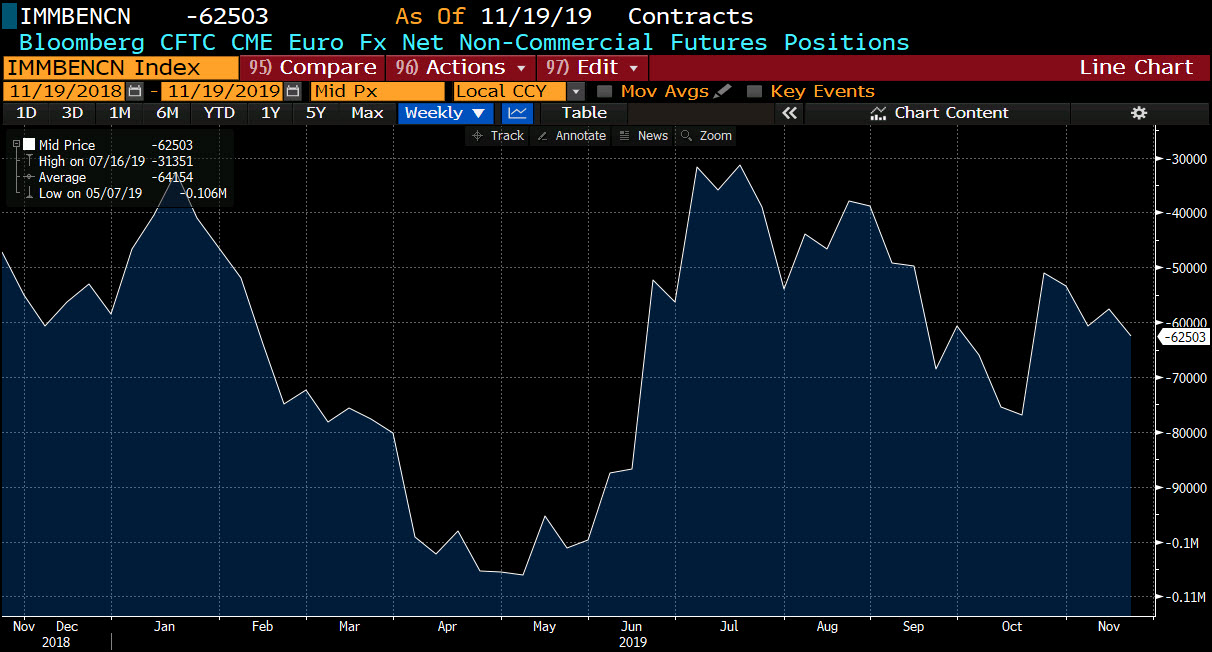

Forex futures positioning data for the CFTC for the week ending November 19, 2019

- EUR short 63K vs 58K short last week. Shorts increased by 5K

- GBP short 32K vs 28K short last week. Shorts increased by 4K

- JPY short 35K vs 35K short last week. Unchanged

- CHF short 16K vs 15K short last week. Shorts increased by 1K

- AUD short 47k vs 41K short last week. Shorts increased by 6K

- NZD short 35K vs 36K short last week. Shorts trimmed by 1K

- CAD long 29k vs 42K long last week. Longs trimmed by 13K

Highlights:

- EUR shorts remain the largest speculative position The short position is near the middle of the high to low range over the last year.

- CAD is the largest and only, net long position (short USD position). However, the position was pared by 13K

- AUD shorts increased by 6K