But markets are still plagued by poor liquidity conditions for the most part

Happy New Year, everyone! Hope that all of you had a great celebration or time off and that you’re refreshed for another new trading year ahead.

Markets are still largely affected by thin conditions with liquidity still rather lacking and I would expect things to stay that way until tomorrow or next week at least.

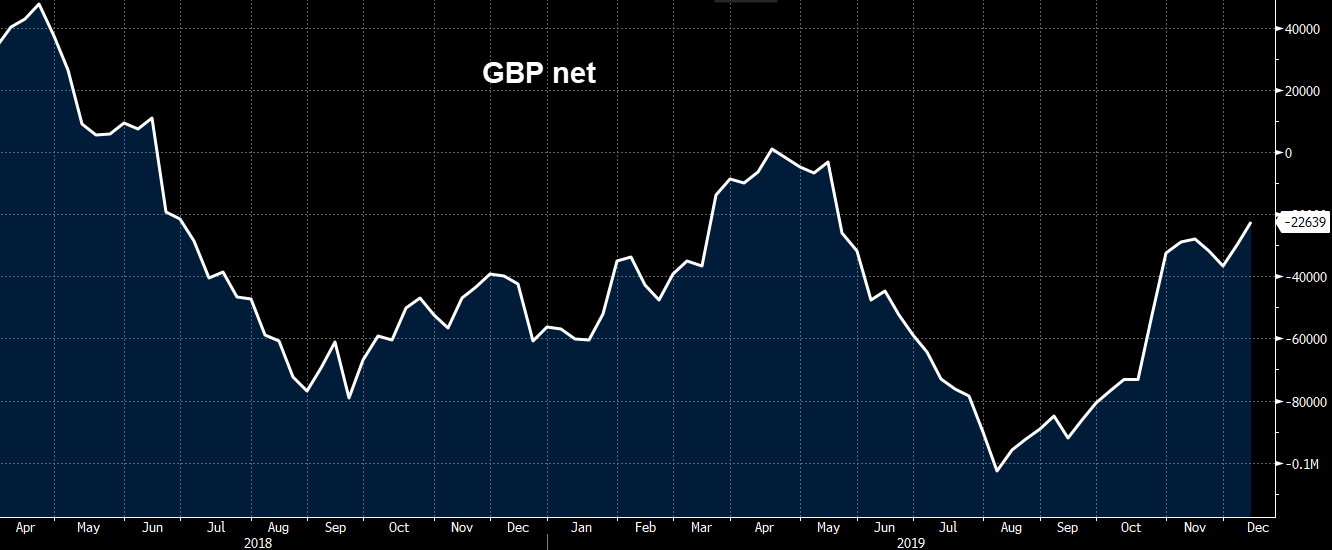

In the major currencies space, things are a little mixed with the pound finding itself on the back foot while the aussie and franc are also mildly weaker on the day so far.

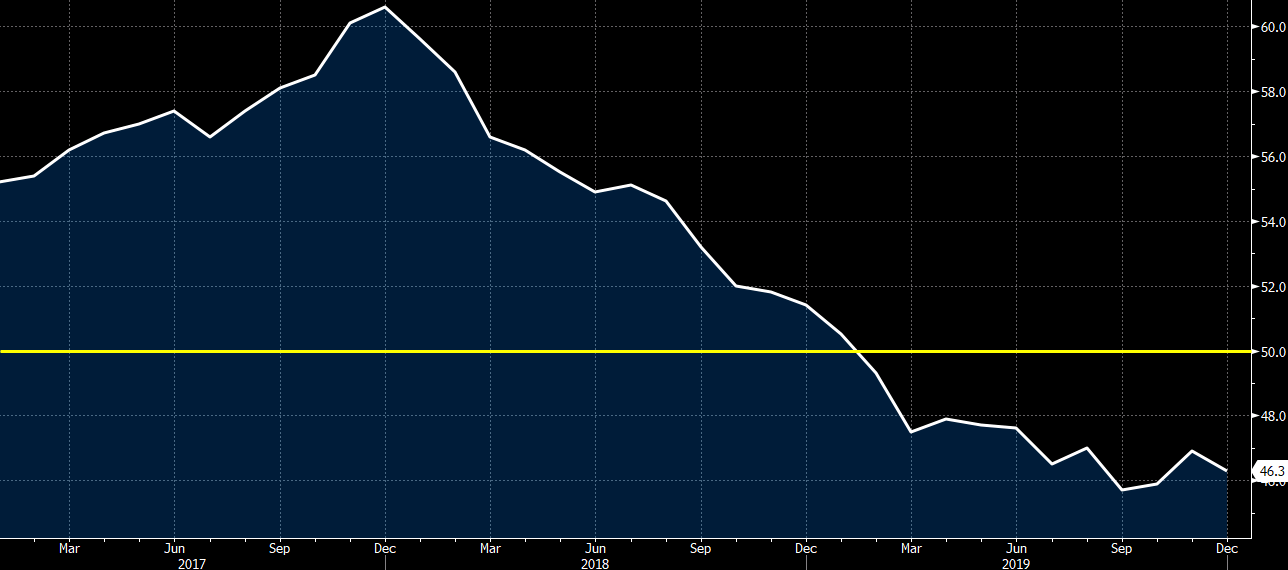

Looking ahead, we’ll have manufacturing PMI releases in the European morning but these will be final readings for December, so they won’t really matter all too much.

0815 GMT – Spain December manufacturing PMI

0845 GMT – Italy December manufacturing PMI

0850 GMT – France December final manufacturing PMI

0855 GMT – Germany December final manufacturing PMI

0900 GMT – Eurozone December final manufacturing PMI

(more…)

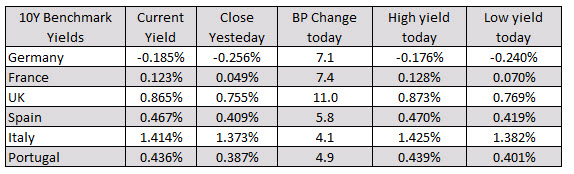

In other markets as European traders exit:

In other markets as European traders exit: