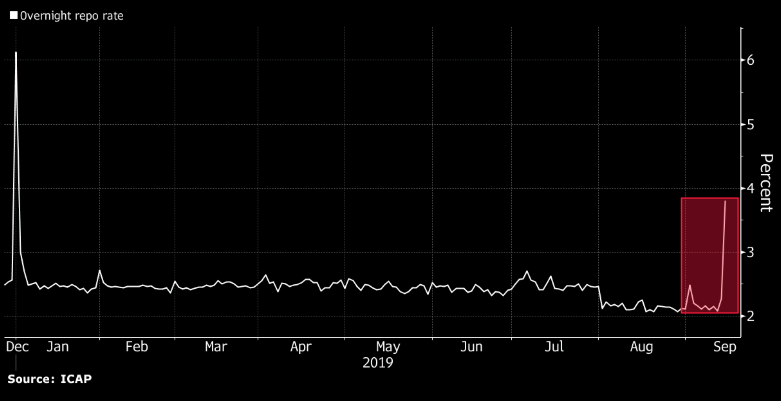

The Fed just hiked the amount offered in its repo operations

The statement via the NY Fed:

“The Open Market Trading Desk (the Desk) at the Federal Reserve Bank of New York has updated the current monthly schedule of repurchase agreement (repo) operations.

Beginning with today’s operation and through March 12, 2020, the Desk will increase the amount offered in daily overnight repo operations from at least $100 billion to at least $150 billion. In addition, the Desk will increase the amount offered in the two-week term repo operations on Tuesday, March 10, 2020 and Thursday, March 12, 2020 from at least $20 billion to at least $45 billion.”