1. OPTIMISM – It all starts with a hunch or a positive outlook leading us to buy or sell.

2. EXCITEMENT – Things start moving our way and we get excited. We start to anticipate and hope that a possible success story is in the making.

.

3. THRILL – The market continues to be favorable and we just can’t help but start to feel a little “Smart.”

At this point we have complete confidence in trading system.

4. EUPHORIA – This marks the point of maximum financial risk but also maximum financial gain. Our investments turn into quick and easy profits, so we begin to ignore the basic concept of risk and now start trading anything that we can get our hands on to make a quick buck.

5. ANXIETY – Oh no – it’s turning around! The markets start to show their first signs of taking your “hard earned” profits back. But having never seen this happen, we still remain ultra greedy and think the long-term trend is higher.

6. DENIAL – The markets don’t turn as quickly as we had hoped. There must be something wrong we think to ourselves. Our “long-term” view now shortens to a near-term hope of an improvement.

7. FEAR – Reality sets in that we are not as smart as we once thought. Instead of being confident in our trading we become confused. At this point we should get out with a small profitand move on but we don’t for some stupid reason.

8. DESPERATION – All gains have been lost at this point. We had our chance to profit and missed it. Not knowing how to act, we attempt to do anything that will bring our positions back into the black.

9. PANIC – The most emotional period by far. We are clueless and helpless. At this stage we feel like we are at the mercy of the market and have absolutely no control.

Archives of “February 2019” month

rssThe 14 Stages of Trading Psychology

This Way Economists are Working

A mathematician, an accountant and an economist apply for the same job.

The interviewer calls in the mathematician and asks “What do two plus two equal?” The mathematician replies “Four.” The interviewer asks “Four, exactly?” The mathematician looks at the interviewer incredulously and says “Yes, four, exactly.”

Then the interviewer calls in the accountant and asks the same question “What do two plus two equal?” The accountant says “On average, four – give or take ten percent, but on average, four.”

Then the interviewer calls in the economist and poses the same question “What do two plus two equal?” The economist gets up, locks the door, closes the shade, sits down close to the interviewer and says “What would you like it to equal?”

Trade to win

“If a betting game among a certain number of participants is played long enough, eventually one player will have all the money. If there is any skill involved, it will accelerate the process of concentrating all the stakes in a few hands. Something like this happens in the market. There is a persistent overall tendency for equity to flow from the many to the few. In the long run, the majority loses. The implication for the trader is that to win you have to act like the minority. If you bring normal human habits and tendencies to trading, you’ll gravitate toward the majority and inevitably lose.”

“If a betting game among a certain number of participants is played long enough, eventually one player will have all the money. If there is any skill involved, it will accelerate the process of concentrating all the stakes in a few hands. Something like this happens in the market. There is a persistent overall tendency for equity to flow from the many to the few. In the long run, the majority loses. The implication for the trader is that to win you have to act like the minority. If you bring normal human habits and tendencies to trading, you’ll gravitate toward the majority and inevitably lose.”

Dissection of a Foolish Trader

- Foolish traders confuse hindsight with trading. They think that because they reviewed price performance history, and saw patterns or results, trading in real time would be simple . They don’t understand that real time trading involves risk management, discipline, and a developed trading plan and probably never will.

- Foolish traders believe that what they learned in textbooks will make them great traders. They are used to being able to supply the ‘right’ answer for a good grade, but the markets are a moving target, and the right answer changes daily.

- A foolish trader thinks that trading real money in an actual account, followed by a sustained track record, isn’t required. Developing a plan, practicing, and learning from wins and losses is the only way.

- A foolish trader’s opinions and theories have no basis in reality when trading six figure or multimillion dollar accounts. ‘In theory, there is no difference between theory andpractice. But in practice, there is.” – Yogi Berra

- Foolish traders make blanket statements like “Day trading doesn’t work.” When they should be saying: “Day trading doesn’t work, for me.” -Richard Weissman.

- Foolish traders come into social media trying to be teachers when they should be students. They don’t even know what they don’t know.

- Foolish traders have a recency bias. They think that what works in the current market environment is what will always work.

- Foolish traders develop too much confidence before they have built competence, and that never ends well.

- Foolish traders have made up their mind and cannot be swayed. This is the opposite of successful traders who remain curious, always seeking to learn and grow in all areas of life.

- A foolish trader has no need to interact with other traders, read books, or learn from more experienced traders. In their mind, they already know everything.

Never hurts when the chart are not showing me what I want to see I sit in cash and wait for price to come to my levels. Patience pays

Trade The Trader :Book Review

It is pretty clear that over the last couple of years the stock market has changed. You can try to play the companies with the best financials and outlook, but, with the “greedy hungry” traders exponentially growing, the most successful traders are those that can out-trade the other traders – that is what Quint Tatro’s book, Trade the Trader, is about.

It is pretty clear that over the last couple of years the stock market has changed. You can try to play the companies with the best financials and outlook, but, with the “greedy hungry” traders exponentially growing, the most successful traders are those that can out-trade the other traders – that is what Quint Tatro’s book, Trade the Trader, is about.

Stock trading is a zero-sum game. For every winning trade there is a loser on the other end and knowing how to play the competition will make a successful trader.

Tatro’s strategy is based around technical analysis and learning how to read trends while betting against the conventional stock plays. Essentially getting inside the mind of the other traders to determine when to strike and when to pull back.

