Startups are continuing to grow in Japan, with a Nikkei survey finding the estimated corporate value of the 20 leading newer businesses increased 22% to exceed a combined value of 1 trillion yen ($9.2 billion) in the year to September. Growth is especially notable in the artificial intelligence and financial technology, or fintech, areas.

Technological innovations have increased startups’ corporate value, but signs of reservations among investors are also emerging in the wake of SoftBank Group-backed WeWork’s high-profile troubles. Masayoshi Son, who announced on Wednesday that his group’s net loss for the July-September quarter was 700 billion yen, admitted regretting a large investment in WeWork. “My investment judgment was poor in many ways,” he said.

Nikkei conducted the survey jointly with the Japan Venture Capital Association to estimate the corporate value of unlisted startups established up to 20 years ago as of the end of September. The valuation, calculated by multiplying the latest issue price of shares by their total number, corresponds to the market capitalization of listed companies.

The corporate value of 181 startups, among 189 firms that responded to the survey, was estimated, with the top 20 found to be worth a combined 1.19 trillion yen. Top-ranked Preferred Networks, an artificial intelligence developer, and two others were valued at more than $1 billion each. In 2018, there was only one so-called unicorn.

Using deep-learning technology, Preferred has been developing self-driving and other technologies jointly with auto giant Toyota Motor. The assessment of the company has grown also because it has expanded its partnerships with other companies, such as joint studies on automated control of oil plants with JXTG Holdings.

TBM, a Tokyo-based materials startup, was placed second in the survey. The company uses limestone to develop alternatives to plastics for items such as shopping bags, and it plans to start building its first overseas factory in China in 2020.

Fourth-ranked freee helps companies address labor shortages with its automated accounting software. The top 20 startups include seven fintech companies, reflecting strong expectations for innovations in financial services. The number of startups each valued at more than 10 billion yen increased about 30% to 63.

Unicorn candidates have also increased in sectors such as health care. According to U.S. research firm CB Insights, the U.S. has some 200 unicorns, or half the world’s total. Britain and India each boast dozens of them, but the number in Japan remains small.

The startup boom began earlier this decade as the digital revolution made headway, prompting large companies to expand investment in emerging innovative firms in a bid to avoid taking major risks alone.

One focal point ahead is the trend of investment, because the boom is partly attributable to the global glut of money. According to Japan Venture Research, privately held companies in Japan raised a total of 421.1 billion yen in 2018, a fivefold increase from five years earlier.

However, office-sharing WeWork’s woes raise the risk of a knock-on effect on other startups, which may find themseves under extra pressure to demonstrate their technology and business growth potential if they are to continue to attract investment.

Until recently, investors have tended to consider it enough for businesses to simply be expanding to warrant their support, but following the WeWork fiasco, there is a new focus on examining their governance of management thoroughly, according to Gen Isayama, general partner and chief executive of WiL, a U.S.-based incubator.

Softbank Group Chairman and CEO Son also referred to corporate governance during the earnings conference. “We will learn from our mistakes on WeWork, and create solid governance standards regarding business founders.”

Meanwhile, investment in startups in the U.S. has ballooned to 14 trillion yen. Amid the bubble-like situation, WeWork has faltered following the failure of its planned initial public offering, making investors more cautious about investment in new businesses.

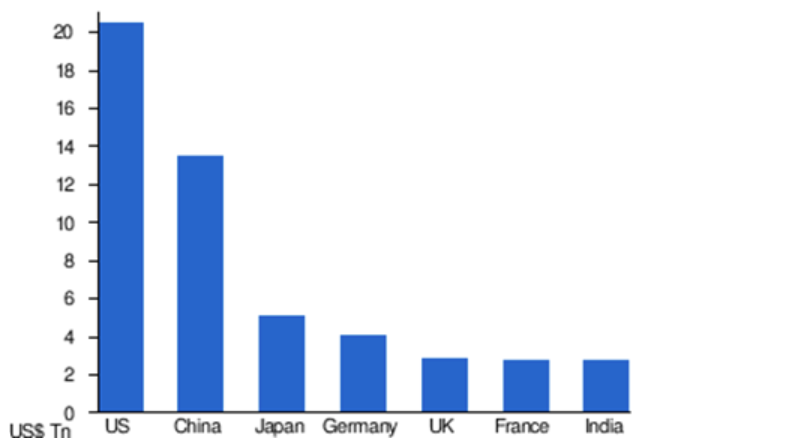

The focus of the market on the China-US trade war is acute due to China’s and the United States economic weight. In 2018 the US’s GDP was above $20 trillion and China’s GDP over $14 trillion, which makes them the world’s two largest economies by nominal GDP.

The focus of the market on the China-US trade war is acute due to China’s and the United States economic weight. In 2018 the US’s GDP was above $20 trillion and China’s GDP over $14 trillion, which makes them the world’s two largest economies by nominal GDP.