- You must have faith in yourself. You must believe that you can trade as well as anyone else.. This belief arises from doing your homework and staying disciplined in your system. Understanding that it is not you, that it is your system that wins and loses based on market action will keep the negative self talk at bay.

- You must have faith in your method. You must study the historical performance of your trading method so you can see how it works on charts. Also it is possible to quantify and back test mechanical trading systems for specific historical performance in different kinds of markets.

- You must have faith in your risk management. You must manage your risk per trade so it brings you to a 0% mathematical probability of ruin. A 1% to 2% of total capital at risk per trade will give almost any system a 0% risk of ruin.

- You must have faith that you will win in the long term if you stay on course. Reading the stories of successful traders and how they did it will give you a sense that if they can do it you can to. If trading is something you are passionate about all that separates you from success is time.

- You need faith in your stock. It helps in your trading if you trade stocks, commodities, or currencies that you 100% believe in. Traders tend to have no trouble trading a bullish system with $AAPL if they believe it is the greatest company to ever exist and will go to $500 within six months. It is much easier to follow an always in trend reversal system with Gold if you believe it tends to trend strongly one way or the other. Of course you have to follow a defined system and take the signals even if it goes against your opinions but believing in your trading vehicle helps tremendously.

Archives of “stocks” tag

rssControl Your Emotion or Other People Will Control You

Many people are controlled by fear. Fear of losing an opportunity causes you to act in haste. Fear of losing your paper profit causes you to sell out too early. And fear of losing everything causes you to sell right at the bottom. Although selling right at the bottom is caused more by frustration than anything else, fear also plays a part. How do we overcome these kind of fears? Knowledge is the best weapon. When you know, people cannot scare, frighten or intimidate you. They can’t con you in anyway. Knowledge is your first key to success.

Hope causes you to hold on to a falling stock. Sometimes your hope is rewarded; your stock turns around and you make a profit. Unfortunately, hope often becomes hopeless. Experience tells me that it is much better to keep an uptrend stock and let go a falling one. This strategy is vital, simply because a trend in motion is likely to continue. Hope also causes people to buy into excessively high PE stocks. I prefer what is good today and better tomorrow. (more…)

Traders Daily Lessons

Have the courage to say no.

Have the courage to face the truth.

Have the courage to do the right thing because it is right.

– W. Clement Stone

An inner dialogue typically reinforces the way you think. So the goal is to consciously expose yourself to thoughts that ultimately will positively impact your trading. Through the use of repetition you can considerably strengthen a positive attitude and sound trading behavior. The beauty of it is the simplicity of the method. It’s entirely up to you which trading mantras you want to adhere to. Here are a few that I strongly believe in and that characterize my thinking as a trader:

- Kill your greed

- Isolate yourself from the opinions of others

- Never chase stocks

- Always strive for emotional detachment

- Focus on proper execution

- There is never a shortage of opportunities

- Never make excuses

- Stay in control

- Don’t compare yourself to others

- Always use stop losses

- Standing aside is a position

- Money comes in bunches

- Never add to a losing position

- Stay calm and focused

- Don’t believe the hype

- Cultivate independent thinking

- Be ready for worst case scenarios

- Nosce te ipsum – Know thyself

How To Make Your Own Luck in Trading

The only place luck has in trading is that you will hopefully be on the right side of unexpected moves due to surprises. In trading you should trade in such a way that good luck will benefit you and bad luck will not destroy you. In my trading luck has little to do with my profits. I trade when the probabilities are on my side based on what the chart is saying about the current action of buyers and sellers in a stock. New traders hoping for luck belong in Las Vegas not the stock market. Trade the trends, play the odds, manage the risk, have faith in yourself that you have the discipline to trade your winning plan.

- I do not trade on luck I trade with probabilities being on my side.

- I manage my risk carefully so bad luck on one trade does not blow up my trading account.

- I trade in the direction of the markets current trend to enable me to stay on the right side of strong moves.

- I trade in the direction of the markets current trend so the odds are on my side of being right.

- I buy the strongest stocks and sell short the weakest stocks.

