Archives of “March 29, 2021” day

rssEach red dot Red circle represents a headline in the news that called #Bitcoin “dead”, “failed”, or “worthless”.

#Bitcoin is now larger than the Australian Dollar (M1).

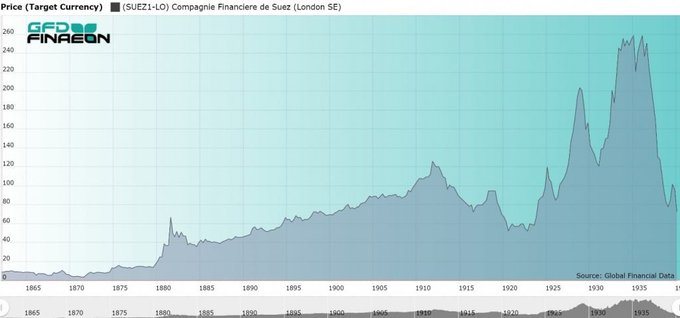

Did you know that the Suez Canal was a publicly traded company?

shows the stock returns from IPO in 1862 through the 1930s.

US dollar climbs to the best levels of the day

Broad US dollar bid

There was a broad US dollar bid into the 4 pm London fix. It was particularly visible in the euro and sterling and boosted the dollar to the best levels of the day.

The Dollar Index has crept up above Thursday’s high and is flirting with 93.00.

Watch for stops in EUR/USD as the pair flirts with the late-March lows. Here’s the 8-hour chart:

Bitcoin jumps as Visa is reportedly said to allow payment settlements using cryptocurrency

Reuters reports on the matter

Visa is said that on Monday, it will allow the use of cryptocurrency USD Coin to settle transactions on its payment network. The report headline may be a bit of a stretch since this actually only covers USDC.

However, Visa’s acceptance of the stablecoin in general – this one is pegged to the US dollar and runs on Ethereum and Algorand blockchain – is a positive sign for the rest of the cryptocurrency industry at least.

Bitcoin has jumped from $56,250 to just above $57,000 on the headlines.

Nomura statement on Archegos blowup.

Understanding the USD’s narratives

USD in focus

At the start of the COVID-crisis we saw the USD and US 10 year yields move in negative correlation to one another. When 10 year yields rose, the USD fell. Why was this? This is because both were acting as safe havens. A worried world wanted to buy US treasuries (this causes bond yields to fall) and they wanted the USD as the most liquid currency

What changed?

Then in March the world started to focus on the US growth story. This more optimistic footing allows US 10 year yields to rise alongside the USD.

Why has the above changed again?

Germany in extended lockdowns, oil prices falling, AstraZeneca roll outs slowing + health scares have all led to the reflation trade being questioned last week. So, this is why we are seeing the COVID relationship between the US 10 year yields and the USD return.

So, in summary.

A worried world:

Rising US 10 year yields – falling dollar

Falling US 10 year yields – rising dollar

A world focused on US recovery:

Rising US 10 year yields – rising dollar

Falling US 10 year yields – falling dollar

Hope this helps to see what is driving the USD and when.

Suez Canal update: Stem of Ever Given ship said to still be stuck

Boskalis CEO provides an update to the situation

The Ever Given ship has been partially refloated but the stem is said to still be stuck. As such, it will still take some time to free the ship completely and move it to the side so that smoother passage across can be observed.

However, Twitter talk is saying that some smaller vessels are already able to navigate through the small opening past the Ever Given so that is some good news.

New Turkish central bank chief says that April rate cut is not guaranteed

Remarks by new Turkish central bank chief, Şahap Kavcıoğlu

He also reaffirms that the 1-week repo rate continues to be the main policy tool for the central bank. As much as the headline looks enticing, he would not have been appointed if he isn’t going to follow through on Erdogan’s wishes.

USD/TRY has been holding steadier in recent days after the lira’s implosion last Monday: