John Maynard Keynes's investment performance for King's College:Includes the Great Depression & WWII

Good traders are able to identify opportunities in the market, plan trades, execute trades, and manage trades at a reasonable level. A good trader identifies the opportunity, plans the trade, and executes the trade. He takes his losses with discipline. One might think that great traders are similar to good traders but just better. The reality is that great traders are distinctly different from good traders. The difference is not merely a difference in measure but a difference in kind.

Great trading is actually much closer to gambling. One of the key differences between great trading and good trading is that great traders don’t just play the odds: great traders play the unknown. The market simply isn’t predictable enough – enough of the time — to allow for the type of returns that great traders seek. So, great traders are much more likely to be going out into that unknown space. This seeking out the unknown always involves a cost. The cost for greatness is the potential for loss, even significant loss. A great trader will typically take more risks. The risks could involve taking trades with higher uncertainties (less confirmation), higher risk per trade (giving a trade more room), and in general just a higher level of risk. This increased level of risk taking is balanced by increased trading skill.

The problem with trading just trading well is that the game, the trading game, is really close to a zero sum game, even when played perfectly. The focus on limiting risk tends to ignore the reality that every business has to make a profit to survive. The problem with trying to avoid risks is that it tends to push the game to such a competitive level such that the trader must trade at a near perfect level just to break even and nobody can trade perfectly forever. Eventually mistakes are made and losses occur. Great traders are more creative. They move laterally and find creative solutions. Great traders don’t really compete against others. It is more of a dance. Instead of playing the games against others, they make up their own game. (more…)

* There are basically two types of over trading. Trading too often and trading too many shares/contracts.

* Remember that there really is no good reason to trade constantly, since extreme over-trading creates stress, produces high commissions and can often lead to more losses.

* Market forces do not last forever and time has shown various examples of the law of gravity in the trading market- that whatever comes up must go down. – and vice versa.

* Instead of grabbing every opportunity that comes along (or thinking that it is an opportunity) make sure each trade setup meets the criteria of your trading plan, don’t be over confident or scared of making trades.

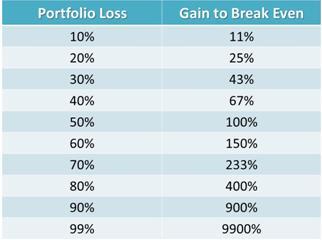

* Utilizing a risk calculator to determine the appropriate position size before you enter a trade can help you determine how many shares/contracts you initially buy. You can start off with a small position and add as the trade continues in your favor. It relieves stress to know that the amount at risk for each position you hold is well proportioned to the size of your entire account and this is great asset management.

* Whenever you feel that you did not stick to your trading plan and made a mistake, quickly learn from that and let it go.

Confusion and frustration is part of the learning curve. Frankly, if you’re not getting confused by the array of opinions and information out there, then you’re doing something wrong. The key is to keep working though it and continue learning as much as you can. With time and effort, the confusion you have now will be replaced with a clear understanding of key elements of trading that can’t be learned in a different way. But, it takes time

Confusion and frustration is part of the learning curve. Frankly, if you’re not getting confused by the array of opinions and information out there, then you’re doing something wrong. The key is to keep working though it and continue learning as much as you can. With time and effort, the confusion you have now will be replaced with a clear understanding of key elements of trading that can’t be learned in a different way. But, it takes time

Don’t Miss to Watch