Archives of “March 2021” month

rss$806m Bitcoin transfer registered … institutional flow?

Noting this item on financial sites (here’s a link, there are others also)

- data point extracted from the Bitcoin blockchain

- $806 million worth of the cryptocurrency apparently transferred earlier in the day off of the Coinbase exchange’s institution-focused unit, Coinbase Pro

- 14,666 BTC were moved off the exchange during the early U.S. hours in a small number of transactions.

- outflow was split into multiple wallets

BTC update:

Intel to splash US$20bn in capex on two new chip plants in Arizona

Intel says it’ll be making chips for others

—

Of course this’ll take a good while to come online so I don’t think it’ll be an immediate relief for the global chip shortage.

Intel does add however its expanding the use of other plants to produce semiconductors, partially for other firms. Will make X86, ARM, RISC-V chips for other firms

Fed’s Bullard looking for 6.5% GDP growth, unemployment down to 4.5% this year

St. Louis Federal Reserve President Bullard speaking in the US at the NABE conference

- Says we are coming to the end of the war here, hopefully the pandemic will be behind us

- says the US dollar will be the world’s reserve currency for a “long, long time “

S&P and Nasdaq give back yesterday’s gains. Russel 2000 tumbles

Dow falls -300 points

The S&P index and NASDAQ gave back most if not all of the gains yesterday.

- NASDAQ index closed lower for the 1st time in 3 sessions

- NASDAQ nearly gave back all the gains from yesterday. The index rose 162 points yesterday and fell about 150 points today

- S&P index gave back all the gains from yesterday. It rose 0.7% yesterday and fell -0.76% today

- Russell 2000 index tumbled by -3.58% after falling -0.9% yesterday

The final numbers are showing:

- S&P index -30.07 points or -0.76% at 3910.52

- Nasdaq index fell -149.84 points or -1.12% at 13227.69

- Dow fell -308.05 points or -0.94% at 32423.15.

Thought For A Day

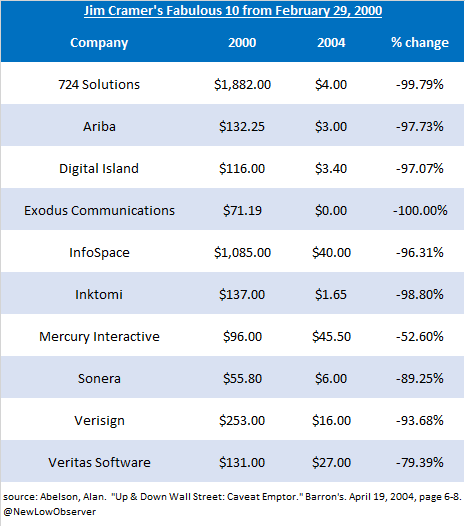

February 29, 2000: Jim Cramer’s Fabulous 10 As outlined in Barron’s in 2004.

US Treasury to sell $60B of 2 year notes at the top of the hour

The 6 month averages for the 2 year auction

The US treasury will sell $60 billion of two-year notes at the top of the hour. Below are some of the prior auction averages:

- Last auction high yield 0.119%. The average over the last 6 months 0.139%

- Bid to cover. 2.52x six-month average

- Dealers. 32.6% six-month average

- Directs: 15.1% six-month average

- Indirects: 52.3% six month average

The current WI is trading at 0.1525%

Powell has all the ammo..

