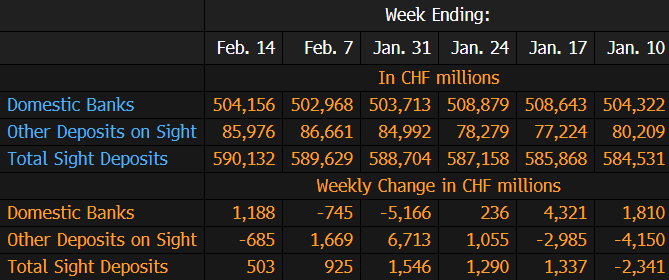

Latest data released by SNB – 17 February 2020

- Domestic sight deposits CHF 504.2 bn vs CHF 503.0 bn prior

Prior week’s release can be found here. A rather minimal increase in overall sight deposits and that continues to suggest limited intervention by the SNB over the past few weeks.

If anything, this reaffirms that they can only slow down the appreciation in the franc and not counteract it altogether by the look of things – or fear incurring the wrath of the US.