TOKYO — Suzuki Motor expects group net profit to drop 22% to 140 billion yen ($1.3 billion) for the year ending in March, the company said Thursday, as auto sales continue to fall in its mainstay Indian market.

The downgrade reverses an originally forecast 12% gain to 200 billion yen. The Japanese automaker had hoped to recover from an earnings decline in the previous fiscal year, when it booked losses following a vehicle inspection scandal.

Total passenger vehicle sales in India have slumped for 10 consecutive months through August, data from the Society of Indian Automobile Manufacturers shows.

Subsidiary Maruti Suzuki India, the top automaker in the country, has not been immune to the woes. Unit sales in September sunk 27% on the year, falling for the eighth straight month. Maruti Suzuki contributes roughly 40% of Suzuki’s group net profit.

Suzuki now anticipates 3.5 trillion yen in sales this financial year, down 400 billion yen from the previous estimate. The new sales forecast turns a projected 1% year-on-year increase into a 10% decline.

Operating profit is set to plunge 38% to 200 billion yen, down 130 billion yen from the previous guidance. In India, sales incentives have weighed on margins.

In Japan, the corrections to the vehicle inspection process have slowed production. The heavier per-vehicle fixed costs are expected to erode profitability.

Currency pressures are also squeezing earnings. The euro, the U.S. dollar and the Indian rupee have all softened against the yen. This raises the cost of procuring material locally.

Suzuki presents its first-half earnings on Nov. 5.

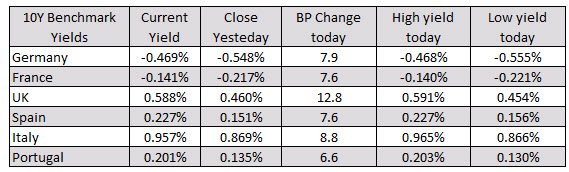

In the European debt market, yields have soared higher with the UK yield up the most at 12.8 basis points on hopes for a successful Brexit deal. The German yield is up 7.9 basis points. France’s yields are up 7.6 basis points.

In the European debt market, yields have soared higher with the UK yield up the most at 12.8 basis points on hopes for a successful Brexit deal. The German yield is up 7.9 basis points. France’s yields are up 7.6 basis points.