It’s going to be an interesting one

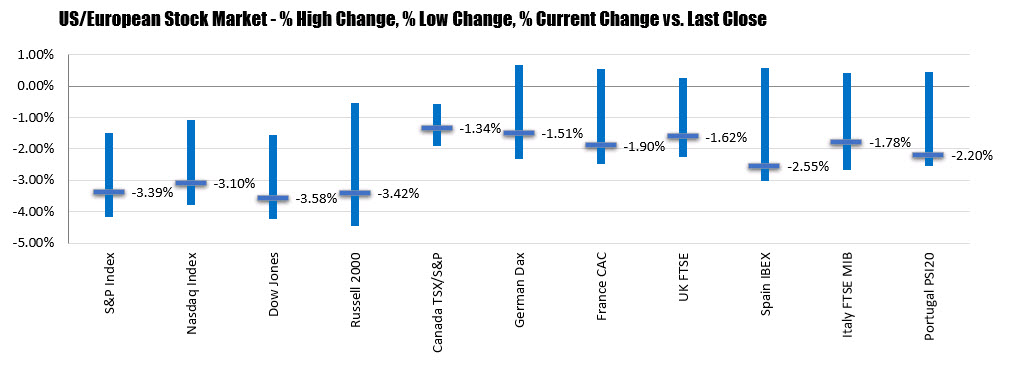

S&P 500 futures are down 94 points following a 106 point decline yesterday. That more-than wipes out there 2% gain so far this week.

It’s a bloodbath in Europe as well with all the main indexes down around 3.5%.

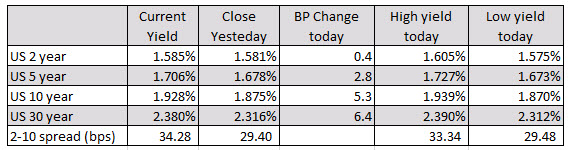

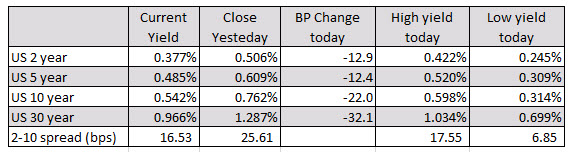

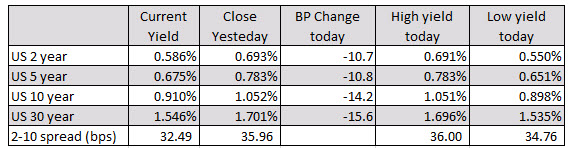

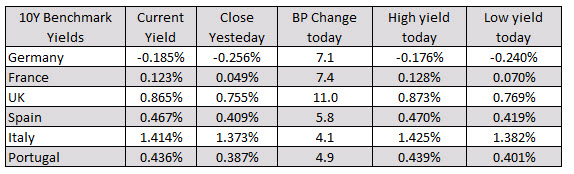

What’s frightening is the drop in bond yields. US 10-year yields are down a whopping 17 basis points to 0.75% after falling to as low as 0.69%. Those numbers are below the T-bill yield of 0.755% and Fed funds. That’s a fresh inversion despite a 50 basis point cut on Tuesday.

