Archives of “March 2021” month

rssUS futures ramp higher as the early jitters abate

S&P 500 futures up 0.3%

The collapse in the Turkish lira has been met with a bit of a pause in European morning trade so far, with USD/TRY ranging between 7.80 and 8.00 for the most part after having opened with a 15% gap higher at 8.35 earlier in the day.

The relative “calm” is helping to see risk assets recover on the session now ahead of North American trading with the dollar also falling to the lows of the day.

Bundesbank says German economy likely to contract sharply in Q1 2021

Bundesbank comments in its monthly report

- The measures to contain the virus are on average stricter in Q1 than Q4 last year

- Economic output will probably decline sharply in Q1

- Activity in services in particular is likely to decline again

- Higher VAT rates since the start of the year also likely to have played a role

- Industry sector benefited from dynamic foreign demand, should have supported economic activity in Q1

Nothing that we don’t already know but keep an eye out on the daily virus numbers out of Germany for a sense of how things may progress next and at what pace. In particular, be mindful of the 7-day incidence rate – which has climbed to 107.3 today.

Barclays expects a delay to Eurozone economic recovery

Barclays revises lower its 2022 Eurozone GDP growth forecast

Amid recent developments, the firm is less confident about the strength of the recovery in the euro area as they revise lower their 2022 growth projections for the region from 5.3% previously to 4.3% currently.

The 2021 GDP growth forecast remains unchanged at 3.9%. Barclays notes that:

“We expect a delayed and more modest economic recovery, due to recent negative epidemiological developments and their potential scarring effect. Our revised annual read GDP growth forecasts are 3.9% in 2021 (unchanged) and 4.3% in 2022 (-1.0%).

Our forecasts imply a growing divergence between the euro area and the US, and among euro area member states, with 2022 real per-capita GDP still 7% below pre-global financial crisis levels in Italy, but 20% and 16% above in the US and Germany.

Euro area governments are currently tightening mobility restrictions and, in our view, are likely to scale them back only late in Q2 and gradually, which will weaken domestic demand and, consequently, imports.”

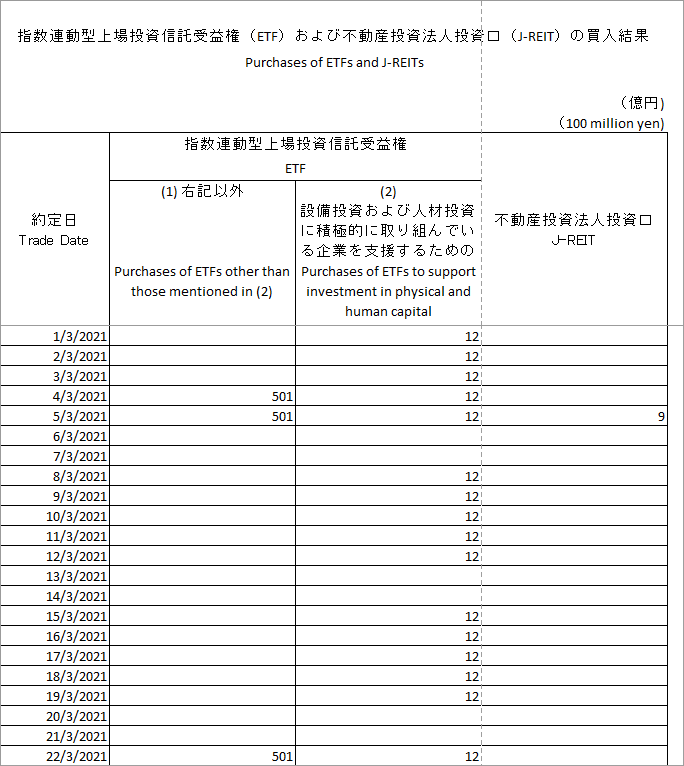

BOJ purchases ¥50.1 billion worth of ETFs today

BOJ kicks off its new ETF policy with a ¥50.1 billion purchase today

That’s the third time this month and the fourth time (all same amounts) this year.

The latest purchase today comes amid a 2% drop in the Nikkei and a 1% drop in the Topix. The latter is the focus of the latest shift in BOJ policy but if anything, it just rather shifts the support away from less growth-heavy stocks to more value-heavy stocks.

AstraZeneca US phase III vaccine trial shows 79% efficacy in preventing symptomatic cases

AstraZeneca publishes the data from a study of more than 30,000 volunteers

The vaccine was also shown to be 100% effective at preventing severe disease, death and hospitalisation. So, that is arguably the more important statistic.

In any case, this should bolster the approval process for the vaccine in the US – which may help to ease some of fears about the efficacy and use as debated in Europe lately.

Nikkei 225 closes lower by 2.07% at 29,174.15

No reprieve for Japanese stocks after BOJ ETF decision

Even the Topix fell by 1.1% on the day, despite BOJ efforts to reaffirm that they will still step into the market to purchase ETFs if and when necessary.

As much as the BOJ claims that removing the numerical value on a set amount of purchases does not mean lesser commitment, it just isn’t the same.

Elsewhere, Chinese markets are keeping more resilient and rebounding after the lira collapse sparked a wave of risk aversion early on in Asian trading.

The Hang Seng is up 0.1% while the Shanghai Composite is up 1.1% on the day.

Meanwhile, S&P 500 futures are flat while Nasdaq futures are up 0.6% as Treasury yields keep lower going into European morning trade.

It may be difficult for Turkey to avoid another currency crisis – SocGen

The Turkish lira is the talk of the town to start the week

The currency plunged to a low of 8.47 against the dollar earlier today, opening with a gap of over 15% after the removal of Turkish central bank governor, Naci Agbal.

Société Générale’s London-based strategist, Phoenix Kalen, argues that the move by Erdogan leaves the country “beyond the point of no return” and that may lead to a fresh record low in the lira – forecasting a move to 9.70 against the dollar in Q2.

Adding that:

“Without much remaining reserves to defend the currency, and considering an expected exodus in foreign and local investor capital, it may be difficult for Turkey to avoid another currency crisis in the coming months.”

The firm now forecasts USD/TRY at 9.70 in Q2, 9.0 by Q3 before settling at 9.30 in Q4.

Bank of Japan Governor Kuroda says his 2% inflation target is helping stabilise FX rates

BOJ Gov Kuroda says there is no need to change the 2% inflation target, its a global standard and must not change.

And, more:

- More flexible ETF buyings to improve nimbleness

—

Given the performance of Japanese stocks today he might want to get on the bid!

More:

- have not considered selling ETF holdings at all, or of halting purchases

- decided to buy ETFs that are linked to the TOPIX to avoid impact on individual stocks

- need to watch financial stability carefully

- monetary easing will last for a considerably long time ahead