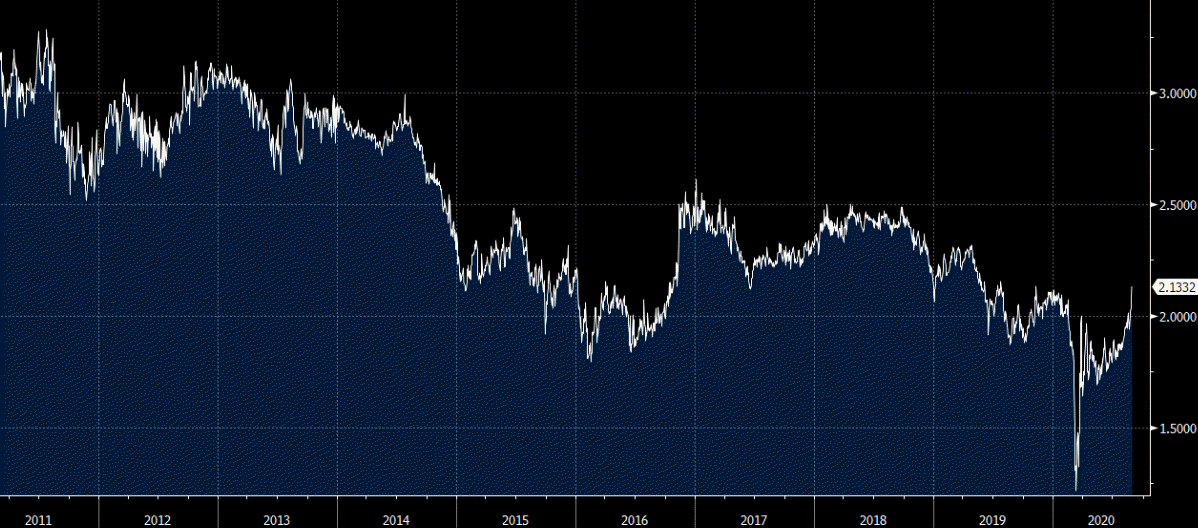

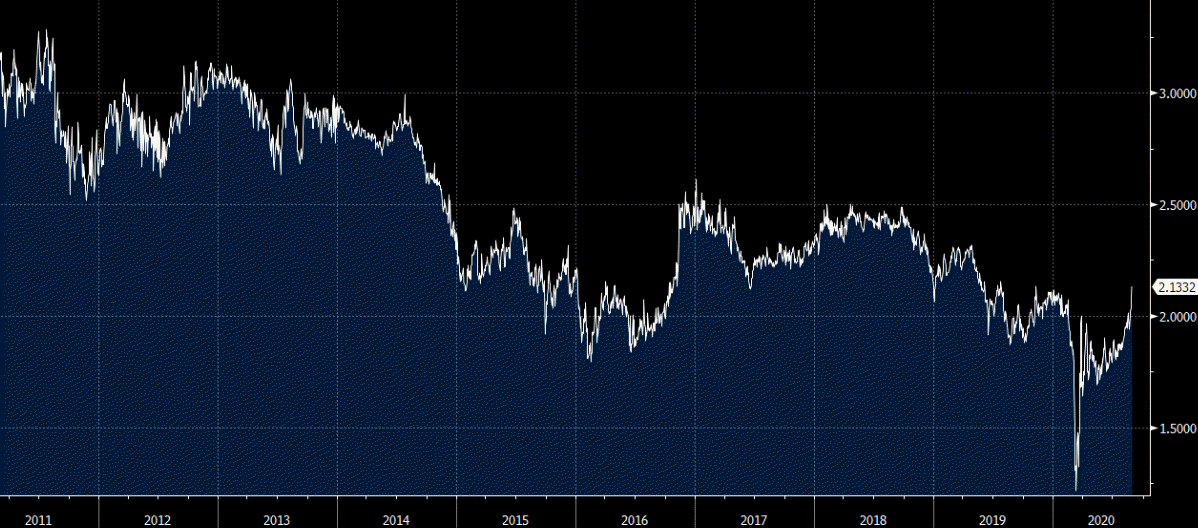

Central banks doing now what they should have been doing a decade ago

1/ The desire for constant action irrespective of underlying conditions is responsible for many losses in Wall Street even among the professional.

2/ In this business a man has to think of both theory and practice. A speculator must not be merely a student, he must be both a student and a speculator.

3/ When you know what not to do in order not to lose money, you begin to learn what to do in order to win.

4/ Not even a world war can keep the stock market from being a bull market when conditions are bullish, or a bear market when conditions are bearish. And all a man needs to know to make money is to appraise conditions.

5/ They say you never grow poor taking profits. No, you don’t. But neither do you grow rich taking a four-point profit in a bull market.

6/ When you are as old as I am and you’ve been through as many booms and panics as I have, you’ll know that to lose your position is something nobody can afford.

7/ The big money was not in the individual fluctuations but in the main movements— that is, not in reading the tape but in sizing up the entire market and its trend. It never was my thinking that made the big money for me. It always was my sitting.

8/ One of the most helpful things that anybody can learn is to give up trying to catch the last eighth—or the first. These two are the most expensive eighths in the world.

9/ The average man doesn’t wish to be told that it is a bull or a bear market. What he desires is to be told specifically which particular stock to buy or sell. He wants to get something for nothing. He does not wish to work. He doesn’t even wish to have to think.

10/ I don’t buy long stock on a scale down, I buy on a scale-up. Remember that stocks are never too high for you to begin buying or too low to begin selling.

11/ When I am long of stocks it is because my reading of conditions has made me bullish. But you find many people, reputed to be intelligent, who are bullish because they have stocks. I do not allow my possessions—or my prepossessions either—to do any thinking for me

12/ The trend has been established before the news is published, and in bull markets bear items are ignored and bull news exaggerated, and vice versa.

13/ A speculator must concern himself with making money out of the market and not with insisting that the tape must agree with him.

14/ A man can excuse his mistakes only by capitalizing them to his subsequent profit.

15/ Of all speculative blunders, there are few greater than trying to average a losing game. Always sell what shows you a loss and keep what shows you a profit.

1. Follow the Rule of Three. The rule of three simply states that a trade will not be made unless you can carefully articulate three reasons for doing so. This eliminates trading from an indicator alone.

1. Follow the Rule of Three. The rule of three simply states that a trade will not be made unless you can carefully articulate three reasons for doing so. This eliminates trading from an indicator alone.

2. Keep Losses Small. It is vitally important to keep losses small as most all of large losses began as small ones, and large losses can put an end to your trading career.

3. Adjust Stops. When a trade is working move your stop loss up in order to lock in gains.

4. Keep Commissions Low. There is a cost to trading but there is no reason to overpay brokerage fees. A discount brokerage is just as good as a premium brand name one.

5. Amateurs at the Open, Pros at the Close. The best time to enter trades are after lunch when the professionals are looking to get in at a better price than one provided in the morning.

6. Know the General Market Trend. When trading individual stocks make sure you trade with the general market trend or condition, not against it.

7. Write Down Every Trade. Doing this will allow you to learn what is working and what is not. It will also help you determine what types of trades work best for your personality.

8. Never Average Down a Losing Position. It is a loser’s game when you add to a loser. You add to winning positions because they are winners and are proving themselves to be such.

9. Never Overtrade. Overtrading is a direct result of not following a well thought out plan, deciding it is best to trade off emotion instead. This will do nothing but cause frustration and a loss of money.

10. Give 10 Percent Away. Money works the fastest when it is divided. When we share we prime the economic pump of the universe.

Trading is a game of rules. We either make the decision to abide by them or we break them. We do the latter at our own peril.

Trade what is… for in doing so your trading is based on fact, substance and reality. It provides clarity, confidence, manageability, and useful feedback for consistent success where appreciation for winning, and respect for losing, keeps you in the game.

Do not trade what you think should be….for in doing so your trading is based on egotism, a false sense of foresight, the desire for validation and approval, and the “win at all cost” mentality, which leads to confusion, anxiety, anger, and despair…not to mention the inability to trade another day.

1. Always change a losing game; never change a winning game.

2. Always have a plan going into a match, and a backup plan.

3. Always have a surprise to pull out all the stops.

4. Reconnoiter your opponent before the match for his strengths and weaknesses.

5. Have a general strategy against all power players, and another against all control players.

6. Analyze every match – how would you play it differently next time.

7. Keep a log of your strategies, and of the opponents.

8. Always have a customized strategy against each opponent, if possible.

9. Call a timeout whenever you skip two straight shots, or the opponent runs three straight points.

10. Keep a coach in the crowd for a second opinion. (more…)

To anyone who doubted that the gloves are now fully off between France and Britain, we bring you exhibit A: Speaking in an interview with local newspaper Le Telegramme de Brest to be published later on Thursday, Bank of France head and ECB member Christian Noyer saidthat a downgrade of France’s AAA credit rating would not be justified and ratings agencies are making decisions based more on politics than economics and questioned whether the use of ratings agencies to guide investors was still valid. “In the arguments they (ratings agencies) present, there are more political arguments than economic ones,” said Noyer, the head of the Bank of France and a member of the ECB’s governing council. “The downgrade does not appear to me to be justified when considering economic fundamentals,” Noyer said. “Otherwise, they should start by downgrading Britain which has more deficits, as much debt, more inflation, less growth than us and where credit is slumping.” The bolded sentence confirms two things: i) that the Nash equilibrium in Europe is now fatally broken, because when you have the head of one central bank doing all he can to throw another central bank under the bus, that’s pretty much game (theory) over; and ii) when he said that “the agencies have become incomprehensible and irrational. They threaten even when states have taken strong and positive decisions. One could think that the use of agencies to guide investors is no longer valid.” it proves that this amateur has no more understanding of basic finance than your generic Reuters blogger, both of whom apparently fail to comprehend that there are several hundred thousand bond and loan indentures in the real world, not the world of “S&P has no credibility so ignore it”, which are loaded with covenants discussing springing liens, rating indexed interest levels and collateral thresholds, all of which are based on a sovereign and corporate rating, and all come into play in a completely unpredictable way (hint AIG – the reason why AIG imploded was because a rating agency downgrade unleashed a terminal margin call) when there is a rating downgrade. Such as that of France in a few hours to days top. (more…)

