The full statement by the BOE on its August policy decision

The Bank of England’s Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target, and in a way that helps to sustain growth and employment. In that context, its challenge at present is to respond to the economic and financial impact of the Covid-19 pandemic. At its meeting ending on 4 August 2020, the MPC voted unanimously to maintain Bank Rate at 0.1%. The Committee voted unanimously for the Bank of England to continue with its existing programmes of UK government bond and sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, maintaining the target for the total stock of these purchases at £745 billion.

The Committee’s projections for activity and inflation are set out in the accompanying August Monetary Policy Report. Although recent developments suggest a less weak starting point for the Committee’s latest projections, it is unclear how informative they are about how the economy will perform further out. The outlook for the UK and global economies remains unusually uncertain. It will depend critically on the evolution of the pandemic, measures taken to protect public health, and how governments, households and businesses respond to these factors. The MPC’s projections assume that the direct impact of Covid-19 on the economy dissipates gradually over the forecast period. Given the inherent uncertainties regarding the evolution of the pandemic, the MPC’s medium-term projections are a less informative guide than usual.

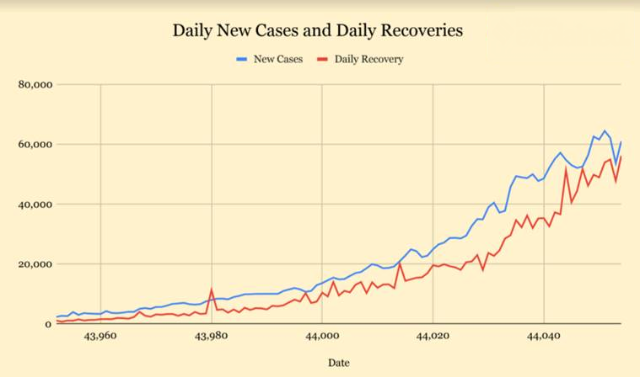

Global activity has strengthened over recent months, although it generally remains below its level in 2019 Q4. Covid-19 has continued to spread rapidly within a number of emerging market economies, however, and there has been a renewed rise in cases in many advanced economies. (more…)