- When I am wrong I do not hope for luck I just get out of a losing trade.

- When I buy options I buy the in the money options with the odds in my favor not the far out of the money ones that require some luck.

- I primarily buy options instead of selling them so I can get big moves for small fees instead of small fees for big risks.

- I only risk 1% of my capital per trade so I do not blow up my account with a string of bad trades.

- I trade with confidence in my myself and my method not hoping for luck.

Women and The Market

1.) I suggest that one pays attention to the stocks that could care less if they are purchased or traded. The quiet ones. The non volatile ones.(the best, most stable women are thriving and so busy enjoying their lives they don’t really worry about being snagged, they have more men in pursuit than they can usually manage or have time for.) They are the best catches. They don’t dress to necessarily impress or seduce, they don’t have to. 2.) If the idea of competition stirs interest, don’t get seduced, investors might merely be competing with each other when they should be focused on learning about how the market moves and what she needs at the moment. The male or investor might miss something big being divulged or demonstrated when he worries about the competition. The conversation/connection with the woman or the market must be sustained fully. 3.) Men can NEVER be caught. Men fall in love first. If a woman tips her hand in this regard she is done. Men are suspect if something comes too easily. Unless he’s a narcissist and imagines that he is irresistible or invincible. It doesn’t hit him immediately that he has to have her. If a stock gains lots of attention it will probably lose it’s momentum soon and is probably just flirting with you or using you to create competition for the man she truly wants. Real interest from a woman is steady and climbs deliberately, carefully, without much frenzy. Watch out for those stocks and when you find one commit. |

Word of Wisdom from :Technical Analysis of Stock Trends by Robert Edwards and John Magee.

No stock trader should be without Technical Analysis of Stock Trends by Robert Edwards and John Magee. Originally penned in 1948 and revised numerous times over the years, it is a classic. What Edwards and Magee wrote 60+ years ago is today still the same as it ever was.

No stock trader should be without Technical Analysis of Stock Trends by Robert Edwards and John Magee. Originally penned in 1948 and revised numerous times over the years, it is a classic. What Edwards and Magee wrote 60+ years ago is today still the same as it ever was.

In a chapter entitled “Stick To Your Guns” we find the following words of wisdom for those traders who seek the oftentimes elusive peace of mind of the disciplined few.

It has often been pointed out that any of several different plans of operation, if followed consistently over a number of years, would have produced consistently a net gain on market operations. The fact is, however, that many traders, having not set up a basic strategy and having no sound philosophy of what the market is doing and why, are at the mercy of every panic, boom, rumor, tip, in fact, of every wind that blows. And since the market, by its very nature, is a meeting place of conflicting and competing forces, they are constantly torn by worry, uncertainty, and doubt. As a result, they often drop their good holdings for a loss on a sudden dip or shakeout; they can be scared out of their short commitments by a wave of optimistic news; they spend their days picking up gossip, passing on rumors, trying to confirm their beliefs or alleviate their fears; and they spend their nights weighing and balancing, checking and questioning, in a welter of bright hopes and dark fears.

Furthermore, a trader of this type is in continual danger of getting caught in a situation that may be truly ruinous. Since he has no fixed guides or danger points to tell him when a commitment has gone bad and it is time to get out with a small loss, he is prone to let stocks run entirely past the red light, hoping that the adverse move will soon be over, and there will be a ‘chance to get out even,’ a chance that often never comes. And, even should stocks be moving in the right direction and showing him a profit, he is not in a much happier position, since he has no guide as to the point at which to take profits. The result is he is likely to get out too soon and lose most of his possible gain, or overstay the market and lose part of the expected profits. (more…)

Ed Seykota’s Magic Trading System

1: Do not stress about whipsaws – one good trend pays for them all.

A whipsaw is when you enter a stock, but get stopped out quickly. In a period of whipsaws, this may happen many times. This can be frustrating to a trader or investor, and it may cause them to change their system. But the fact is that one good trend will pay for all of these whipsaws, and if you change your system you lose the benefit of that!

2: When you Catch a Trend, ride it to the end.

