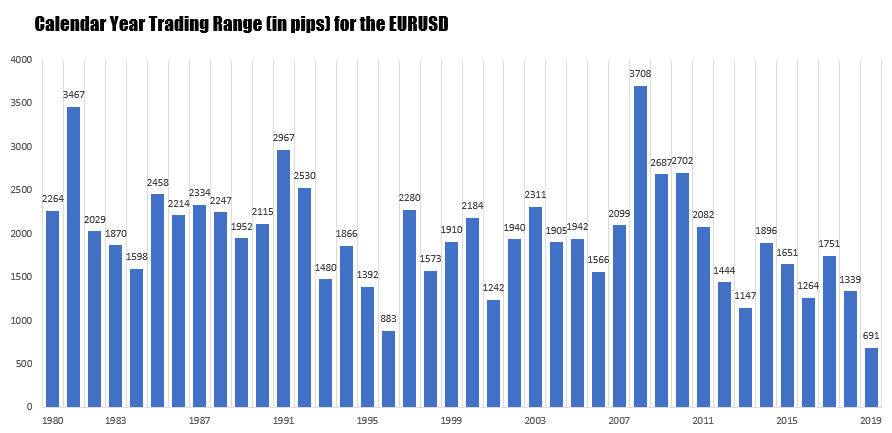

Record low ranges for many of the major currency pairs

If I were to name the currency year, it would be “The Year of Low Volatility”.

Three of the currency pairs had low to high trading ranges that were the lowest since 1980. Even the GBPUSD which had alll the Brexit goings on, had a relatively low range year (the 5th lowest since 2000).

If the low ranges are indicative of non-trending, the good news is non-trending transitions to trending. As a result, I would expect a more volatile/larger trading range for 2020 for many of the currency pairs. Keep that thought in mind in 2020.

Below are the graphical historical ranges for the major currency pairs versus the dollar along with comments about each. .

EURUSD.

The low to high trading range for the EURUSD in 2019 could only extend to 691 pips. That was the lowest range going back to 1980. The prior low was 883 pips back in 1996. In 1997, the range rose to 2280 pips.

The low for the year reached 1.0879. The high for the year was up at 1.1570. The pair is 347 pips or so off the low price and 344 pips off the high price. That puts the pairs price smack dab in the middle of the trading range for the year. Which way do we tilt in 2020?

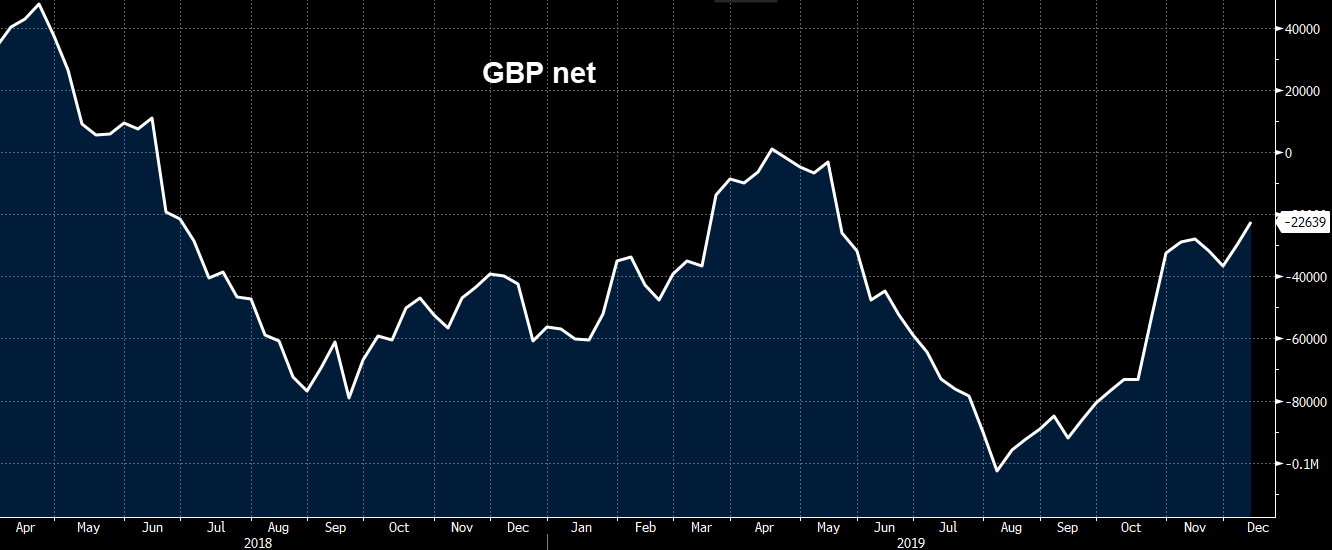

GBPUSD