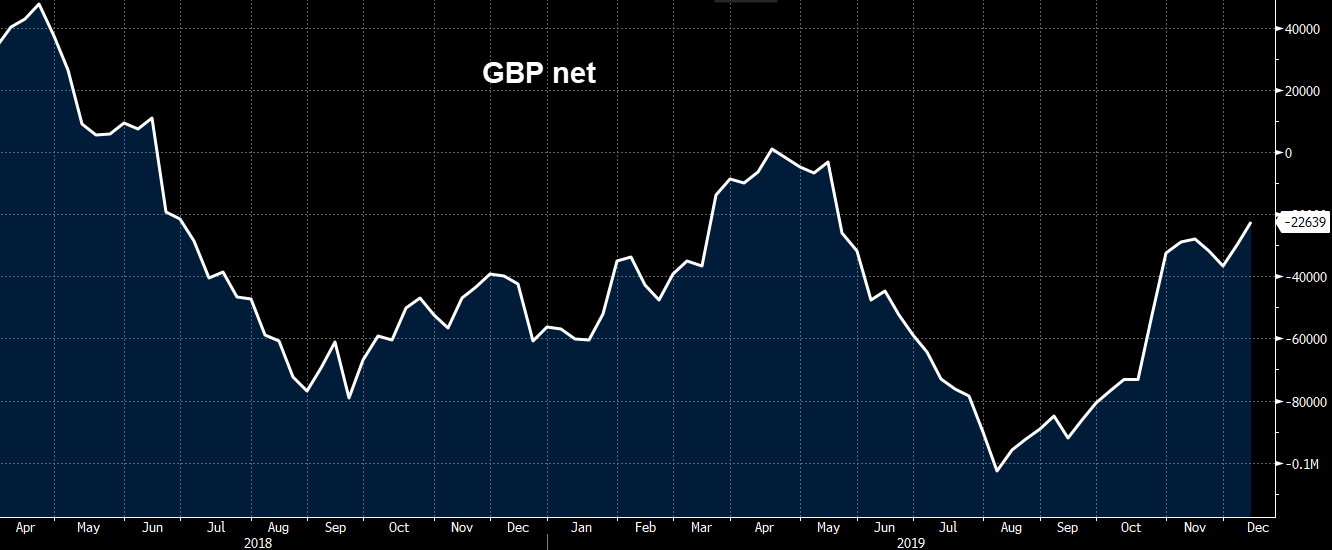

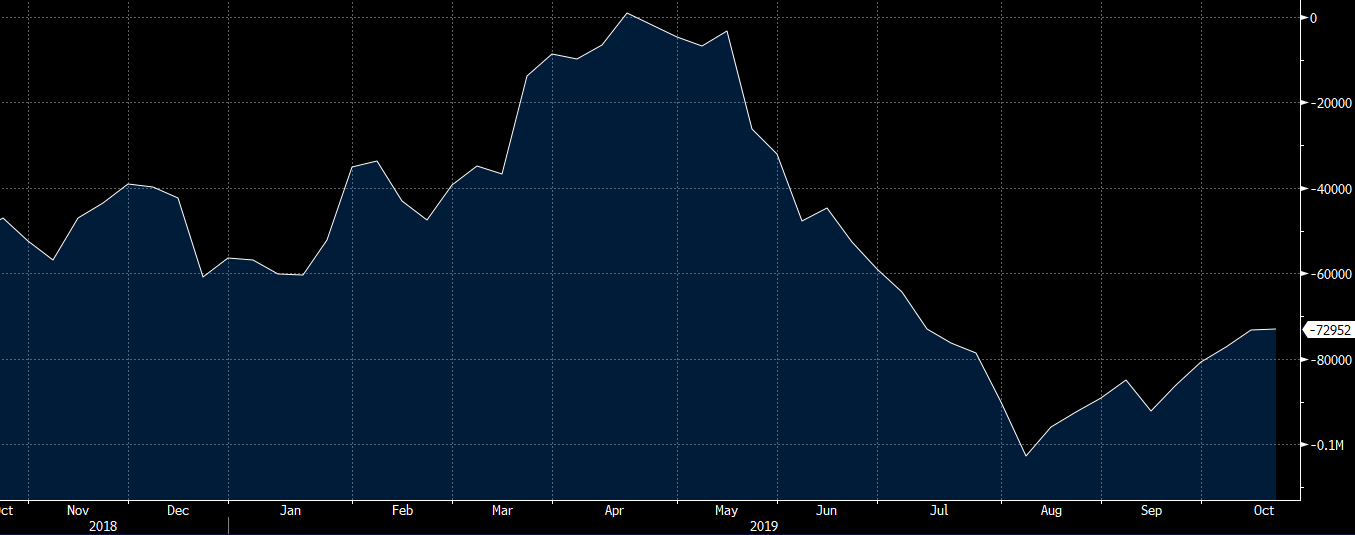

With those declines, the dollar’s yield advantage is getting wiped out and as a result it’s falling sharply against the low yielders — JPY, CHF and EUR. I expect to see some additional dollar weakness but we’re fast-approaching the lower bound and the Fed has been steadfast that it won’t go negative. Once we get there, I think the dollar will start to appreciate again on safe haven flows.

In other markets as European traders exit:

In other markets as European traders exit: