“Will there be a clear, uncontested and accepted winner?” is a better question

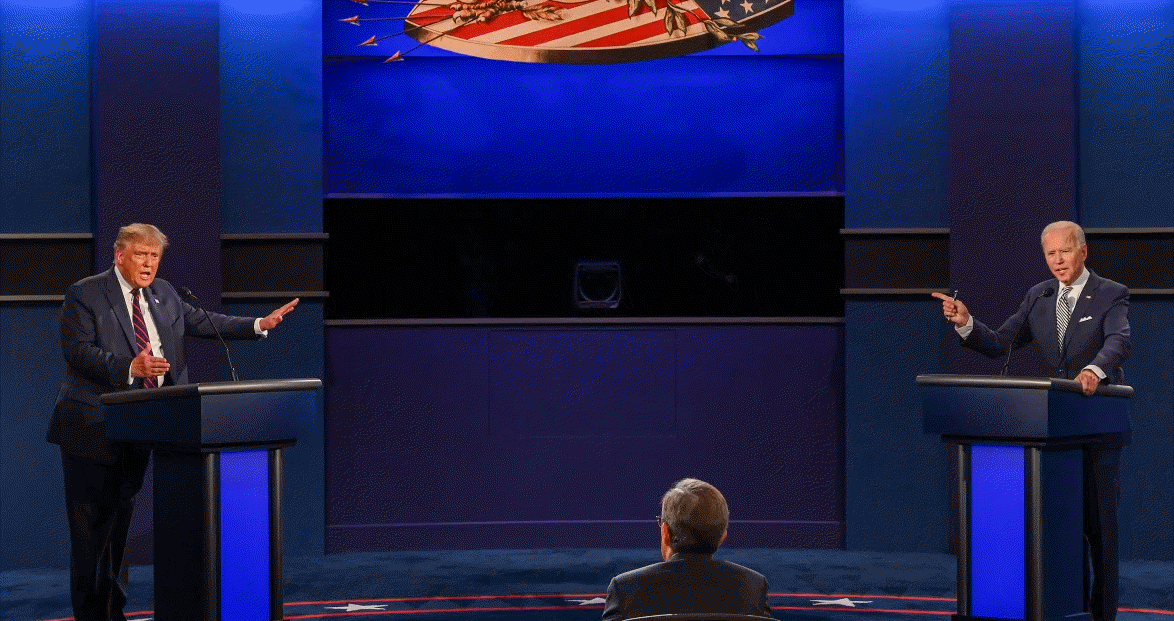

The betting odds of a Biden Presidency ticked higher after yesterday’s debate. I believe Trump’s constant interrupting was at least partly strategic in the hope of tripping up Biden and making him look more like the bumbling caricature he’s tried to construct. By and large that didn’t work and I doubt Trump won over many undecideds.

Given the polling lead, Biden should be a large favourite but he’s stuck at 60/40 because no one can forget Trump’s upset win over Hillary Clinton, or Brexit.

For markets, I think the outcome itself is less important in the short term than the question of whether or not their will be a clear winner; and whether Trump will ever concede.

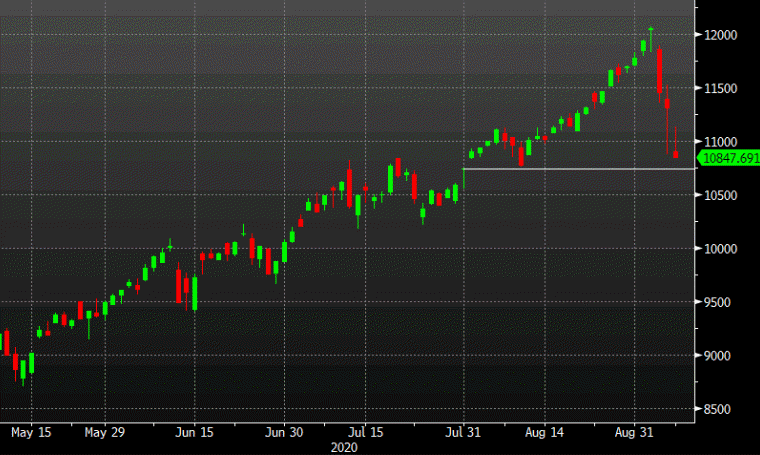

BMO’s fixed income team writes today about the tail risk of a contested election but ponders the degree to which the consensus opinion is already fully incorporated into current valuations.

Let’s face it, very few in the market are anticipating a smooth election nor for any potential transition of power to be uneventful. The extent to which November serves to disrupt functioning of the federal government or fuel further civil unrest remains to be seen and, frankly, is the most significant tail risk as we ponder potential outcomes.

I’m open to the ‘sell the rumour, buy the fact trade’ but skeptical that it’s even possible to price in uncertainty in that way. Uncertainty is — by definition — something that persists for an indefinite amount of time. If Trump refuses to concede even on a clear loss, he will still have a strong political base and I expect him to use it to dog Biden for years. It’s a question of how far he’s willing to go and with Trump, the sky is the limit.

The ‘buy the fact’ trade relies on an eventual return to Obama-era levels of civility (which isn’t saying much) but I just don’t think that’s coming.