75% of the price movement in most stocks takes place in 20% of the time. The rest is nothing but noise within a range. Relevant information that causes repricing doesn’t change quickly and frequently. This is why trends exist. Higher prices often attract more buyers and lower prices attract more sellers until the rules of the game change. Focus on the main drivers and forget the rest.

75% of the price movement in most stocks takes place in 20% of the time. The rest is nothing but noise within a range. Relevant information that causes repricing doesn’t change quickly and frequently. This is why trends exist. Higher prices often attract more buyers and lower prices attract more sellers until the rules of the game change. Focus on the main drivers and forget the rest.

Archives of “February 12, 2019” day

rssPerfectionism has become a hidden epidemic among young people

The creative adult

The 1% Gets A Scare – More To Come?

Most Americans have spent the last few years pressed up against the proverbial bakery window, watching the 1% enjoy a life of ever-increasing wealth and seemingly total indifference to the multitudes who aren’t favored by zero interest rates, big trust funds and political/corporate connections.

The one consolation for the have-nots has been that, by owning few stocks and bonds, they would suffer less when those bubble markets did what bubbles always do, which is burst.

Friday was a small but satisfying taste of that eventuality.

From Bloomberg:

World’s Richest People Lose $68.5 Billion in Stock Selloff

The fortunes of the world’s 500-richest people dropped by $73.9 billion Friday as equity markets swooned with investor worries about the pace of interest rate hikes in the U.S. Warren Buffett led the declines, shedding $3.3 billion to end the day at No. 3 on the Bloomberg Billionaire Index with $90.1 billion.

The chart shows about $100 billion of play money evaporating in the past week. Not enough to seriously inconvenience most of the people on Bloomberg’s billionaires list, but still a nice reversal of fortune versus the average person with a house, small bank account and not much more – who didn’t lose a thing.

As for whether Friday was just a blip in an ongoing “secular bull market” or a sign that fundamentals are at last gaining the upper hand on “liquidity,” that remains to be seen. Longer-term though, there can’t be much doubt that today’s stock and bond valuations are higher than they’ll be during the next downturn.

Here’s a chart from John Hussman’s latest (Measuring the Bubble) that illustrates the point.

Work hard to live a life of deferred-gratification.

Trading Truths

- It’s all about risk management … never risk what you can’t comfortably lose.

- Never fall in love with a stock.

- To be succesfull in trading; study, understand and practice. The rest is easier.

- Always start by assuming your analysis is WRONG and that people much smarter and with more recent information are already positioned opposite you.

- Never take on a position larger than your comfort zone. (Don’t overtrade)

- Patience. never chase a stock.

- Before entering the trade very think carefully what will make you wrong, write it down clearly and put it infront of you where you trade, and when your wrong get out happy you’ve followed your trading discipline.

- Buy strength, sell weakness. Most traders are essentially counter-trend; most traders lose.

- No one ever went broke taking a profit!

- Once you find a good one, hang on unless of course they do you wrong.

- Never add to a losing position! (Unless scaling in was part of the plan).

- Whenever you think you’ve found the key to the lock, they’ll change the lock.

- Do not overtrade.

- Trade price not perception.

- Know the difference between stocks that you want to stay married to and those that are just a fling.

- The only sure way to make a small fortune is to start with a large one.

- Cut your losses quickly and you may have a chance. (more…)

and to paraphrase Will Rogers: Buy only stocks that will go up. Don’t buy the ones that don’t go up. “THIS is GAMBLING.”

Vantage Point teaches trading

I saw this poster for Vantage Point and immediately thought of trading the markets, of how there are so many traders with so many points of view. There is also the question of the the truth: is it the price, or is it where the price ‘should’ be? Does the truth even exist? One thing is for sure and that is, like the characters in this film, no individual has the complete picture.

A million traders, a million points of view, no truth.

Things you will never see.

