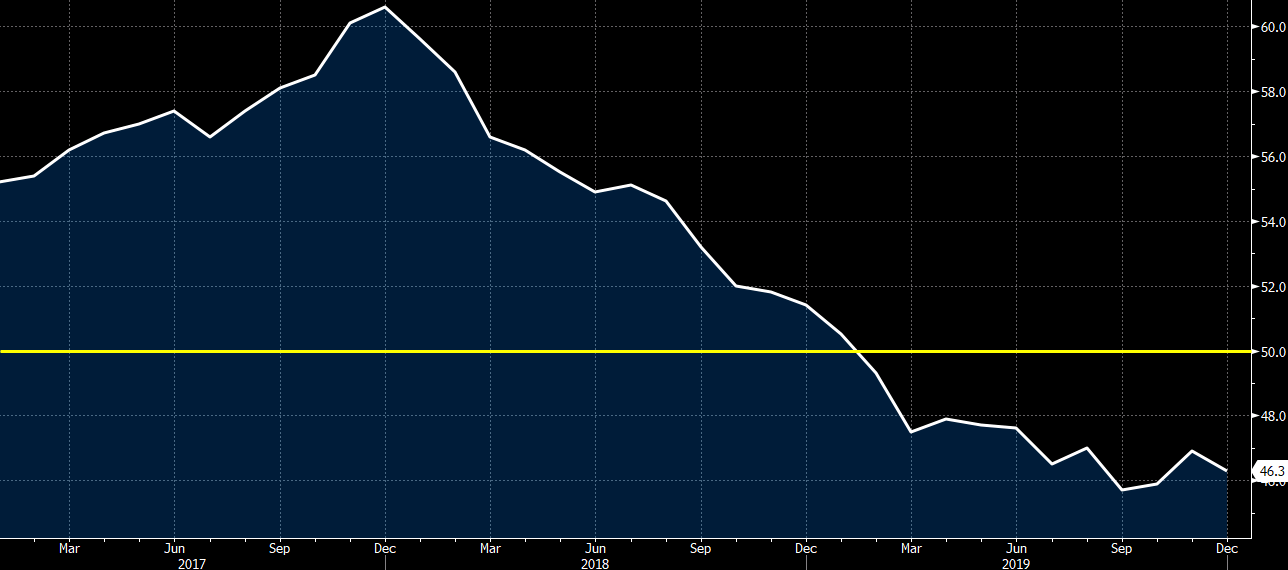

Latest data released by Markit – 2 January 2020

The preliminary release can be found here. The mildly higher revision was predicated by the French and German readings earlier but it is still weaker than the November print.

“Eurozone manufacturers reported a dire end to 2019, with output falling at a rate not exceeded since 2012. The survey is indicative of production falling by 1.5% in the fourth quarter, acting as a severe drag on the wider economy.

Although firms grew somewhat more optimistic about the year ahead, a return to growth remains a long way off given that new order inflows continued to fall at one of the fastest rates seen over the past seven years. Firms sought to reduce inventory levels and cut headcounts as a result, focusing on slashing capacity and lowering costs. Such cost cutting was again also evident in further steep falls in demand for machinery, equipment and production-line inputs.”

In other markets as European traders exit:

In other markets as European traders exit: