April to June GDP data from China +11.5% q/q (sa) and +3.2% y/y

- expected 9.6% q/q, prior -9.8%

- expected 2.4% y/y, prior -6.8%

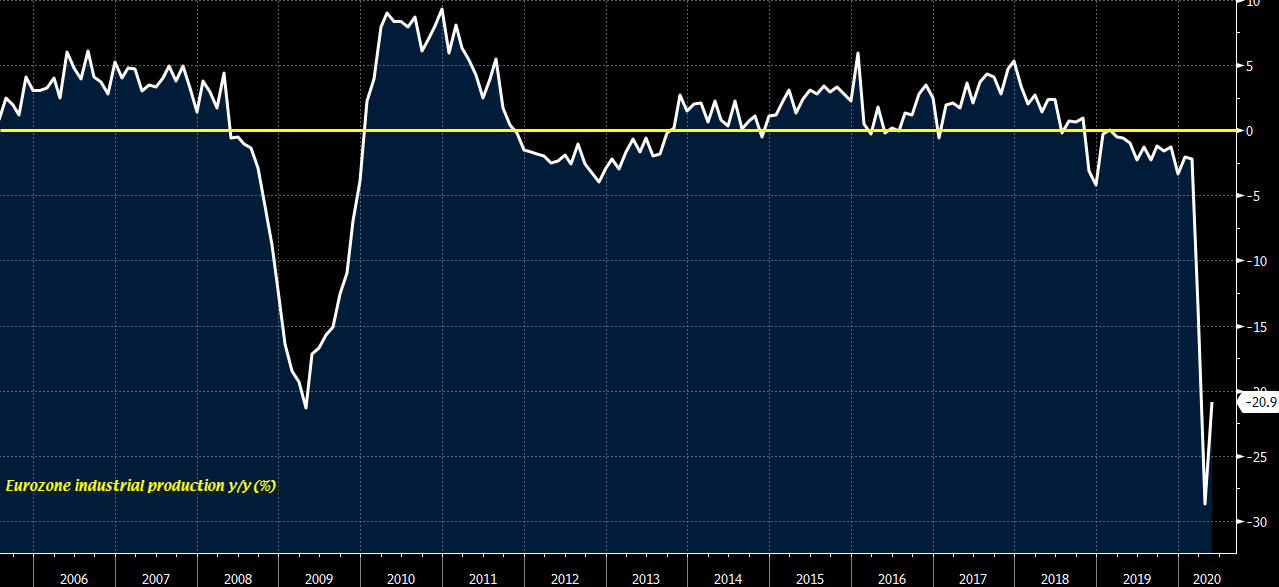

Factory output rebounded in May but not as robust as anticipated, with the annual reading highlighting the plight faced by the euro area economy despite the gradual easing of lockdown measures. June should also reflect a rebound but new normal conditions and the pace of the recovery will likely only be seen in July to August or later in Q3.

GDP -3.4% annualised sa q/q

GDP deflator (an inflation indication) %

Private consumption -0.7%

Business spending -0.5% (capex)

The report says that Chinese leaders at the upcoming National People’s Congress will unveil a description of the goal for GDP instead, although a final decision has not been made on how to characterise the target.

Fitch Ratings-London-02 April 2020: A deep global recession in 2020 is now Fitch Ratings’ baseline forecast according to its latest update of its Global Economic Outlook (GEO) forecasts.