Your system must be able to jump on a trending stock (for instance, up if you are going long), but then also be able to ride that trend to the end. Many novice traders will jump out of stocks before they are finished trending because they are scared the market has gone too far. Let your system tell you when the trend is ending, and only exit once it does.

3: When you show a loss, give the loss a toss.

Every single successful money manager ever interviewed has said something along the lines of: “Cut your losses short”. Get rid of your losses. Keep your winners. And once you have your system don’t second guess it! Being stopped out is part of the process.

4: We know if our risk is right when we make a lot of money, but can still sleep at night.

Risk is the amount of risk per trade (the price between your entry and your stop loss), and how much your total risk is (regarding how many positions you have open at one time). (more…)

Risk is the Possibility of Loss

“Risk is the possibility of loss. That is, if we own some stock, and there is a possibility of a price decline, we are at risk. The stock is not the risk, nor is the loss the risk. The possibility of loss is the risk. As long as we own the stock, we are at risk. The only way to control the risk is to buy or sell stock. In the matter of owning stocks, and aiming for profit, risk is fundamentally unavoidable and the best we can do is to manage the risk. To manage is to direct and control. Risk management is to direct and control the possibility of loss. The activities of a risk manager are to measure risk and to increase and decrease risk by buying and selling stock.”

Simple?

16 Rules for Thirsty Traders

I always liked these rules for their simplicity and I think they can benefit some of you, if only in the form of a gentle reminder of what you should be doing…or not doing.

I always liked these rules for their simplicity and I think they can benefit some of you, if only in the form of a gentle reminder of what you should be doing…or not doing.

1. Market direction is the most important thing in determining a stock’s

probable direction.

2. Price and Volume action are more important than a jillion indicators and

complex theories, no matter how cool they may be.

3. Don’t miss the forest (broad market) for the trees (individual stocks).

4. Don’t anticipate. Wait for confirmation.

5. Don’t trade contrary to the market’s direction.

6. Don’t try to “outsmart” the market.

7. Things can go much, MUCH further than you think they can, in either

direction.

8. Divergences work best with double tops and double bottoms.

9. Quite often, divergence analysis doesn’t work at all. When that happens, it

means the prevailing trend is very strong.

10. You need to effectively filter or limit the amount of data or charts to look

at; otherwise, you will spread yourself way too thin. You must have the time and

alertness to keep your eye on the ball…..hard to do, when you are juggling

thousands.

11. Don’t focus on every tick of each trade. If you are, you are holding on to

the handlebars too tight.

12. Have a plan. Set stops and targets. Don’t be afraid to take 1/2 profits and

raise (or lower) your stops. If your trade follows your script, great. If it

doesn’t within a reasonable time, consider getting out.

13. That said, it’s OK to give your trade a little time, unless you are clearly

wrong. You are often ahead of the market a little bit.

14. You will lose money sometimes. Every trader does. It’s a business, not a

personal indictment against you. Get over it and move on to the next trade.

