Timeless and rare notes from Peter Lynch (c. 1983)

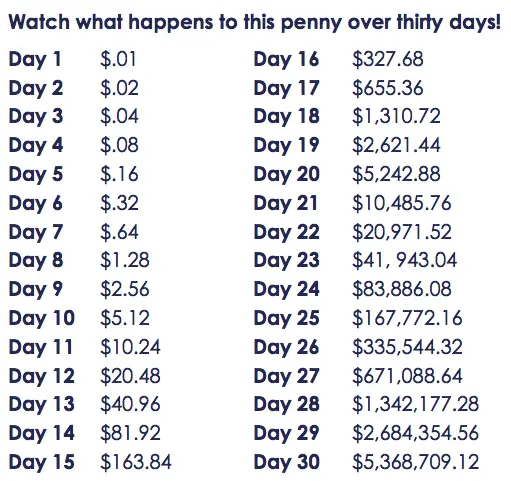

If you took a penny on the first day of the month and doubled it every day for that month (all 30 days), how much would you end up at the end of the month? One cent, two cents, four cents, 8 cents…. you end up with $5,368, 709.12 at the end of day thirty. Surprised? This is the power of compounding money over and over for staggering returns. This also shows how much money some traders on social media would quickly have if they were as good as they pretend to be. This also explains this quote from Jesse Livermore:

“If a man didn’t make mistakes, he‘d own the world in a month. But if hedidn’t profit by his mistakes, he wouldn’t own a blessed thing.” ~ Jesse Livermore

Chutzpah is a Yiddish word meaning gall, brazen nerve, effrontery, sheer guts plus arrogance. It’s Yiddish and, as Leo Rosten writes, “No other word and no other language, can do it justice.” This example is better than 1,000 words. Read the story below the picture and then you will understand.

Chutzpah is a Yiddish word meaning gall, brazen nerve, effrontery, sheer guts plus arrogance. It’s Yiddish and, as Leo Rosten writes, “No other word and no other language, can do it justice.” This example is better than 1,000 words. Read the story below the picture and then you will understand.

A little old lady sold pretzels on a street corner for 25 cents each. Every day a young man would leave his office building at lunch time, and as he passed the pretzel stand, he would leave her a quarter, but never take a pretzel. This went on for more than 3 years. The two of them never spoke. One day, as the young man passed the old lady’s stand and left his quarter as usual, the pretzel lady spoke to him. Without blinking an eye she said: “They’re thirty five cents now.”

ATMs in Hindi-speaking states will now generate receipts in Hindi, along with English, as the Home Ministry has asked the Reserve Bank of India to direct banks to procure only those ATMs that can print receipts in Hindi.

The ministry has also instructed two major foreign suppliers of ATMs to upgrade the software in the existing ATMs to ensure printouts in Hindi.

The Department of Financial Services has written to the Home Ministry, saying the matter is under consideration. “We will be perusing this matter… the issue is that the printout of the receipt (from the ATM) should come in the language in which the transaction is being made,” a Home Ministry spokesperson said.

At present, only ATMs procured by the Union Bank of India from Diebold firm have the facility to print in Hindi.

“Trading is also highly addictive. When behavioral psychologists have compared the relative addictiveness of various reinforcement schedules, they found that intermittent reinforcement – positive and negative dispensed randomly (for example, the rat doesn’t know whether it will get pleasure or pain when it hits the bar) – is the most addictive alternative of all, more addictive than positive reinforcement only. Intermittent reinforcement describes the experience of the compulsive gambler as well as the future trader. The difference is that, just perhaps, the trader can make money.” However, as with most affective aspects of trading, its addictiveness constantly threatens ruin. Addictiveness is the reason why so many players who make fortunes leave the game broke.”

“Trading is also highly addictive. When behavioral psychologists have compared the relative addictiveness of various reinforcement schedules, they found that intermittent reinforcement – positive and negative dispensed randomly (for example, the rat doesn’t know whether it will get pleasure or pain when it hits the bar) – is the most addictive alternative of all, more addictive than positive reinforcement only. Intermittent reinforcement describes the experience of the compulsive gambler as well as the future trader. The difference is that, just perhaps, the trader can make money.” However, as with most affective aspects of trading, its addictiveness constantly threatens ruin. Addictiveness is the reason why so many players who make fortunes leave the game broke.”

(So you didn’t have a clear exit point) In other words, the only way you could stop trading was by losing.

If you can’t take a small loss, sooner or later you will take the mother of all losses.

There are old traders and there are bold traders, but there are very few old, bold traders.

Dramatic and emotional trading experiences tend to be negative. Pride is a great banana peel, as are hope, fear, and greed. My biggest slip-ups occurred shortly after I got emotionally involved with positions.

I prefer not to dwell on past situations. I tend to cut bad trades as soon as possible, forget them, and then move on to new opportunities.

The elements of good trading are: 1. Cutting losses, 2. Cutting losses, and 3. Cutting losses. If you can follow these three rules, you may have a chance.

Trying to trade during a losing streak is emotionally devastating. Trying to play “catch up” is lethal. (more…)