Financial education opens up the opportunities to allow your money to work for you.

It is not the financial markets, nor government intervention in the markets, nor even the other competing traders that are the greatest enemy of any speculator, it is the greed and fear dwelling deep within his own human heart. To become an elite speculator, one must carefully learn over decades of real-world trading how to turn off one’s own dangerous emotions of greed and fear like a switch. The goal is to be totally emotionally neutral, never growing too scared nor stumbling into the deadly trap of greed.

It is not the financial markets, nor government intervention in the markets, nor even the other competing traders that are the greatest enemy of any speculator, it is the greed and fear dwelling deep within his own human heart. To become an elite speculator, one must carefully learn over decades of real-world trading how to turn off one’s own dangerous emotions of greed and fear like a switch. The goal is to be totally emotionally neutral, never growing too scared nor stumbling into the deadly trap of greed.

A greedy speculator is doomed before he even starts because he will buy in at the wrong time and will inevitably fail to sell high when everyone else is confirming his greed and bidding up prices. A fearful speculator will fare no better, as he will be too scared to buy in at the right time when everyone else is also frightened and he will sell out too soon as his fear multiplies, missing most of the market move.

Jesse Livermore learned through long, hard experience that his own internal greed and fear were his greatest enemies as a speculator. Once he learned how to tame his own dangerous emotions when he traded, both his success and fortunes soared.

From Forbes:

Coming off a huge debt deal with Argentina, hedge fund billionaire Paul Singer’s advise is to be wary of expert advice. “The important turning points in markets are never identified with precision in advance by ‘experts’ and policymakers. This lack of foresight is not surprising, because markets and the course of the economy are not model-able scientific phenomena but rather are examples of mass human behavior, which are never predictable with anything like precision,” says Singer. “But what is surprising is that even the most sophisticated investors, traders and commentators continue to rely on predictions issued by those who have no record of success at such forecasts.”

Nice.

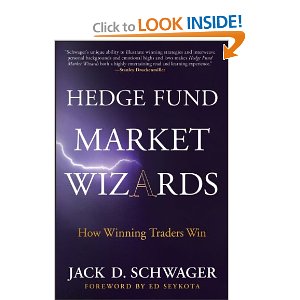

1. As long as no one cares about it, there is no trend. Would you be short Nasdaq in 1999? You can’t be short just because you think fundamentally something is overpriced.

1. As long as no one cares about it, there is no trend. Would you be short Nasdaq in 1999? You can’t be short just because you think fundamentally something is overpriced.

2. All markets look liquid during the bubble (massive uptrend), but it’s the liquidity after the bubble ends that matters.

3. Markets tend to overdiscount the uncertainty related to identified risks. Conversely, markets tend to underdiscount risks that have not yet been expressly identified. Whenever the market is pointing at something and saying this is a risk to be concerned about, in my experience, most of the time, the risk ends up being not as bad as the market anticipated.

4. The low-quality names tend to outperform early in the cycle, and the high-quality names tend to outperform toward the end of the cycle.

5. Traders focus almost entirely on where to enter a trade. In reality, the entry size is often more important than the entry price because if the size is too large, a trader will be more likely to exit a good trade on a meaningless adverse price move. The larger the position, the greater the danger that trading decisions will be driven by fear rather than by judgment and experience.

6. Virtually all traders experience periods when they are out of sync with the markets. When you are in a losing streak, you can’t turn the situation around by trying harder. When trading is going badly, Clark’s advice is to get out of everything and take a holiday. Liquidating positions will allow you to regain objectivity.

7. Staring at the screen all day is counterproductive. He believes that watching every tick will lead to both selling good positions prematurely and overtrading. He advises traders to find something else (preferably productive) to occupy part of their time to avoid the pitfalls of watching the market too closely.

8. When markets are trending up strongly, and there is bad news, the bad news counts for nothing. But if there is a break that reminds people what it is like to lose money in equities, then suddenly the buying is not mindless anymore. People start looking at the fundamentals, and in this case I knew the fundamentals were very ugly indeed.

9. Buying low-beta stocks is a common mistake investors make. Why would you ever want to own boring stocks? If the market goes down 40 percent for macro reasons, they’ll go down 20 percent. Wouldn’t you just rather own cash? And if the market goes up 50 percent, the boring stocks will go up only 10 percent. You have negatively asymmetric returns.

10. If a stock is extremely oversold—say, the RSI is at a three-year low—it will get me to take a closer look at it.8 Normally, if a stock is that brutalized, it means that whatever is killing it is probably already in the price. RSI doesn’t work as an overbought indicator because stocks can remain overbought for a very long time. But a stock being extremely oversold is usually an acute phenomenon that lasts for only a few weeks. (more…)

At some point in time the realization strikes that you are alone in the market – there is only you. The illusion that the market can ‘do’ anything to you falls away and it becomes obvious that you are 100% responsible for everything that happens to your account. You either give yourself money, or else you give your money away – there is nothing else.

At some point in time the realization strikes that you are alone in the market – there is only you. The illusion that the market can ‘do’ anything to you falls away and it becomes obvious that you are 100% responsible for everything that happens to your account. You either give yourself money, or else you give your money away – there is nothing else.

The market is one of the few arenas where there are no external constraints, except in the case of a margin call. It never forces you to take a position, long or short, or tells you to get out of your position. It does not say how long to stay in a position or what time to exit, how much profit or loss is enough. There are no external constraints at all, and as such people run riot. You are relying on yourself 100% and there is only ever you to blame.

The above is a core part of a winning trading psychology, yet its difficult to adopt. Shifting the blame is a basic way we defend our ego every single day of the week – yet in the market this practice is absolutely unsupported by price action. How can any other market participant be doing something to you if he is totally unaware of your existence or what position you hold?

Its necessary to really ponder this until the truth of it shines out:

You are alone…