15. Political opinion and markets do not mix.

16. Learn from your mistakes, or you will be condemned to repeat them.

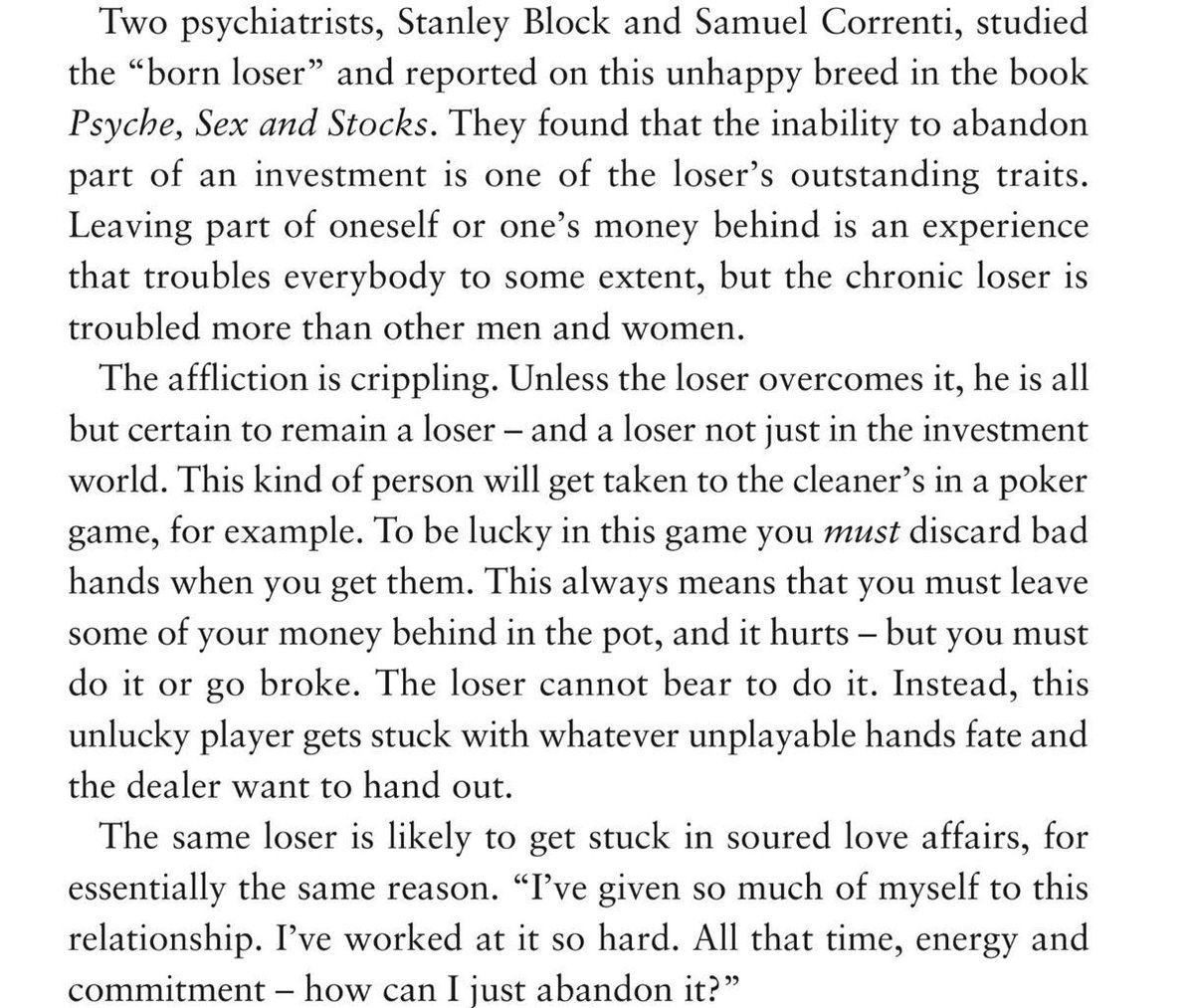

Born loser … (Must Read )

Have the courage to say no.

Have the courage to say no. “Risk is the possibility of loss. That is, if we own some stock, and there is a possibility of a price decline, we are at risk. The stock is not the risk, nor is the loss the risk. The possibility of loss is the risk. As long as we own the stock, we are at risk. The only way to control the risk is to buy or sell stock. In the matter of owning stocks, and aiming for profit, risk is fundamentally unavoidable and the best we can do is to manage the risk. To manage is to direct and control. Risk management is to direct and control the possibility of loss. The activities of a risk manager are to measure risk and to increase and decrease risk by buying and selling stock.”

“Risk is the possibility of loss. That is, if we own some stock, and there is a possibility of a price decline, we are at risk. The stock is not the risk, nor is the loss the risk. The possibility of loss is the risk. As long as we own the stock, we are at risk. The only way to control the risk is to buy or sell stock. In the matter of owning stocks, and aiming for profit, risk is fundamentally unavoidable and the best we can do is to manage the risk. To manage is to direct and control. Risk management is to direct and control the possibility of loss. The activities of a risk manager are to measure risk and to increase and decrease risk by buying and selling stock.”