In his preface to the new edition of The Invisible Hands: Top Hedge Fund Traders on Bubbles, Crashes, and Real Money (Wiley, 2014) Steven Drobny contends that “real money investors rem

ain stuck in their antiquated ways. They will view their investments from a notional allocation standpoint, and diversify their holdings by asset class names, not by underlying risk characteristics.” Investors are unprepared for another crisis, despite the fact that “quantitative easing is coming to an end, and tremendous uncertainty exists everywhere.” Hence the renewed timeliness of the interviews, conducted in the spring of 2009, with traders who managed to navigate the financial crisis of 2008.

With the exception of Jim Leitner, who was also interviewed for Drobny’s Inside the House of Money, the managers—ten who run global macro hedge funds and one real money manager—remain anonymous. Drobny “chose the anonymous route to increase candor as well as keep the focus on the ideas as opposed to the personalities.” (p. xxx)

The Invisible Hands is a terrific book even though many of the strategies described in it are difficult if not impossible for the individual investor to implement. But the thinking behind these strategies and the way their risk is managed are often so compelling that everyone who is active in the markets can learn a tremendous amount from the interviews. Moreover, even though most of the contributors are anonymous their life stories are fascinating, sometimes even inspiring. (more…)

Archives of “finance” tag

rssMRI’s of Succesful Traders

I’ve seen this study making the rounds on several websites now as a type of neuroeconomic confirmation of Buffetological principles…

Perhaps procedure might be slightly useful as a means of seeing physical brain improvement by training– such as that found through meditative practices.

“Traders who buy more aggressively based on NAcc signals earn less. High-earning traders have early warning signals in the anterior insular cortex before prices reach a peak, and sell coincidently with that signal, precipitating the crash. These experiments could help understand other cases in which human groups badly miscompute the value of actions or events.”

“Neuroeconomists Confirm Warren Buffet’s Wisdom”:

“Seeing what’s going on in people’s brains when they are trading suggests that Buffett was right on target,” says Colin Camerer, the Robert Kirby Professor of Behavioral Economics at Caltech.

That is because in their experimental markets, Camerer and his colleagues found two distinct types of activity in the brains of participants—one that made a small fraction of participants nervous and prompted them to sell their experimental shares even as prices were on the rise, and another that was much more common and made traders behave in a greedy way, buying aggressively during the bubble and even after the peak. The lucky few who received the early warning signal got out of the market early, ultimately causing the bubble to burst, and earned the most money. The others displayed what former Federal Reserve chairman Alan Greenspan called “irrational exuberance” and lost their proverbial shirts.

J.P Morgan and Rockefeller

At the time of his death on March 31, 1913 J.P. Morgan had an estate worth $80 million. Compared to his peers of the era, especially Rockefeller, it was not such a large estate. In fact, Rockefeller’s comment at the time [after reading the pages and pages of obituaries, was rather sniffy:], “And to think he wasn’t even a rich man.”

At the time of his death on March 31, 1913 J.P. Morgan had an estate worth $80 million. Compared to his peers of the era, especially Rockefeller, it was not such a large estate. In fact, Rockefeller’s comment at the time [after reading the pages and pages of obituaries, was rather sniffy:], “And to think he wasn’t even a rich man.”

Source: Ahamed: Lords of Finance

Just Avoid These 7 Words -If U Are A Trader

Be careful how you use the following words and phrases as they become road blocks or worse take you down the wrong path.

Should– Phrases include: “The market should have” and “I should have”. Those phrases are often used to socialize losses. They are a strong signal something is off. They should be used to aid you in correcting your vision not make you feel better.

Must– Phrases include: “The market must…”, “I must make money”, or “I must trade”. The market does not have to do anything and either do you. When you use the word “must” it is hardly ever from a position of strength. The market knows when you are desperate and will take full advantage of you. Keeping your expenses as low as possible will make it easier to not make those statements.

Will– Phrases include: “The market will..” and “I will make money”. Once again the market does not like to be told what to do. It is the bratty kid screaming at the tops of his lungs. The word “will” relaxes your mind, similar to “should”, people use it to be lazy instead of a black background in an otherwise light picture. You can do everything right and still lose money. That is why trading is so effective at diminishing confidence. In most every activity, if you do everything right you are going to get the desired result. Doing the “right” things is bare minimum. Of course, over time you will get paid for doing the right things but it is never when you think it should be and hardly how much you anticipated. (more…)

The Alchemists of Wall Street

Ever wonder what goes on behind the scenes? What kind of thinking and reasoning goes behind creating those sophisticated financial trading forumlas that create billions of dollars every year? Even more, do you wonder what kind of math wizard it takes to create these formulas?

Quants, or quantitative managers, are the math wizards and computer programmers in the engine room of our global financial system who designed the financial products that almost crashed Wall st.

The credit crunch has shown how the global financial system has become increasingly dependent on mathematical models trying to quantify human (economic) behaviour. Now the quants are at the heart of yet another technological revolution in finance: trading at the speed of light.

Below is a pretty interesting video that reveals the type of people and thinking that goes into creating these forumlas.

This One Thing that Separates losing traders from the Winners

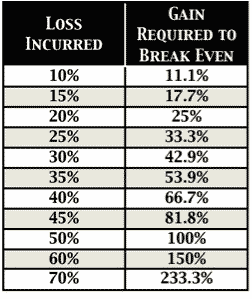

Making money in the financial markets is not only challenging but just surviving an account blow up is also a win for many new traders. There is one thing that ultimately determines your success in the markets. It is not your stock picking skills, your trend following or even trading a robust method. The dividing line between the winners and the losers in trading and investing is risk management. If you trade all in and risk it all over an over you will eventually blow up your account, and the funny thing is that it will likely be on your ‘can’t miss’ trade that is just way to obvious to everyone and is a crowded trade. Traders that believe have 10 losing trades in a row are impossible will discover it is very possible. Each trade should be large enough to return enough to make it worth your while, but small enough to make it inconsequential to your results in the long term. Trading small not only eliminates the financial risk of account ruin that is ever present in a market environment that is not conducive to your methodology but small risks also keep your logical brain in control of your trading and your emotions on the side lines.Nothing is more painful in my opinion than to build up an account during a great string of wins only to give it back with a string of losses in a different market environment. Small bets and staying out when he market waves get wild is a great formula to avoid big draw downs. You can still win big when you are right by letting a winner run but always lose small when you are wrong. The bet size on each trade will make or break ever trader at some point usually sooner than later. (more…)

You Might be a Bad Trader if:

You Might be a Bad Trader if:

…You are 100% sure about a trade being a winner so you have no need to manage risk.

…You go all in on one trade and it will make you are break you.

…You like to buy deep out of the money stock options not understanding how bad the odds are on them.

…You love directly giving unsolicited advice to other traders due to not understanding they have different trading plans and time frames.

…You are so new to trading you think it is a place of easy money.

…You think traders that talk about risk management and trader psychology are silly and that you are above that.

…You brag to much about your account size and last trade, it indicates to me you do not understand the long term in the markets.

…You are very loud about your winners but never discuss your losing trades.

…You brag to much.

And You Might really be a bad trader if: If you attack trading principles that you do not even fully understand due to lack of real trading.

20 Reasons :Why 95% Traders Not Making Money

- They risk too much to try to make so little.

- They trade with the probabilities against them.

- They think trading is easy money.

- Instead of focusing on learning how to trade they focus on getting rich.

- They blow up due to improper position sizing.

- With no understanding of the mathematical risk of ruin they are doomed after the first long string of losing trades.

- Blindly following a guru that leads them down the road of destruction.

- They don’t do their homework.

- They trade opinions not robust systems. (more…)

The Blind Traders and the Market

There is an old parable known as “the blind men and the elephant.” In this story, there are four blind men who are asked to determine what an elephant looks like. The first blind man feels the leg of the elephant and says, “The elephant is like a tree because it is large and round like a pillar.” The second man feels the tail and says, “The elephant is like a rope because it is small and coarse.” The third man feels the ear and says, “The elephant is like a fan because it is flat and thin.” The fourth man feels the trunk and says, “The elephant is like a snake because it is long and curves.”

A king comes to the four blind men and says, “all of you are correct.” The king goes on to explain that each one had drastically different descriptions of the elephant because they are all feeling different parts. So, they are all correct. The elephant has all the features described by the four blind men.

This parable is a good analogy describing different types of profitable traders. Many of the arguments that erupt between traders on social media are due to not understanding the others time frames or not understanding the other trader’s position sizing, stop loss level, or expected winning percentage. Also too many cult members of Elliot Wave, Trend Following, Market Profile, Day Traders, and option traders etc. think their way of trading price action is the only way when their way is only one of many paths to profitability. There are as many ways to trade price action to be profitable as there are profitable traders.

The elephant in the room is that profitable traders do a few things in common: (more…)

List of Common Characteristics of Great Traders -10 Points

1. They all have a tested, positive expectancy system that’s proved to make money for the market type for which it was designed.

2. They all have systems that fit them and their beliefs. They understand that they make money with their systems because their systems fit them.

3. They totally understand the concepts they are trading and how those concepts generate low-risk ideas

. 4. They all understand that when they get into a trade, they must have some idea of when they are wrong and will bail out

. 5. They all evaluate the ratio of reward to risk in each trade they take. For mechanical traders, this is part of their system. For discretionary traders, this is part of their evaluation before they take the trade.

6. They all have a business plan to guide their trading. You must treat your trading like any other business

7. They all use position sizing. They have clear objectives written out, something that most traders/investors do not have. They also understand that position sizing is the key to meeting those objectives and have worked out a position sizing algorithm to meet those objectives.

8. They all understand that performance is a function of personal psychology and spend a lot of time working on themselves. You must become an efficient rather than inefficient decision maker.

9. They take total responsibility for the results they get. They don’t blame someone else or something else. They don’t justify their results. They don’t feel guilty or ashamed about their results. They simply assume that they created them and that they can create better results by eliminating mistakes.

10. They understand that not following their system and business plan rules is a mistake. If you make even one mistake per month, you can turn a profitable system into a disaster. Thus, the key to becoming efficient is to eliminate such mistakes.

What elements from the above list do you need to work on more than any other? Yes, take a moment to think about this today. As you set your top priorities for this new second quarter, I recommend focusing on just one of these elements by outlining specific steps you need to take this quarter to improve. For some, this will require further study. For others, it only requires just some minor behavior modification, refocus and attitude adjustment. Many times the difference between being great and mediocre