Archives of “February 10, 2019” day

rssJim Grant on Wacky Federal Finances

Brief Eight-Decade History of Volkswagen-VIDEO

//

Trading Notes for Traders

Traders should work on replacing subjectivity with cut and dry analysis. Keep yourself in a box and stick with what you know. The markets are complicated enough without our tendency to over analyze. All a trader needs is to learn how to read a small number of indicators and trade them well. Find a niche; your own niche. Simplification not complication makes a successful trader. When contemplating a trade think first and foremost about how much you are willing to lose before you attempt to calculate your expected gain. A stock is, at any given time, in the process of testing a specific price level. Questions that make a trading decision valid: WHY are you considering a trade? WHEN will you enter it? WHERE do you see it going? Multiple time frame correlation is important for high probability trades. Let the chart tell you its story. OBEY your rules of engagement…ALWAYS. Be well paid to be a follower. Loss of mental capital (drive, will, confidence) is greater than loss of monetary capital. Let the price action CONFIRM your trade analysis. Example: let a break-out test the break-out first. Trading Errors: The “Fudge” Factor 1. Trying to catch a falling knife. 2. Picking Tops 3. Failure to wait for confirmation. 4. Lack of patience. 5. Lack of a clear strategy. 6. Failure to assume responsibility. 7. Failure to quantify risk. |

3 ways to overcome your fear of disruption

Top 26 Quotes From Ed Seykota On Trend Following, Trading And Life

Quote 1:

“Win or lose, everybody gets what they want out of the market. Some people seem to like to lose, so they win by losing money.”

Quote 2:

“Fundamentals that you read about are typically useless as the market has already discounted the price, and I call them “funny-mentals”. However, if you catch on early, before others believe, you might have valuable “surprise-a-mentals”.”

Quote 3:

“If you can’t measure it, you probably can’t manage it… Things you measure tend to improve.”

Quote 4:

“The key to long-term survival and prosperity has a lot to do with the money management techniques incorporated into the technical system.”

Quote 5:

“There are old traders and there are bold traders, but there are very few old, bold traders.”

Quote 6:

“”I would add that I consider myself and how I do things as a kind of system which, by definition, I always follow.”

Quote 7:

“Systems trading is ultimately discretionary. The manager still has to decide how much risk to accept, which markets to play, and how aggressively to increase and decrease the trading base as a function of equity change.”

Quote 8:

“Trying to trade during a losing streak is emotionally devastating. Trying to play “catch up” is lethal.”

Quote 9:

“The elements of good trading are: 1, cutting losses. 2, cutting losses. And 3, cutting losses. If you can follow these three rules, you may have a chance.” (more…)

Trading Quote on Control

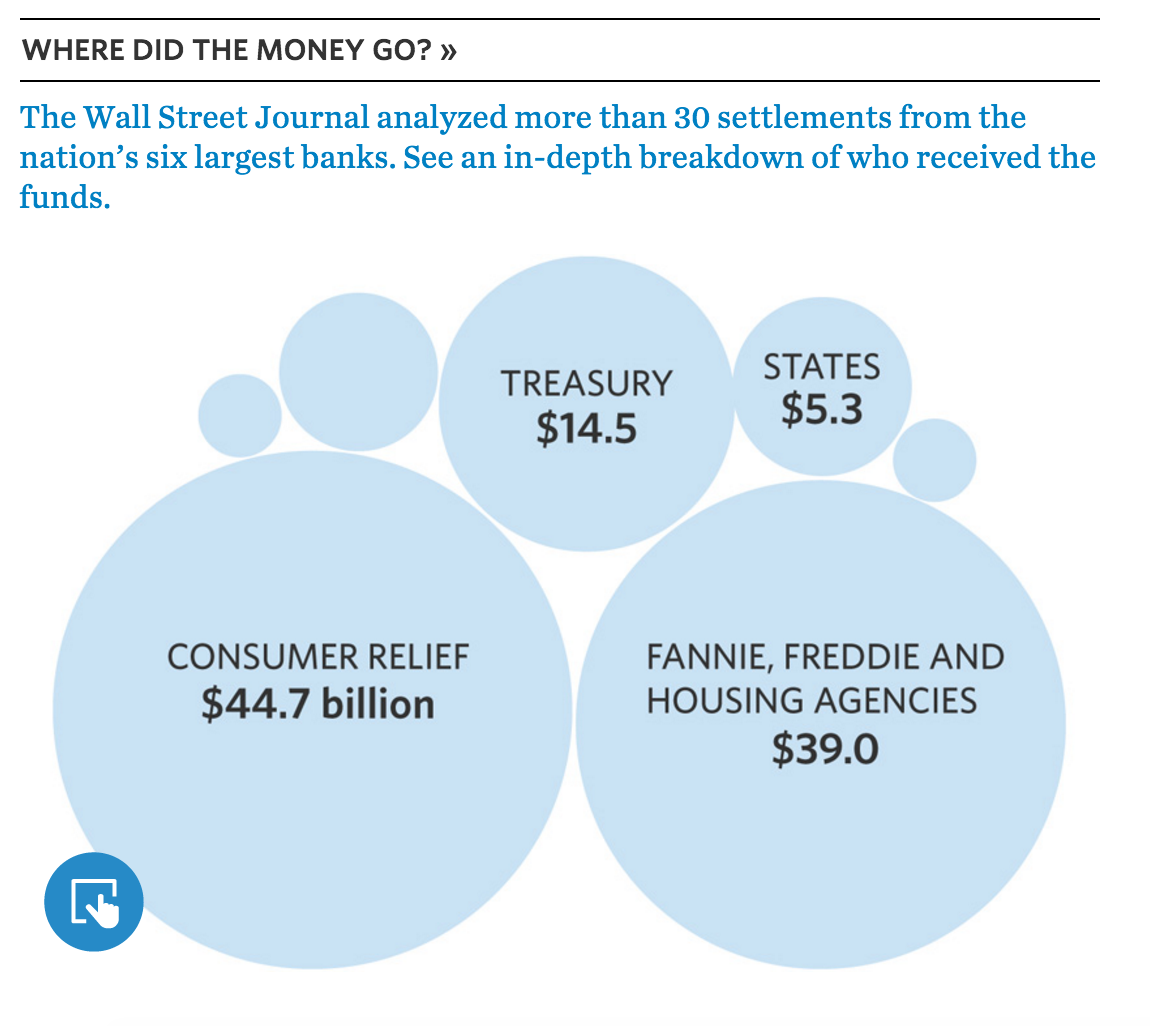

Big banks paid $110 billion in mortgage-related fines. Where did the money go?