S&P and NASDAQ break a today winning streak. Dow industrial average breaks its 4 day winning streak

The major indices have broken their recent winning streaks. Admittedly the NASDAQ and the S&P index is at only reason for 2 straight days, but the Dow industrial average had a 4 day winning streak snapped in trading today.

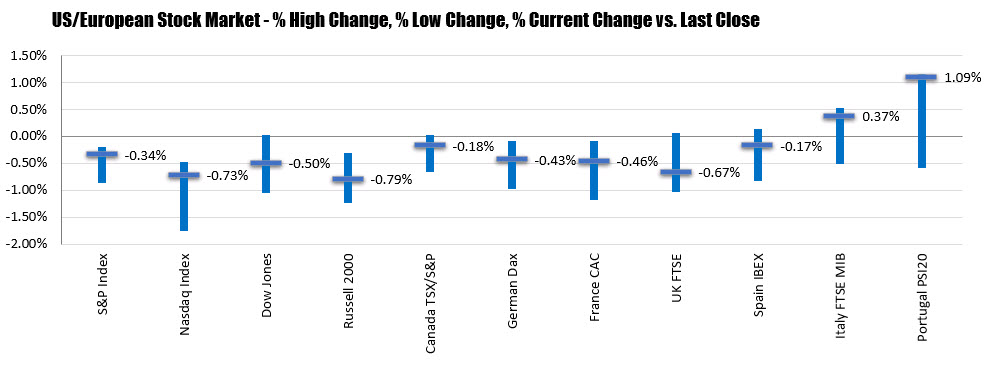

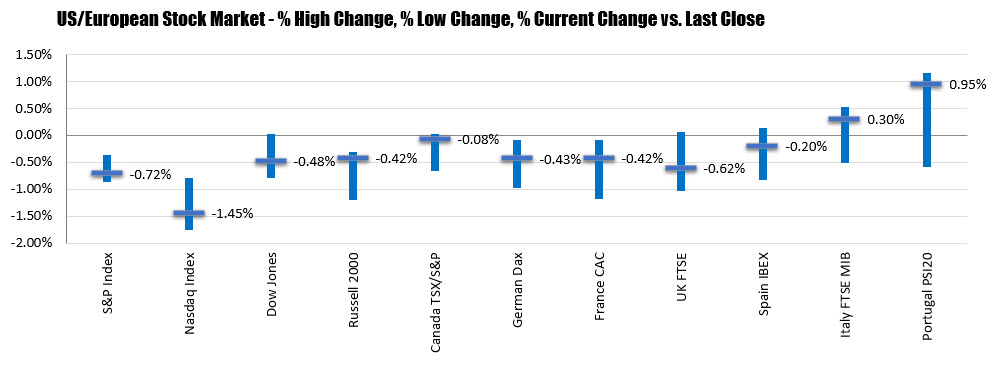

- S&P index -10.99 points or -0.34% at 3215.57

- NASDAQ index -76.66 points or -0.73% at 10473.83

- Dow industrial average -135.39 points or -0.50% at 26734.73

After the close Netflix showed a greater than expected rise in new subscribers (10.1 million vs. 8.2M estimate),. But forecast Q3 subscribers much less than expectations at 2.5 million vs. 5.1 million estimate

After the close Netflix showed a greater than expected rise in new subscribers (10.1 million vs. 8.2M estimate),. But forecast Q3 subscribers much less than expectations at 2.5 million vs. 5.1 million estimate

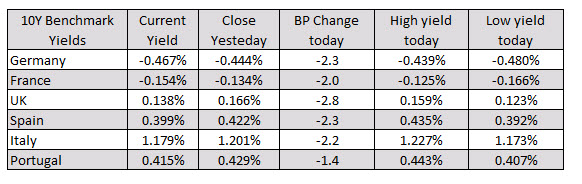

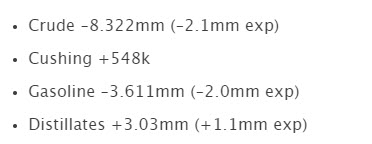

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit:

For position trades, you may not want to be too involved in the intraday timing for your entry. Nonetheless, rather than just buying at a random time, e.g. at the open or at the close, your entry price can be improved by taking note of the intraday trend using some quick-and-dirty methods.

For position trades, you may not want to be too involved in the intraday timing for your entry. Nonetheless, rather than just buying at a random time, e.g. at the open or at the close, your entry price can be improved by taking note of the intraday trend using some quick-and-dirty methods.