Everyone knows we need a good plan to succeed, but what the heck does a good plan entail? In the course of studying how to trade, we begin building assumptions that govern our outlook of what the

market is, and how the market should operate.These assumptions are stitched together by general concepts of technical analysis and stuffed in a little box like a holiday turkey left to bake, the finished product we label a “plan”.

Logically following, if your underlying assumptions are incorrect, your plan will fail no matter how well your analysis. The irony, of course, is that the more disciplined you are in following a bad plan the more money you will lose.

Game Theory:

Majority of traders are taught what trading should entail, but in the market the majority is wrong. It is often said that the market is set up to frustrate the most traders. (more…)

Zero-sum games are the total opposite of win-win situations – such as an agreement that creates value between two counter-parties – or lose-lose situations, like war and mutually destructive relationships for instance. In real life, however, things are not always so clear-cut, and winners and losers are often difficult to quantify. New traders get confused and do not understand that in trading, profits come from the people on the other side of your trade that are making the wrong decision. The reason that trading is difficult is because you have to out smart someone to get their money, how you do this is what gives you your edge if you are profitable. In all financial markets buyers and sellers are always equal and the time frame in which they are trading determines if their decision was the right or wrong one at the time of their trade. Your entry is someone else’s exit and your losses are in some one else’s account as profits.

A zero-sum game is a situation where one person’s gain is always equivalent to another person’s loss, so the total wealth for the players and participants in the game is always a net change of zero as a whole. The financial contract markets of futures and options are a zero-sum game with several million players. Zero-sum games are found in game theory, but are less common than non-zero sum games. Poker and gambling are popular examples of what a zero-sum game is since the sum of the amounts won by some players equals the combined losses of the others. The money at a poker table at the start of the game does not grow it is just redistributed to the winners from the losers by the end of the game. All of the casino’s profits come from the gambler’s losses and all the gamblers profits are taken from the casino. Games like chess and tennis also fit this model becasue there is one winner and one loser they are always equal. In the financial markets, option contracts and future contracts are examples of zero-sum games, excluding transaction costs, for every long contract their is someone short the same contract. Some one has to sell a contract to create open interest and someone has to buy it, there has to be a winner and a loser at all times, one long and one short. Brokers and market makers disrupt the perfect balance of winners and losers by taking commissions or profiting from the bid/ask spreads. But, for every person who profits on a contract’s value going in their direction, there is a counter-party who loses who is on the other side. (more…)

Once upon a time, there were six blind men. The blind men wished toknow what an elephant looked like. They took a trip to the forest and with the help of their guide found a tame elephant. The first blind man walked into the broadside of the elephant and bumped his head. He declared that the elephant was like a wall. The second one grabbed the elephant’s tusk and said it felt like a spear. The next blind man felt the trunk of the elephant and was sure that elephants were similar to snakes. The fourth blind man hugged the elephant’s leg and declared the elephant was like a tree. The next one caught the ear and said this is definitely like a fan. The last blind man felt the tail and said this sure feels like a rope. Thus the six blind men all perceived one aspect of the elephant and were each right in their own way, but none of them knew what the whole elephant really looked like.

Once upon a time, there were six blind men. The blind men wished toknow what an elephant looked like. They took a trip to the forest and with the help of their guide found a tame elephant. The first blind man walked into the broadside of the elephant and bumped his head. He declared that the elephant was like a wall. The second one grabbed the elephant’s tusk and said it felt like a spear. The next blind man felt the trunk of the elephant and was sure that elephants were similar to snakes. The fourth blind man hugged the elephant’s leg and declared the elephant was like a tree. The next one caught the ear and said this is definitely like a fan. The last blind man felt the tail and said this sure feels like a rope. Thus the six blind men all perceived one aspect of the elephant and were each right in their own way, but none of them knew what the whole elephant really looked like.

Oftentimes, the market poses itself as the elephant. There are people who say that predicting the market is like predicting the weather, because you can do well in the short term, but where the market will be in the long run is anybody’s guess. (more…)

When you take a position in the market, you are really playing a game against the market. Profitability doesn’t lie in your actions alone, it lies in the interaction between your position and the market’s price fluctuations…The goal of the individual is obvious. It is to make money. But what is the goal of the market? Simply put, the market wants you to lose money. This may be a provocative thought, but it is quite reasonable in the context of game theory.