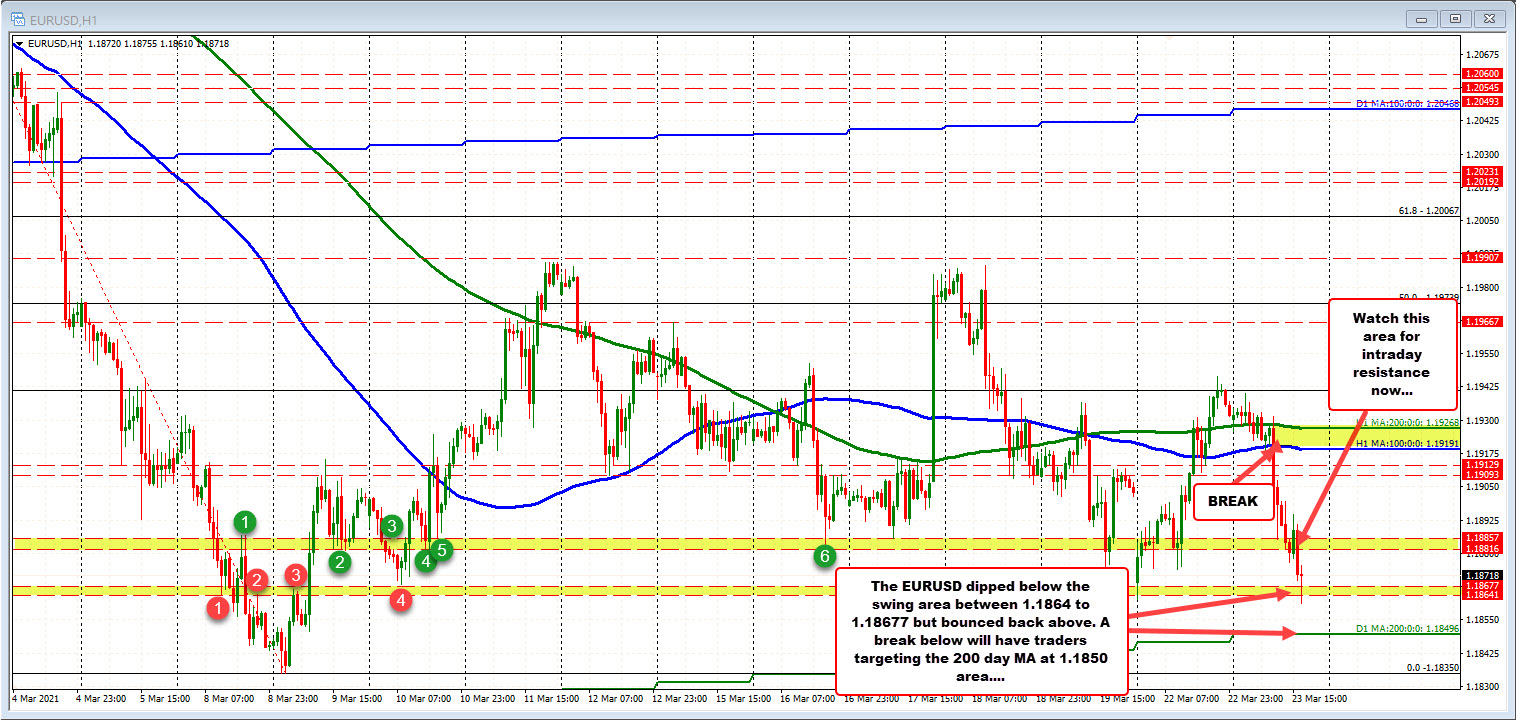

EURUSD trades to new lows

EURUSD approaches 200 day MA

The EURUSD moved to a new session low and in the process dip below a swing area going back to March 8 March 9 and March 10 between 1.1864 and 1.18677. The low reached 1.1861. The pair currently trades back above that area at 1.1870. A move back below will be eyed by sellers/bears.

On a break, traders will start to focus on the 200 day MA currently at 1.18496. That moving average is moving up little by little and will force traders to make a decision. Break below and increase the bearish bias, or buy against the level and keep the buyers in control?

Looking at the daily chart below, the price is not traded below its 200 day moving average since May 2020. The price has now traded below the 100 day moving average since the last break on March 4. A move below the 200 day moving average would target the last swing low from November at 1.17994 (call it 1.1800). If the 200 day moving averages approached, I would expect dip buyers on the first look, with stops on a break below.