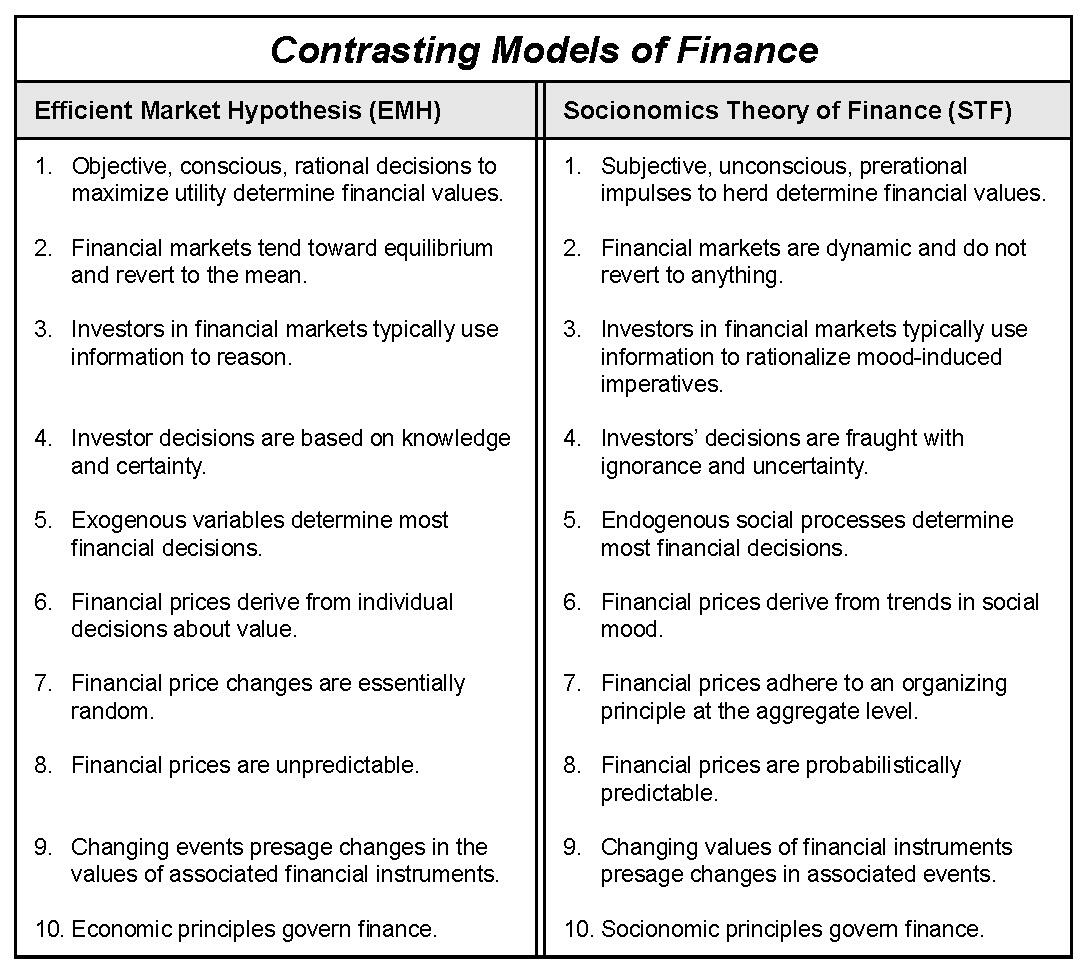

Learn the basics: Efficient Market Hypothesis vs Socionomic Theory of Finance

The 15 Truths about Great Trading

1) 45-55% (Average winning % of any given trader)

1) 45-55% (Average winning % of any given trader)

2) Traders do not mind losing money, they mind losing money doing stupid things

3) You can lose money on a Great trade

4) Focus on the Trade, Not the Money

5) Trading is a game of Probabilities, not Perfection

6) Trade to make money, not to be right

7) Nicht Spielen Zum Spass (if it doesn’t make sense, don’t do it)

The market does not know how much you are up or down, so don’t trade that way (Think: “If I had no trade on right now, what would I do”)

9) Learn to endure the pain of your gains

10) There is no ideal trader personality type

11) Fear and Fear drive the markets, not fear and greed

12) Keep it simple: Up-Down-Sideways

13) Make sure the size of your bet matches the level conviction you have in it (No Edge, No Trade; Small Edge, Small Trade; Big Edge, Big Trade)

14) Making money is easy, keeping it is hard

15) H + W + P = E

a. (Hoping + Wishing + Praying = Exit the Trade!)