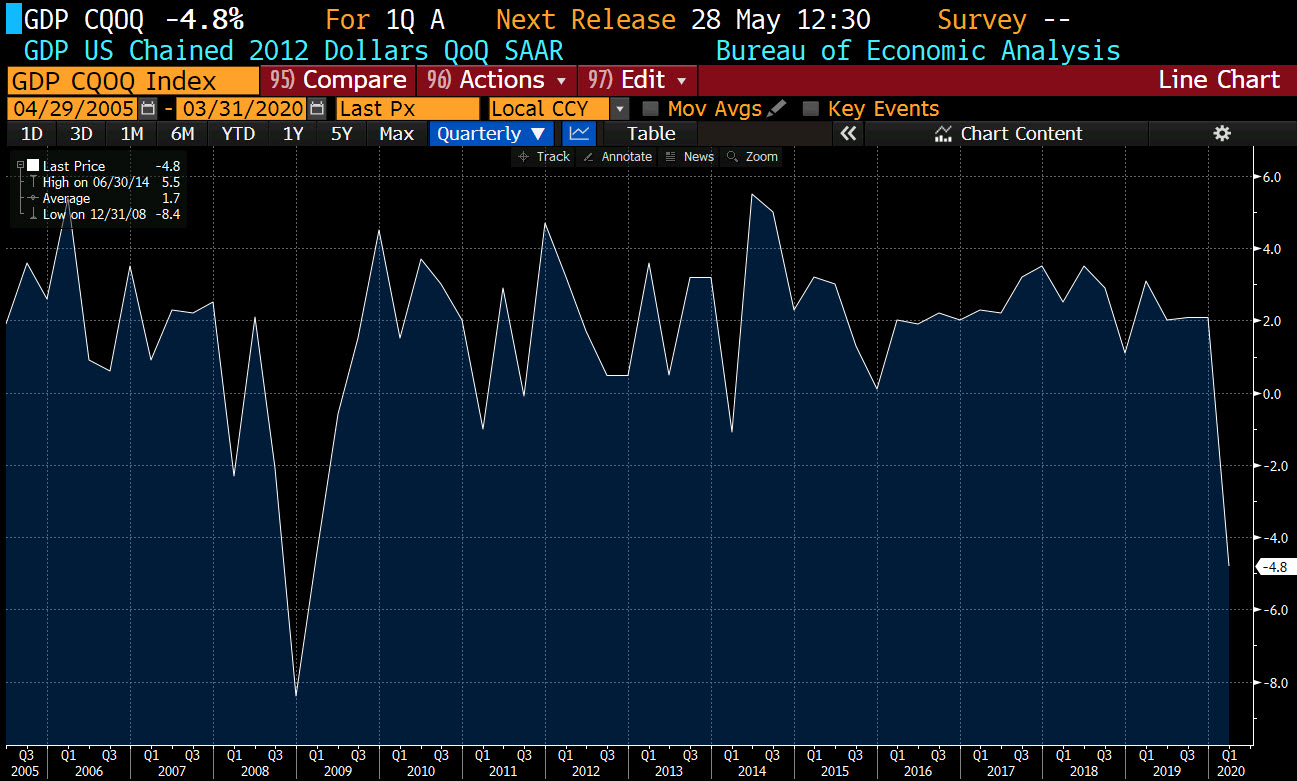

The speed with which the coronavirus pandemic is evolving has necessitated another round of huge cuts to our GDP forecasts. We now expect world economic activity to decline by 1.9% in 2020 with US, eurozone and UK GDP down by 3.3%, 4.2% and 3.9%, respectively. China’s recovery from the disruption in 1Q20 will be sharply curtailed by the global recession and its annual growth will be below 2%.

“The forecast fall in global GDP for the year as a whole is on a par with the global financial crisis but the immediate hit to activity and jobs in the first half of this year will be worse”, said Brian Coulton, Fitch’s chief economist.

The spread of the pandemic and the actions necessary to control it mean that we now have to incorporate full-scale lockdowns across Europe and the US (and many other countries) in our baseline forecasts. This was not the assumption used in our March 2020 GEO forecast. There are many moving parts, but we now judge that lockdowns could reduce GDP across the EU and US by 7% to 8%, or 28% to 30% annualised, in 2Q20. This is an unprecedented peacetime one-quarter fall in GDP and is similar to what we now estimate occurred in China in 1Q20.

On the assumption that the health crisis is broadly contained by the second half of the year there should be a decent sequential recovery in activity as lockdowns are removed, some spending is re-profiled from 1H20, inventories are rebuilt and policy stimulus takes effect. But this has to be set against the many factors amplifying the depth of the dislocation, including job losses, capex cuts, commodity price shocks and the rout in financial markets.

“Our baseline forecast does not see GDP reverting to its pre-virus levels until late 2021 in the US and Europe,” said Coulton.

And for the whole of 2019: 6.1% for a slight miss.

India’s growth rate is projected to decelerate to 5 per cent in 2019-20 amid enduring financial sector issues, according to a World Bank report, which said the country’s GDP was likely to recover to 5.8 per cent in the following financial year.

The government’s advance estimates of national income for the current fiscal released on Tuesday also showed GDP growth at 5 per cent, an 11-year low, mainly because of a poor show by the manufacturing and construction sectors.

“In India, where weakness in credit from non-bank financial companies is expected to linger, growth is projected to slow to 5 per cent in 2019-20 and recover to 5.8 per cent the following financial year,” the bank said in its latest edition of the Global Economic Prospects on Wednesday.

It said tighter credit conditions in the non-banking sector are contributing to a substantial weakening of the domestic demand in India.

“In India, activity was constrained by insufficient credit availability, as well as by subdued private consumption,” the report said.

The bank said the regional growth in South Asia is expected to pick up gradually, to 6 per cent in 2022, on the assumption of a modest rebound in domestic demand.

It said key risks to the outlook include a sharper-than-expected slowdown in major economies, a re-escalation of regional geopolitical tensions and a setback in reforms to address impaired balance sheets in the financial and corporate sectors.

In India, economic activity slowed substantially in 2019, with the deceleration most pronounced in the manufacturing and agriculture sectors, whereas government-related services sub-sectors received significant support from public spending, the bank said.

GDP growth decelerated to 5 per cent and 4.5 per cent in the April-June and July-September quarters of 2019, respectively, the lowest readings since 2013, it said.