Treasury yields fall across the curve to session lows

The missiles were said to have caused an explosion which damaged two tanks on the vessel.

Happy Friday, everyone! Hope you’re all doing well as we look to get things going in the session ahead. It’s been a calmer start to the day as markets are holding out optimism on trade talks in Washington and that has been the main theme playing out so far.

The headlines say that there has been an explosion in a tanker that has set the vessel (owned by the National Iranian Oil Company) on fire near the Saudi port city of Jeddah.

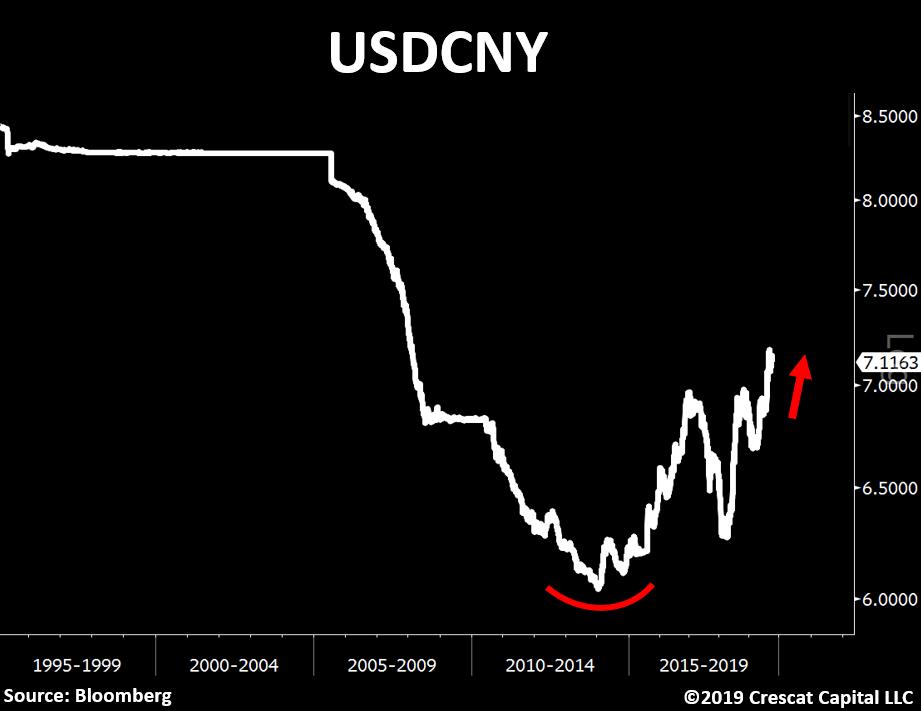

This currency pact, if true, is doomed to fail.

The Chinese economy is at the outset of a debt and currency crisis.

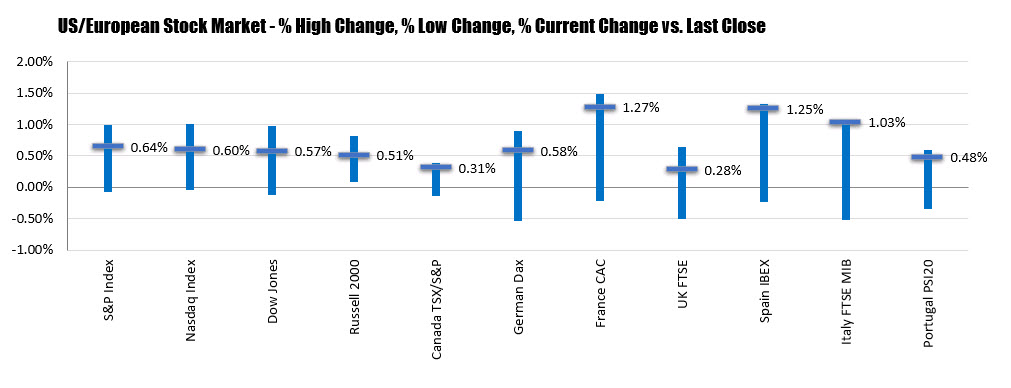

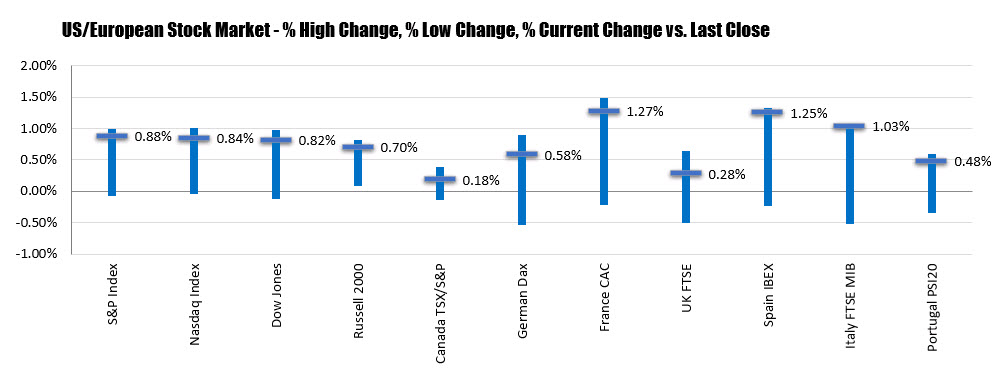

the European major indices ended the session today with gains, with France’s CAC and Spain’s Ibex having the largest gains (around 1.25%). THe UK FTSE laggged at 0.28%.

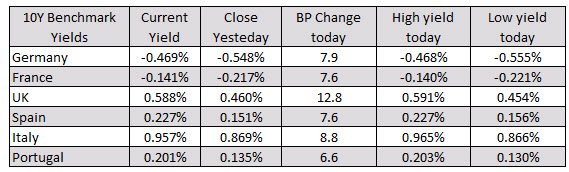

In the European debt market, yields have soared higher with the UK yield up the most at 12.8 basis points on hopes for a successful Brexit deal. The German yield is up 7.9 basis points. France’s yields are up 7.6 basis points.

In the European debt market, yields have soared higher with the UK yield up the most at 12.8 basis points on hopes for a successful Brexit deal. The German yield is up 7.9 basis points. France’s yields are up 7.6 basis points.