USD 4 trillion in stimulus from Biden

Goldman Sachs say that ina addition to the $1.9tln approved last week

- the next round of fiscal legislation … our economists (expect) a package that will include at least $2 trillion in infrastructure spending and could reach $4 trillion if it also funds health care, education, and child care initiatives.

I do not know how the Fed can hold back rate hikes if another $4tln flows into the economy in fiscal aid.

GS do add though:

- Our economists expect the next package will be paid for in part by higher tax rates

So that’ll be some subtraction.

More from GS:

- The tax plan proposed by President Biden in his election campaign would raise the statutory corporate tax rate on domestic income from 21% to 28%, partially reversing the cut from a rate of 35% passed in the 2017 Tax Cuts and Jobs Act. The plan would also raise the tax rate on foreign income (also called the “GILTI” tax) and institute a minimum corporate tax rate.

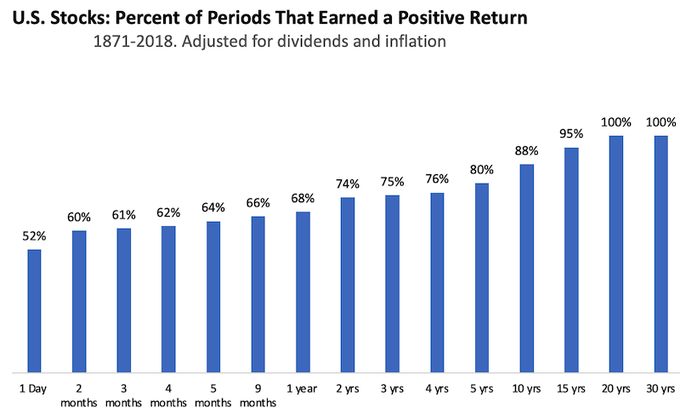

The bullish bias of the American stock market.

Fed’s Barkin says the dot plot is not FOMC policy

Barkin is the president and CEO of the Federal Reserve Bank of Richmond, he has some comments crossing on the wires.

Speaking in a Bloomberg TV interview.

- you want yields to respond to what happening in the economy

- yields reflecting good news on vaccines, fiscal aid

- really hopeful that we’re at the back end of pandemic

- the Fed’s interest-rate dot plot is not Federal Open Market Committee policy

- Fed has tools to handle unwanted inflation

- inflation is not a one-year phenomenon, it’s multi-year

- expect to see price pressures in 2021

- expect strong demand, met by some supply-chain issues

- the US economy will have strong spring and summer

Re that headline I put in the, headline …. the dot plot is part of the Fed’s forward guidance. Barkin’s comments are in line with other comments from Fed officials, they are toeing the party line since Chair Powell laid down the law and told them all to shut up about tapering a month or so back.

The Turkish lira is having its biggest daily decline in the last 20 years.

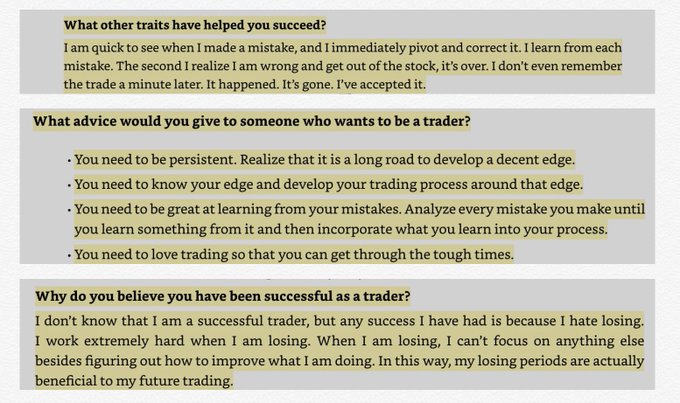

Thought For A Day