Trade the trader is essentially a stock trading book that breaks down technical analysis and how to use this type of trading strategy, with input from Tatro and his own experiences.

The books covers such topics as:

- Timing the entry into a stock

- How to use and read trend lines

- Setting stop limits for your trades

- When to take gains

- How to get into the mind of other traders

What I liked about the book: Tatro did a great job of providing real-world examples on how his strategies have worked and what should be expected.

What I didn’t like about the book: While Trade the Trader does provide educational material, I felt it was accompanied with stories and antedates that could have been left out, and the book could have been shorter than what it currently is.

Overall, Tatro does a great job on teaching the basic fundamentals of technical analysis and how to effectively use it to gain a step up above the other traders. Whether you are new to the game or just need to tweak your technical analysis skills to actually make some money, you should give Trade the Trader a read.

Message for Spammers

Just letting you know that ALL comments here are moderated, and so unfortunately for you not one of your posts will EVER be let through. Damn frustrating ain’t it? You may consider going on with your campaign in the hope that I’ll slip up and let one through by accident – but I’m afraid its totally hopeless. I have full control – you have zero control. What can you do? Nothing… The war is lost.

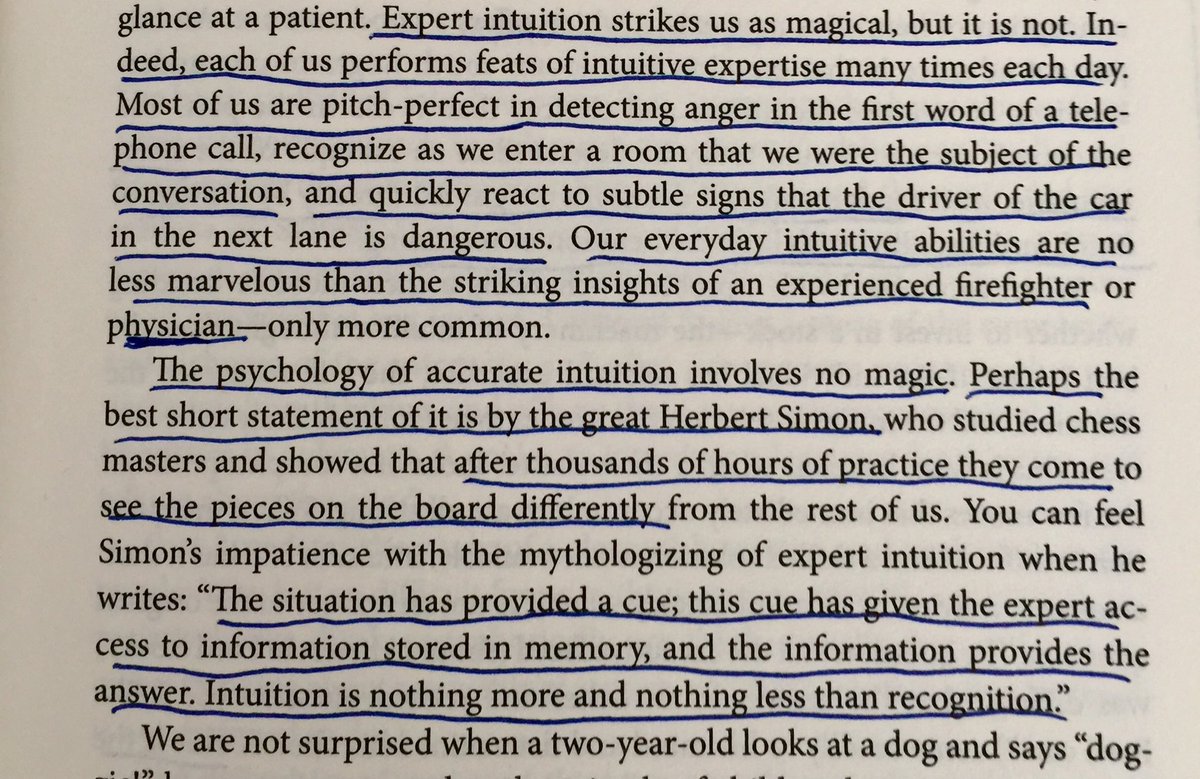

Reading the tape, seeing something in it that others miss, market feel… it’s real. Kahneman explains:

THE SUCCESSFUL TRADER … ACCORDING TO MARK DOUGLAS

There is a reason why so few traders succeed. It is not for lack of study or effort or passion. It is not for lack of education or a Bloomberg platform subscription. It is not because only a select few have access to technical “secrets” (a.k.a. indicators). No. So few succeed at trading for the same reason that so few succeed at living an abundant life.

The unsuccessful refuse to think differently when faced with difficulties believing that luck has passed them by. They do not succeed because the want of instant gratification and its fleeting rewards has replaced the need for sustainable, hard fought, earned rewards indicative of a mindset prepared to tackle failure as nothing but a mathematical equation: here is the problem now let’s find the solution.

The mediocre search for easy answers to difficult problems believing that the right answers to their questions are found somewhere “out there”. The successful make difficult decisions where there are no easy answers, questioning whether their perception of what is out there is a distorted reflection of what is inside of them.

The best traders, according to Mark Douglas, think differently than others because they know that what is most important is “how they think about what they do and how they’re thinking when they do it.”